Answered step by step

Verified Expert Solution

Question

1 Approved Answer

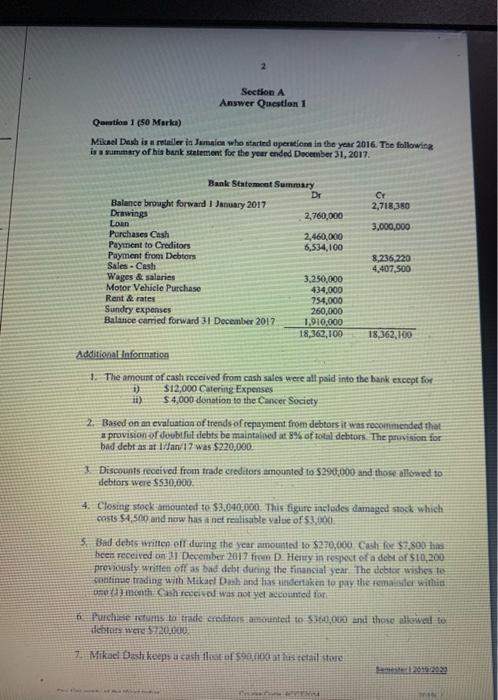

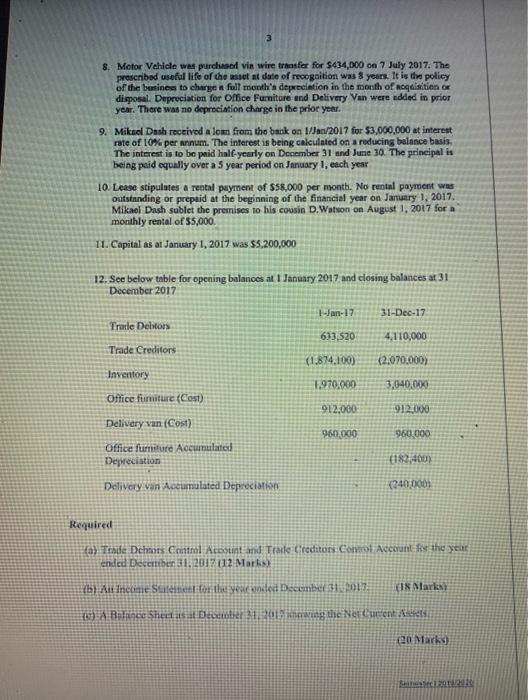

Difficult Financial Accounting Question Section A Answer Questlon 1 Qambilan 1 (50 Mfarka) Misael Dedh is n retaller in Janaien who startod uperwion in the

