Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Differential Analysis involving Opportunity Costs On July 1, Matrix Stores Inc. is considering leasing a building and buying the necessary equipment to operate a public

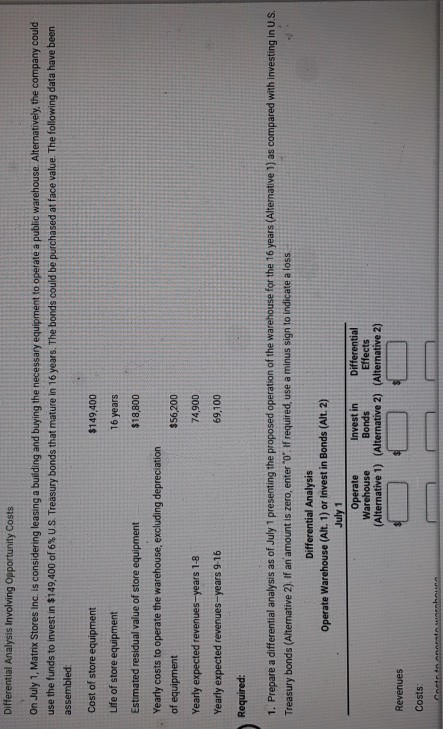

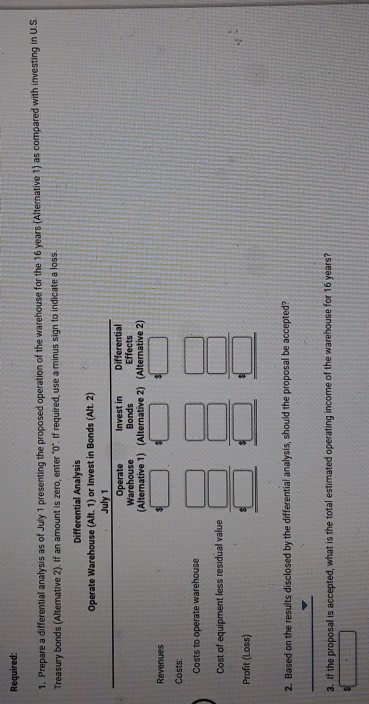

Differential Analysis involving Opportunity Costs On July 1, Matrix Stores Inc. is considering leasing a building and buying the necessary equipment to operate a public warehouse. Alternatively, the company could use the funds to invest in $149,400 of 6% U.S. Treasury bonds that mature in 16 years. The bonds could be purchased at face value. The following data have been assembled: Cost of store equipment $149,400 Life of store equipment 16 years $18,800 Estimated residual value of store equipment Yearly costs to operate the warehouse, excluding depreciation of equipment $56,200 Yearly expected revenues-years 1-8 74,900 Yearly expected revenues-years 9-16 69,100 Required: 1. Prepare a differential analysis as of July 1 presenting the proposed operation of the warehouse for the 16 years (Alternative 1) as compared with investing in U.S. Treasury bonds (Alternative 2). If an amount is zero, enter "o". If required, use a minus sign to indicate a loss. Differential Analysis Operate Warehouse (Alt. 1) or Invest in Bonds (Alt. 2) July 1 Operate Invest in Differential Warehouse Bonds Effects (Alternative 1) (Alternative 2) (Alternative 2) Revenues Costs: Required: 1. Prepare a differential analysis as of July 1 presenting the proposed operation of the warehouse for the 16 years (Alternative 1) as compared with investing in U.S. Treasury bonds (Alternative 2). If an amount is zero, enter "o". If required, use a minus sign to indicate a loss Differential Analysis Operate Warehouse (Alt. 1) or Invest in Bonds (Alt. 2) July 1 Operate Invest in Differential Warehouse Bonds Effects (Alternative 1) (Alternative 2) (Alternative 2) Revenues Costs: Costs to operate warehouse Cost of equipment less residual value Profit (Loss) 2. Based on the results disclosed by the differential analysis, should the proposal be accepted? 3. If the proposal is accepted, what is the total estimated operating income of the warehouse for 16 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started