Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Differential Analysis III Instructions Hadley Company is considering the disposal of equipment that is no longer needed for operations. The equipment originally cost $600,000 and

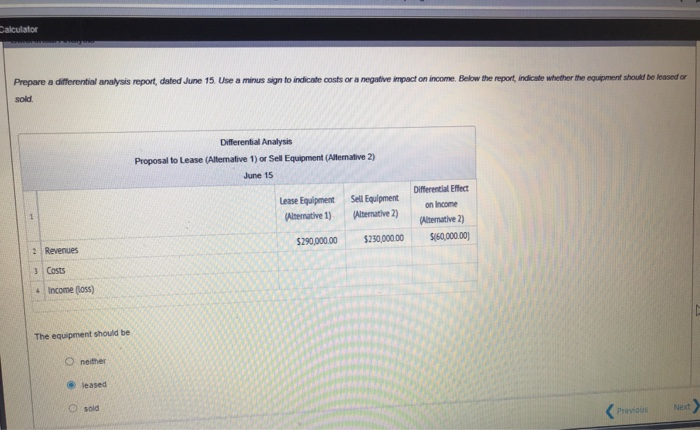

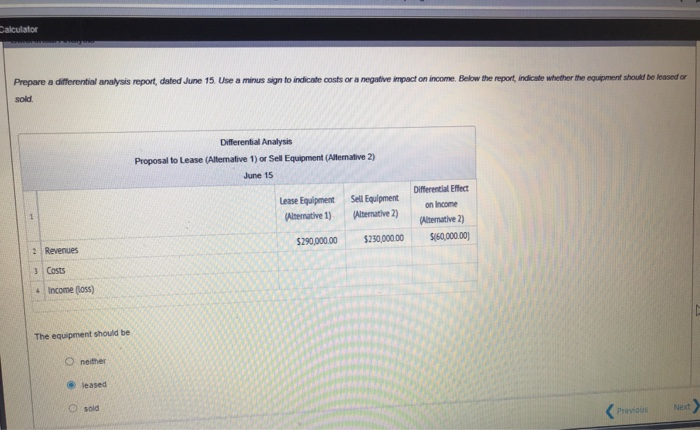

Differential Analysis III Instructions Hadley Company is considering the disposal of equipment that is no longer needed for operations. The equipment originally cost $600,000 and accumulated depreciation to date totals 5460,000. An offer has been received to lease the machine for its remaining useful life for a total of 5290,000, after which the equipment will have no salvage value. The repair, insurance, and property tax expenses that would be incurred by Hadley on the machine during the period of the lease are estimated at 575,800. Alternatively, the equipment can be sold through a broker for $230,000 less a 10% commission Required: Prepare a differential analysis report dated June 15. Use a minus sign to indicate costs or a negative impact on income. Below the port, indicate whether the equipment should be leased or sold Differential Analysis Calculator Prepare a differential analysis report, dated June 15. Use a minus sign to indicate costs or a negative impact on income. Below the report, indicate whether the equipment should be leased or sold Differential Analysis Proposal to Lease (Alternative 1) or Sell Equipment (Alternative 2) June 15 Lease Equipment (Alternative 1) Sell Equipment Alternative 2) Differential Effect on Income (Alternative 2) 5(60,000.00) $290,000.00 $250,000.00 2 Revenues 3 Costs + Income (los) The equipment should be Oneither leased O sold Next

Differential Analysis III Instructions Hadley Company is considering the disposal of equipment that is no longer needed for operations. The equipment originally cost $600,000 and accumulated depreciation to date totals 5460,000. An offer has been received to lease the machine for its remaining useful life for a total of 5290,000, after which the equipment will have no salvage value. The repair, insurance, and property tax expenses that would be incurred by Hadley on the machine during the period of the lease are estimated at 575,800. Alternatively, the equipment can be sold through a broker for $230,000 less a 10% commission Required: Prepare a differential analysis report dated June 15. Use a minus sign to indicate costs or a negative impact on income. Below the port, indicate whether the equipment should be leased or sold Differential Analysis Calculator Prepare a differential analysis report, dated June 15. Use a minus sign to indicate costs or a negative impact on income. Below the report, indicate whether the equipment should be leased or sold Differential Analysis Proposal to Lease (Alternative 1) or Sell Equipment (Alternative 2) June 15 Lease Equipment (Alternative 1) Sell Equipment Alternative 2) Differential Effect on Income (Alternative 2) 5(60,000.00) $290,000.00 $250,000.00 2 Revenues 3 Costs + Income (los) The equipment should be Oneither leased O sold Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started