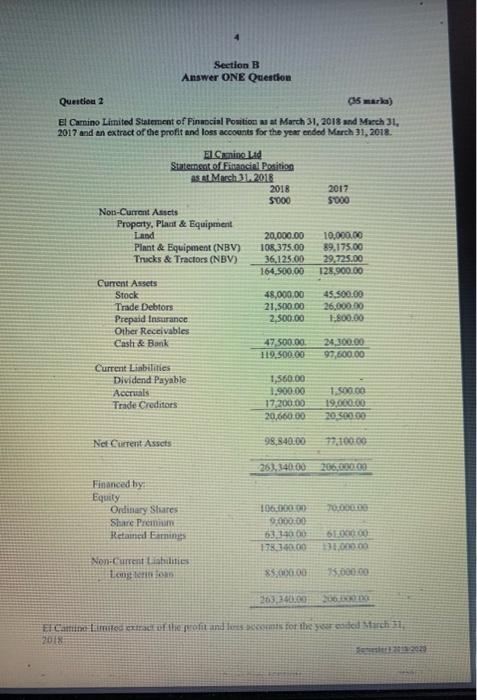

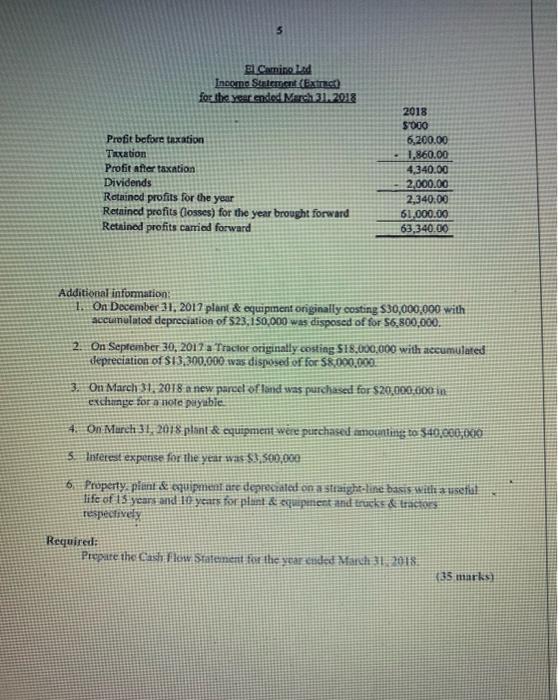

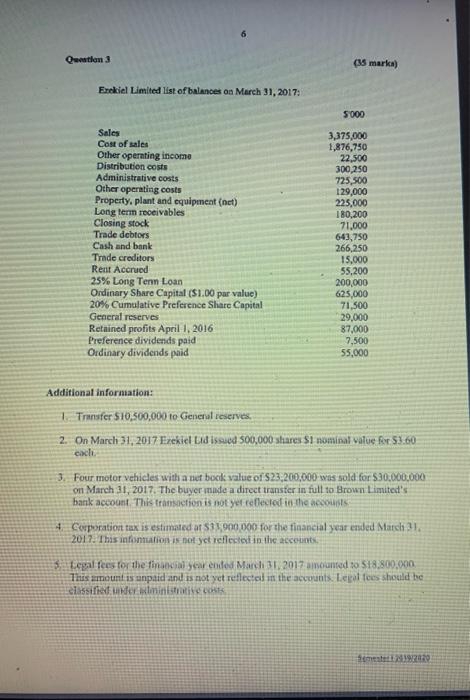

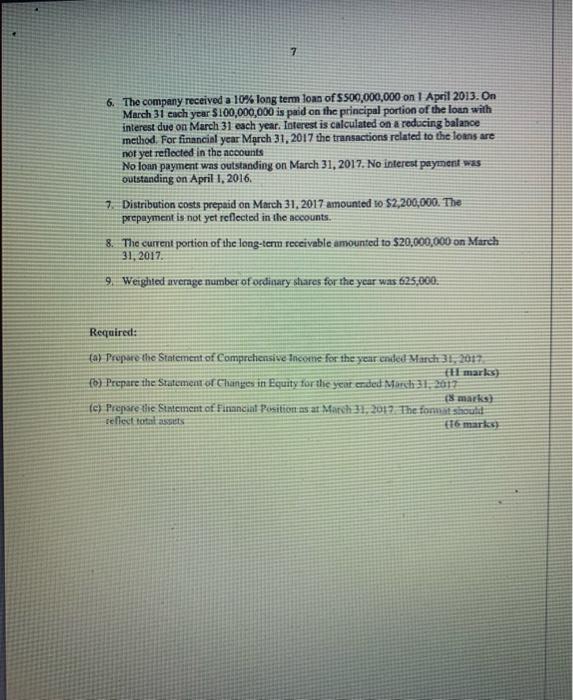

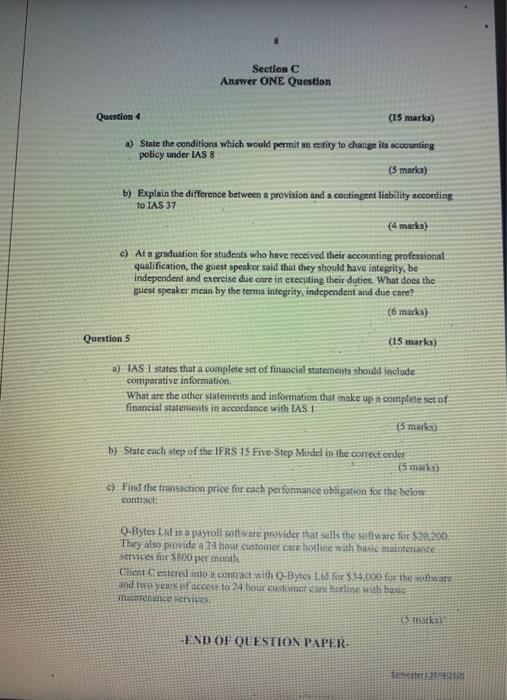

Difficult Financial Accounting Question

Section A Answer Questlon 1 Qambilan 1 (50 Mfarka) Misael Dedh is n retaller in Janaien who startod uperwion in the year 2016 . The followick is a summary of his bank stetement for the year ended Deoember 31, 2017. Additionalinformanion 1. The amount of cash reccived from cash sales were all psid into the bank except for i) $12,000 Cateritte Expenses ii) 54,000 donation to the Cancer Secicty. 2. Based on an evaluation of trends of repayment from debtors ir was rocommended that a provision of doublfil debts be maintained at 3% of todal debtors. The prrifishon for bad debt as at Ixdan/7 was $220,000. 3. Discoun: tcceived from trade credators amounted to 5295 then and those alifned to: vebtors were 5530,000 4. Otoshtg sock imotantet ro. 33.040, 0ut. This figure inelodes danaged stock. which conts 54,500 and now has it net rotlisable value of 53 , 190 . prowichsty srritten off ws that dedar dufing the financial year. The debtoc wishos to: 8. Motor Vehicle wes purchsed vie wire transfer for 9434,000 on 7 July 2017. The proseribod useful life of the asset at date of recogaition was 8 yeurs. It is dra policy of the besiness to charge a fult month's deprecintion in the month of noquistitien or digposal. Deperciation for Office Furniture and Delivery Van were ndded in prior year. There was no depreciation charge in the prioc year. 9. Mikacl Dash received a lom from tho bask on 1/Jan/2017 for $3,060,000 at interest rate of 10% per annum. The interest is being calculated on a roducing balance basis. The interest is to be paid half-yearly on December 31 and June 30 . The principal is being paid equally over a 5 year period on January 1 , each year 10. Lease stipulates a reatal payment of 55,,000 per month. No rental payment was outstanafing or prepuid at the beginning of the financial year on January 1, 2017. Mikaol Dash sublet the premises 10 his cousin D. Watwon on Augest 1, 2017 for a monthly rental of 55,000 . 11. Capital as at January 1,2017 was 55,200,000 12. See below table for opcaing balances at 1 January 2017 and closing balances at 31 Deccmber 2017 Reaicol (20) Sertion B Answer ONE Questlon Quentiou 2 (35 marka) El Camino Limited Siatement of Finascial Forition an at March 31, 2018 and Mrech 31, 2017 and an extrect of the profit and loss accoonts for the year ended Merch 31, 2018. Additional infommation: 1. On December 31,2017 plent \& equipment onginally costing $30,000,000 with accuanulated depreciation of 523,150,000 was disposed of for $6,800,000. 2. On September 30,2013 a Tractor ociginally costing 518,000,000 whith accumulated depreciation of 513,300,000 was disposed of for 58,000,000 3. OnMarch 31. 