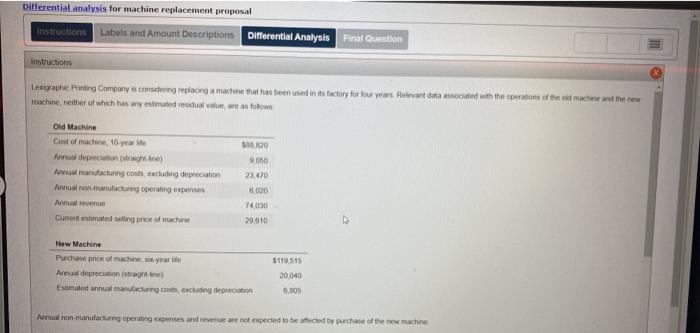

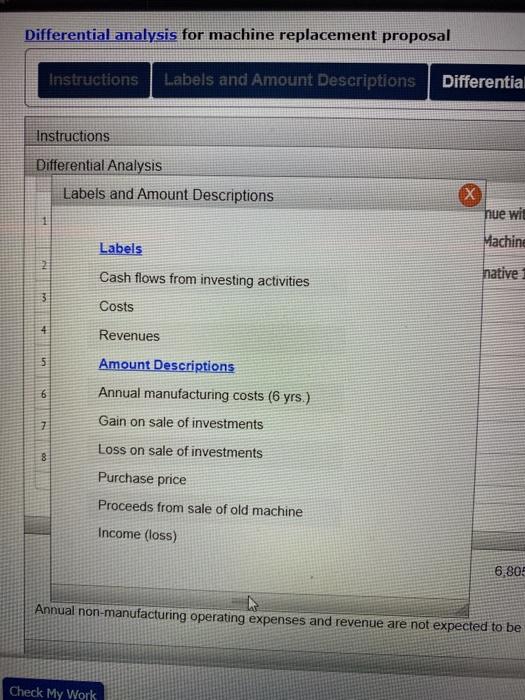

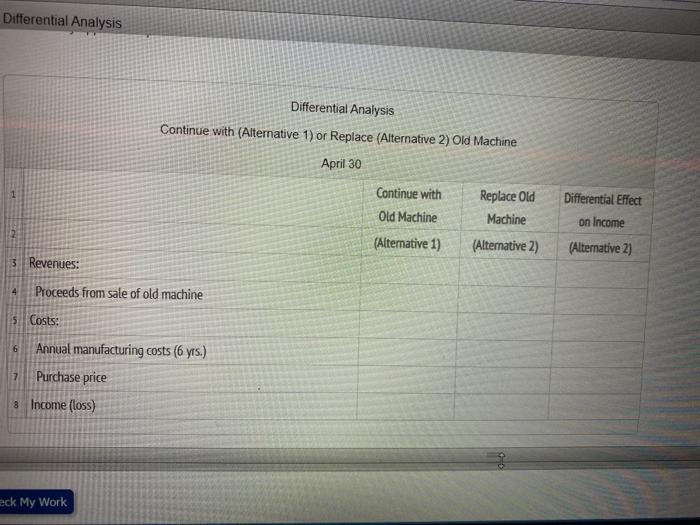

Differential analysis for machine replacement proposal Trostruction Labels and Amount Description Differential Analysis Final Question Instructions Lexy Pleting Companys.comidering plano a machine that has been used in its factory for our years. Rekevert data stocated with the operations of the ok machine and the netw machine, neither of which has any estimated resul value are as follow Old Machine Cost of machine, 10 year Annual depreciation (g) A man tacturing costs, excluding depreciation Annus non manufacturing operating expenses Annual revenue Currentes mated selling price of machine 8100 3,060 23.470 6,020 74030 29.010 New Machine Purchase price of machinerarie Arnul depreciation straight line) Esamad linnual manufacturing costs, xcluding deprecat 5119.515 20.040 5,805 Annual non manufacturing operating experies and even are not expected to be afected by purchase of the new machine Differential analysis for machine replacement proposal Instructions Labels and Amount Descriptions Differential Instructions Differential Analysis Labels and Amount Descriptions EX hue wit Labels Machine 2 Cash flows from investing activities native 3 Costs 4 Revenues 5 6 7 Amount Descriptions Annual manufacturing costs (6 yrs.) Gain on sale of investments Loss on sale of investments Purchase price 8 Proceeds from sale of old machine Income (loss) 6,805 Annual non-manufacturing operating expenses and revenue are not expected to be Check My Work Differential Analysis Differential Analysis Continue with (Alternative 1) or Replace (Alternative 2) Old Machine April 30 Continue with Replace Old Old Machine Machine (Alternative 1) (Alternative 2) Differential Effect on Income (Alternative 2) 3 Revenues: Proceeds from sale of old machine 6 5. Costs: Annual manufacturing costs (6 yrs.) Purchase price 3 Income (loss) 7 eck My Work Differential analysis for machine replacement proposal Trostruction Labels and Amount Description Differential Analysis Final Question Instructions Lexy Pleting Companys.comidering plano a machine that has been used in its factory for our years. Rekevert data stocated with the operations of the ok machine and the netw machine, neither of which has any estimated resul value are as follow Old Machine Cost of machine, 10 year Annual depreciation (g) A man tacturing costs, excluding depreciation Annus non manufacturing operating expenses Annual revenue Currentes mated selling price of machine 8100 3,060 23.470 6,020 74030 29.010 New Machine Purchase price of machinerarie Arnul depreciation straight line) Esamad linnual manufacturing costs, xcluding deprecat 5119.515 20.040 5,805 Annual non manufacturing operating experies and even are not expected to be afected by purchase of the new machine Differential analysis for machine replacement proposal Instructions Labels and Amount Descriptions Differential Instructions Differential Analysis Labels and Amount Descriptions EX hue wit Labels Machine 2 Cash flows from investing activities native 3 Costs 4 Revenues 5 6 7 Amount Descriptions Annual manufacturing costs (6 yrs.) Gain on sale of investments Loss on sale of investments Purchase price 8 Proceeds from sale of old machine Income (loss) 6,805 Annual non-manufacturing operating expenses and revenue are not expected to be Check My Work Differential Analysis Differential Analysis Continue with (Alternative 1) or Replace (Alternative 2) Old Machine April 30 Continue with Replace Old Old Machine Machine (Alternative 1) (Alternative 2) Differential Effect on Income (Alternative 2) 3 Revenues: Proceeds from sale of old machine 6 5. Costs: Annual manufacturing costs (6 yrs.) Purchase price 3 Income (loss) 7 eck My Work