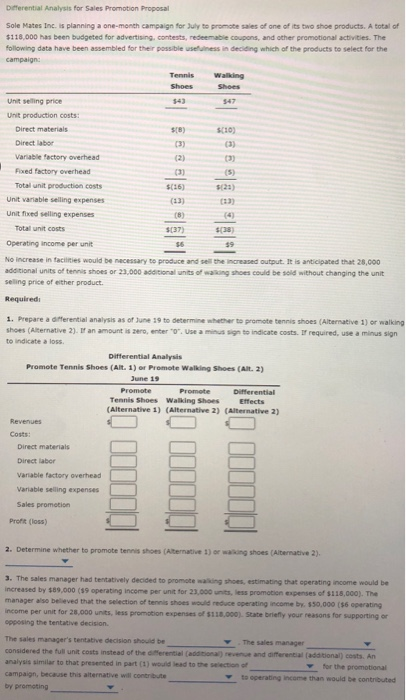

Differential Analysis for Sales Promotion Proposal Sole Mates Inc. is planning a one-month campaign for July to promote sales of one of its two shoe products. A total of $118,000 has been budgeted for advertising, contests, redeemable coupons, and other promotional activities. The following data have been assembled for their possible usefulness in deciding which of the products to select for the campaign: Tennis Walking Shoes Shoes Unit selling price 547 Unit production costs: Direct materials 5[8) $(10) Direct labor Variable factory overhead (2) 033 Foxed factory overhead (3) Total unit production costs $(16) Unit variable selling expenses (13) Unit fixed selling expenses (6) Total unit costs $(37) Operating income per unit 36 59 No increase in facilities would be necessary to produce and sell the increased output. It is anticipated that 28,000 additional units of tennis shoes or 23.000 additional units of wong shoes could be sold without changing the unit seling price of either product. Required: 1. Prepare a differential analysis as of June 19 to determine whether to promote tennis shoes (Alternative 1) or walking shoes (Alternative 2). If an amount is ero, enter to use a mission to indicate costs. If required, use a minus sign to indicate a loss Differential Analysis Promote Tennis Shoes (Alt. 1) or Promote Walking Shoes (Alt. 2) June 19 Promote Promote Differential Tennis Shoes Walking Shoes Effects (Alternative 1) (Alternative 2) (Alternative 2) Revenues Costs: Direct materials Direct labor Variable factory overhead Variable selling expenses Sales promotion Profit (los) 2. Determine whether to promote tennis shoes (Alternative 1) or wang shoes (Alternative 2). 3. The sales manager had tentatively decided to promote ang shoes, estimating that operating income would be increased by $89,000 ($9 operating income per unit for 23.000 units, les promotion expenses of $118,000). The manager also believed that the selection of tennis shoes would reduce operating income by 550.000 (56 operating Income per unit for 28.000 units, less promotion expenses of $110.000). State briefly your reasons for supporting or opposing the tentative decision The sales manager's tentative decision should be The sales manager considered the full unit costs instead of the differential (additional) revenue and differential additional) costs. An analysis similar to that presented in part (1) would lead to the selection for the promotional campaign, because this alternative will contribute to operating income than would be contributed by promoting