2018 a new parcel ofland was purchased for $20,000,0001m excharge tor a mote paydbie: 5 interest expense for the year was 55,560,000 life of 13 yearsand 10 yenr for polat \& equpinent and truch & trates reviectively Required: (35 marlss) Erekiel Limited list of balances on March 31, 2017: Additional information: 1. Transer $10,500,000 to General reserves, 2. On March 31, 2017 Frekicl bla is eved 500,000 shares $1 nominal value fer 53.60 cach. 3. Four motor vehicles with a net bocil sylue of 523,200,000 was sold for 530,000,000 on March 31, 2017. The biyer magle a direct transter in full to Brown Limited's bank accoust. This tramsaction is not yet eefleetcol in-the accouds 4. Corporation tax is estamnecd at 537900000 for the financial year ended March .1. 201 7. Thas infonnation is not yct refecsed in the accerints. tecoil feestor the finaecial gcar cided March, 3,2017 ancounced so 578,800,000 This amount is unpaid and is not yet reflectel in the accuatis. Legal fees should be 6. The company received a 10% long term loas of 5500,000,000 on 1 April 2013 . On March 31 each year $100,000,000 is paid on the principal portion of the loan with interest due on March 31 esch year. Interest is calculated on a reducing balaace method. For financial year Marrch 31, 2017 the transactions related to the loans are not yet reflected in the accounts No loan payment was outstanding on March 31, 2017. No interest payment asas outstanding on April 1, 2016. 7. Distribution costs prepaid on March 31, 2017 amounted to $2,200,000. The prepayment is not yet reflected in the accounts. 8. The current portion of the long-term receivable amounted to 520,000,000 on March 31, 2017. 9. Weighted average number of ocdiaary shares for the year was 625,000 . Required: (a) Peupare the Statement of Comprehensive Incoune for the your cadel March 31,4 hit? (b) Prepare the Statement of Changes in Bquity tor the year ended March 3, 201? (c) Prepare tie Statement of finaneial Porition as at : forsh 31, 2097. The fommat shoulif refiect total assots [t6martex) Question 4 (15 marks) a) State the conditions which would permit an entity to change its accounting. policy wader IAS 8 (5 marks) b) Explain the difference between a provision and a contingent liability according to IAS 37 (4 marka ) c) At a graduation for students who have received their acconnting professional qualification, the guest speaker said that they should have integrity, be independent and exercise due eare in executing their duties. What does the guest speaker mean by the terms integrity, independent and due care? (6 inarks) Question 5 (15 marks) ii) IAS I states that a complete set of financial sratements should include comparative information. What are the other stafements and information that make up a comptele set of financial statenicits in accordance with LAS I (5maiks) b) State each atep of the IFRS 15 Five-Step Nodel in the corret order: (5.mas k ) c) Find the trinisiction price for cach performance obighton for the thelow contract: They atso provide a 2 thour customer cire hother wyth pitste