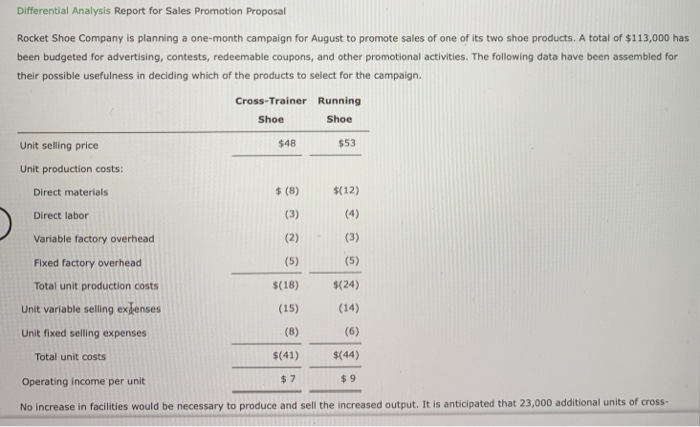

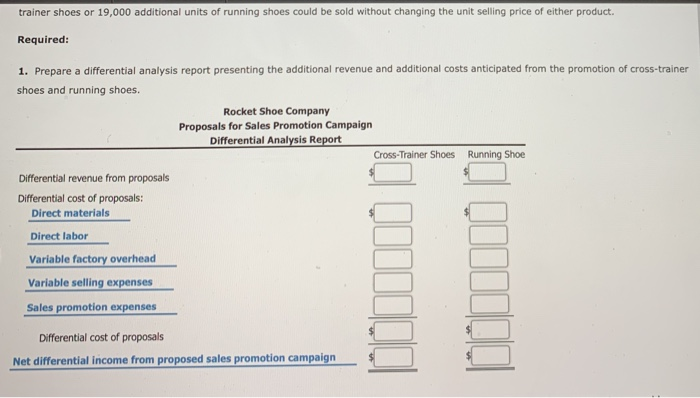

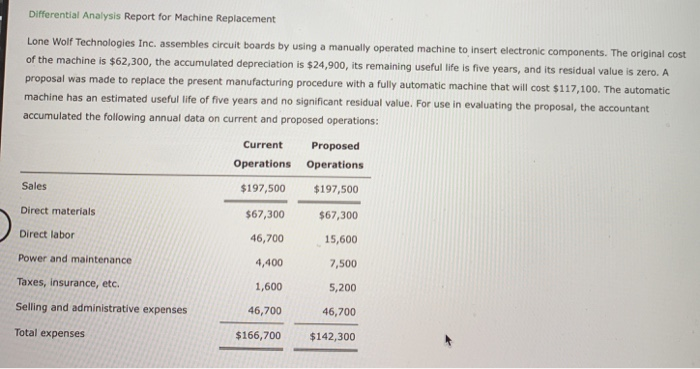

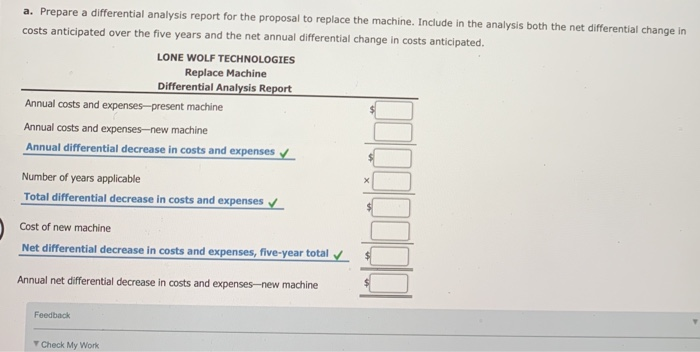

Differential Analysis Report for Sales Promotion Proposal Rocket Shoe Company is planning a one-month campaign for August to promote sales of one of its two shoe products. A total of $113,000 has been budgeted for advertising, contests, redeemable coupons, and other promotional activities. The following data have been assembled for their possible usefulness in deciding which of the products to select for the campaign Cross-Trainer Running Shoe Shoe Unit selling price $48 $53 Unit production costs: Direct materials $(12) Direct labor Variable factory overhead Fixed factory overhead (5) (5) Total unit production costs $(18) $(24) Unit variable selling exdenses (15) (14) Unit fixed selling expenses (8) (6) Total unit costs $(41) $(44) Operating income per unit $ 9 No increase in facilities would be necessary to produce and sell the increased output. It is anticipated that 23,000 additional units of cross- trainer shoes or 19,000 additional units of running shoes could be sold without changing the unit selling price of either product. Required: 1. Prepare a differential analysis report presenting the additional revenue and additional costs anticipated from the promotion of cross-trainer shoes and running shoes. Rocket Shoe Company Proposals for Sales Promotion Campaign Differential Analysis Report Cross-Trainer Shoes Running Shoe Differential revenue from proposals Differential cost of proposals: Direct materials Direct labor Variable factory overhead Variable selling expenses Sales promotion expenses Differential cost of proposals Net differential income from proposed sales promotion campaign Differential Analysis Report for Machine Replacement Lone Wolf Technologies Inc. assembles circuit boards by using a manually operated machine to insert electronic components. The original cost of the machine is $62,300, the accumulated depreciation is $24,900, its remaining useful life is five years, and its residual value is zero. A proposal was made to replace the present manufacturing procedure with a fully automatic machine that will cost $117,100. The automatic machine has an estimated useful life of five years and no significant residual value. For use in evaluating the proposal, the accountant accumulated the following annual data on current and proposed operations: Current Operations Proposed Operations Sales $197,500 $197,500 Direct materials $67,300 $67,300 Direct labor 46,700 15,600 Power and maintenance 4,400 7,500 Taxes, insurance, etc. 1,600 5,200 Selling and administrative expenses 46,700 46,700 $166,700 Total expenses $142,300 a. Prepare a differential analysis report for the proposal to replace the machine. Include in the analysis both the net differential change in costs anticipated over the five years and the net annual differential change in costs anticipated. LONE WOLF TECHNOLOGIES Replace Machine Differential Analysis Report Annual costs and expenses-present machine Annual costs and expenses-new machine Annual differential decrease in costs and expenses Number of years applicable Total differential decrease in costs and expenses Cost of new machine Net differential decrease in costs and expenses, five-year total Annual net differential decrease in costs and expenses-new machine Feedback Cher Mr Work