Answered step by step

Verified Expert Solution

Question

1 Approved Answer

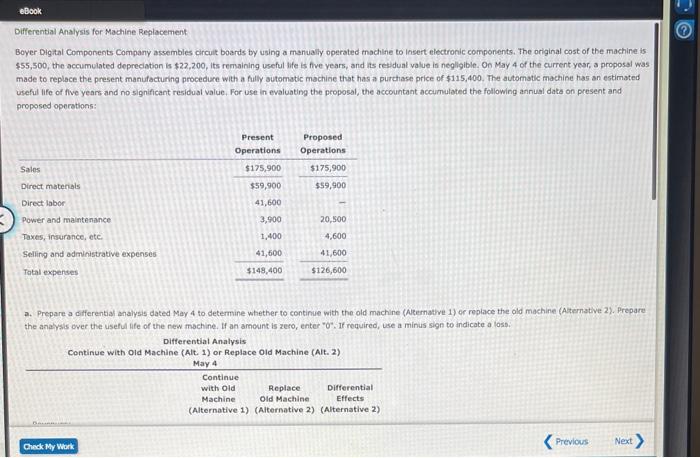

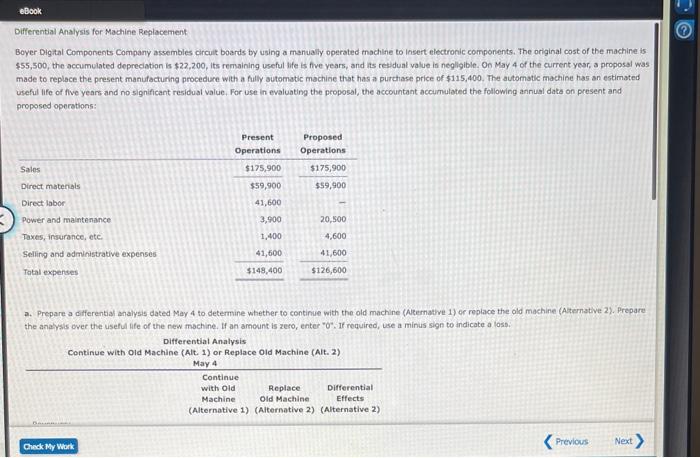

Differential analysis for machine replacement Differential Analysis for Machine Replocement Boyer Digital Components Company assembles circuit boards by using a manually operated thachline to lnsert

Differential analysis for machine replacement

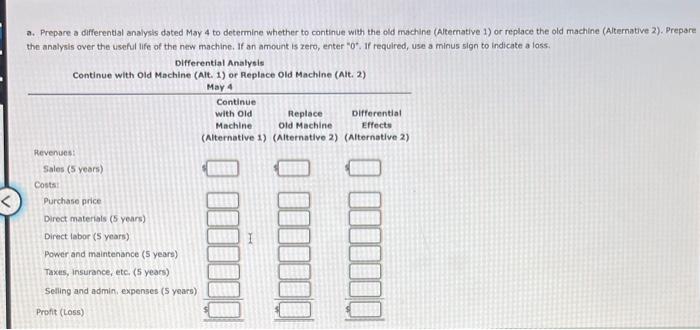

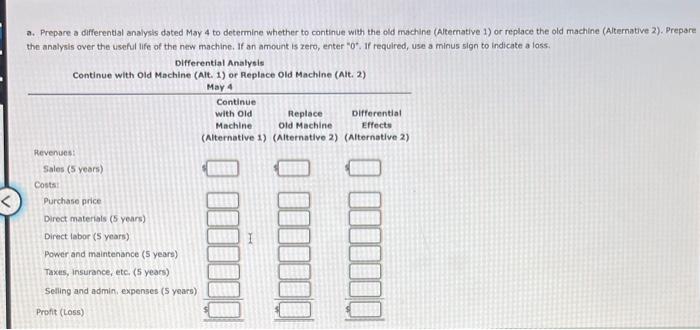

Differential Analysis for Machine Replocement Boyer Digital Components Company assembles circuit boards by using a manually operated thachline to lnsert electronic components. The original cost of the machine is $55,500, the accumulated depreciation is $22,200, Its remaining useful life is five years, and its residual value in negllgible. On May 4 of the current yesr, a proposal was made to replace the present manufacturing procedure with a fully automatic machine that has a purchase price of $115, 400 . The automatic machine has an estimated useful life of flve years and no significant residual value, For use in evaluating the proposal, the accountant accumulated the following annual data on present and proposed operations: a. Prepare a differential ahalysis dated May 4 to determine whether to continue with the old machine (Akernative 1) or repiace the old machine (Atternathe 2). Prepare the analysis over the useful hife of the new machine. If an ameunt is zero, enter "o". If required, use a minus sign to indicate a loss. a. Prepare a differential analysis dated May 4 to determine whether to continue with the old machine (Altemative 1) or replace the old machine (Alternative 2). Prepare the analysis over the useful life of the niw machine. If an amount is zero, enter "0*, If required, use a minus sign to indicate a loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started