imainteriance services for 8 edoaper manals. mantenunce fervies? (23 If 2 k+) 11)(9)(2)+ EIf)NIPAYRR- Section A Answer Questlon 1 Qambilan 1 (50 Mfarka) Misael Dedh is n retaller in Janaien who startod uperwion in the year 2016 . The followick is a summary of his bank stetement for the year ended Deoember 31, 2017. Additionalinformanion 1. The amount of cash reccived from cash sales were all psid into the bank except for i) $12,000 Cateritte Expenses ii) 54,000 donation to the Cancer Secicty. 2. Based on an evaluation of trends of repayment from debtors ir was rocommended that a provision of doublfil debts be maintained at 3% of todal debtors. The prrifishon for bad debt as at Ixdan/7 was $220,000. 3. Discoun: tcceived from trade credators amounted to 5295 then and those alifned to: vebtors were 5530,000 4. Otoshtg sock imotantet ro. 33.040, 0ut. This figure inelodes danaged stock. which conts 54,500 and now has it net rotlisable value of 53 , 190 . prowichsty srritten off ws that dedar dufing the financial year. The debtoc wishos to: 8. Motor Vehicle wes purchsed vie wire transfer for 9434,000 on 7 July 2017. The proseribod useful life of the asset at date of recogaition was 8 yeurs. It is dra policy of the besiness to charge a fult month's deprecintion in the month of noquistitien or digposal. Deperciation for Office Furniture and Delivery Van were ndded in prior year. There was no depreciation charge in the prioc year. 9. Mikacl Dash received a lom from tho bask on 1/Jan/2017 for $3,060,000 at interest rate of 10% per annum. The interest is being calculated on a roducing balance basis. The interest is to be paid half-yearly on December 31 and June 30 . The principal is being paid equally over a 5 year period on January 1 , each year 10. Lease stipulates a reatal payment of 55,,000 per month. No rental payment was outstanafing or prepuid at the beginning of the financial year on January 1, 2017. Mikaol Dash sublet the premises 10 his cousin D. Watwon on Augest 1, 2017 for a monthly rental of 55,000 . 11. Capital as at January 1,2017 was 55,200,000 12. See below table for opcaing balances at 1 January 2017 and closing balances at 31 Deccmber 2017 Reaicol (20) Sertion B Answer ONE Questlon Quentiou 2 (35 marka) El Camino Limited Siatement of Finascial Forition an at March 31, 2018 and Mrech 31, 2017 and an extrect of the profit and loss accoonts for the year ended Merch 31, 2018. Additional infommation: 1. On December 31,2017 plent \& equipment onginally costing $30,000,000 with accuanulated depreciation of 523,150,000 was disposed of for $6,800,000. 2. On September 30,2013 a Tractor ociginally costing 518,000,000 whith accumulated depreciation of 513,300,000 was disposed of for 58,000,000 3. OnMarch 31. 2018 a new parcel ofland was purchased for $20,000,0001m excharge tor a mote paydbie: 5 interest expense for the year was 55,560,000 life of 13 yearsand 10 yenr for polat \& equpinent and truch & trates reviectively Required: (35 marlss) Erekiel Limited list of balances on March 31, 2017: Additional information: 1. Transer $10,500,000 to General reserves, 2. On March 31, 2017 Frekicl bla is eved 500,000 shares $1 nominal value fer 53.60 cach. 3. Four motor vehicles with a net bocil sylue of 523,200,000 was sold for 530,000,000 on March 31, 2017. The biyer magle a direct transter in full to Brown Limited's bank accoust. This tramsaction is not yet eefleetcol in-the accouds 4. Corporation tax is estamnecd at 537900000 for the financial year ended March .1. 201 7. Thas infonnation is not yct refecsed in the accerints. tecoil feestor the finaecial gcar cided March, 3,2017 ancounced so 578,800,000 This amount is unpaid and is not yet reflectel in the accuatis. Legal fees should be 6. The company received a 10% long term loas of 5500,000,000 on 1 April 2013 . On March 31 each year $100,000,000 is paid on the principal portion of the loan with interest due on March 31 esch year. Interest is calculated on a reducing balaace method. For financial year Marrch 31, 2017 the transactions related to the loans are not yet reflected in the accounts No loan payment was outstanding on March 31, 2017. No interest payment asas outstanding on April 1, 2016. 7. Distribution costs prepaid on March 31, 2017 amounted to $2,200,000. The prepayment is not yet reflected in the accounts. 8. The current portion of the long-term receivable amounted to 520,000,000 on March 31, 2017. 9. Weighted average number of ocdiaary shares for the year was 625,000 . Required: (a) Peupare the Statement of Comprehensive Incoune for the your cadel March 31,4 hit? (b) Prepare the Statement of Changes in Bquity tor the year ended March 3, 201? (c) Prepare tie Statement of finaneial Porition as at : forsh 31, 2097. The fommat shoulif refiect total assots [t6martex) Question 4 (15 marks) a) State the conditions which would permit an entity to change its accounting. policy wader IAS 8 (5 marks) b) Explain the difference between a provision and a contingent liability according to IAS 37 (4 marka ) c) At a graduation for students who have received their acconnting professional qualification, the guest speaker said that they should have integrity, be independent and exercise due eare in executing their duties. What does the guest speaker mean by the terms integrity, independent and due care? (6 inarks) Question 5 (15 marks) ii) IAS I states that a complete set of financial sratements should include comparative information. What are the other stafements and information that make up a comptele set of financial statenicits in accordance with LAS I (5maiks) b) State each atep of the IFRS 15 Five-Step Nodel in the corret order: (5.mas k ) c) Find the trinisiction price for cach performance obighton for the thelow contract: They atso provide a 2 thour customer cire hother wyth pitste imainteriance services for 8 edoaper manals. mantenunce fervies? (23 If 2 k+) 11)(9)(2)+ EIf)NIPAYRR Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started