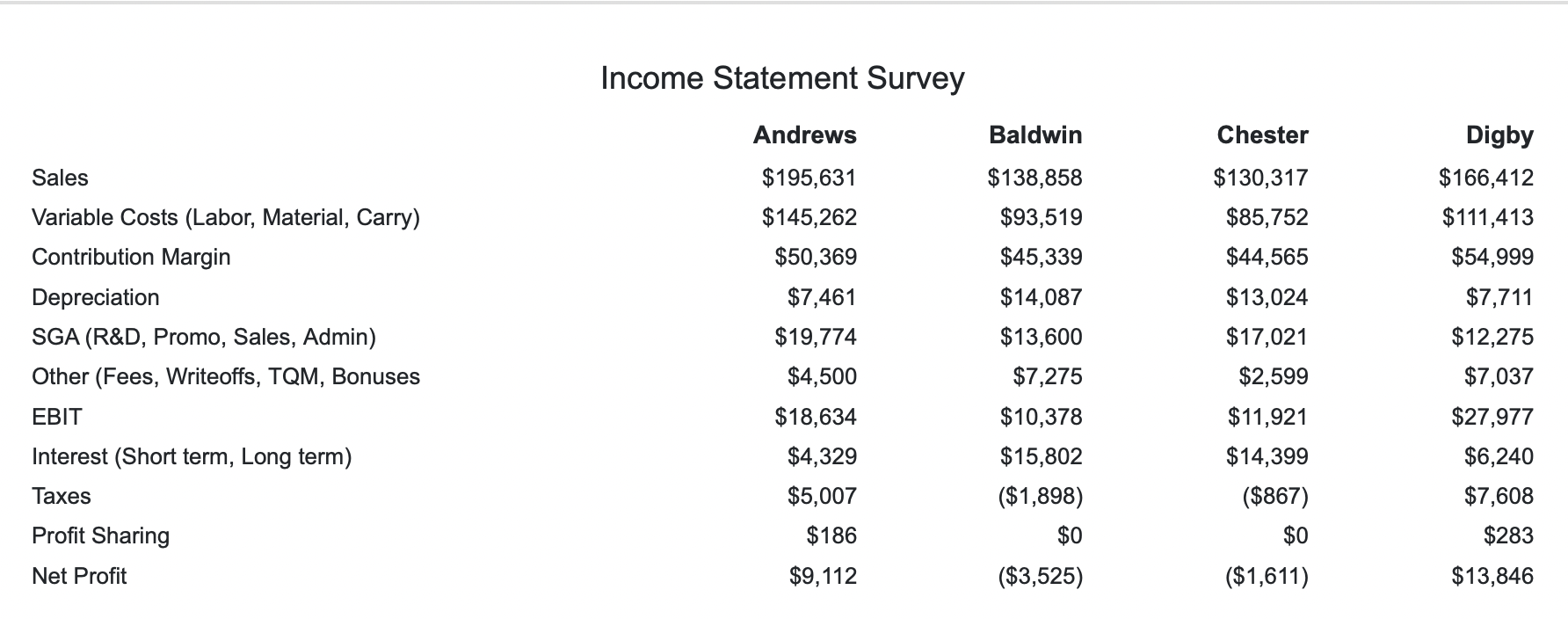

Digby Corp. ended the year carrying $27,043,000 worth of inventory. Had they sold their entire inventory at their current prices, how many more dollars of contribution margin would it have brought to Digby Corp.?

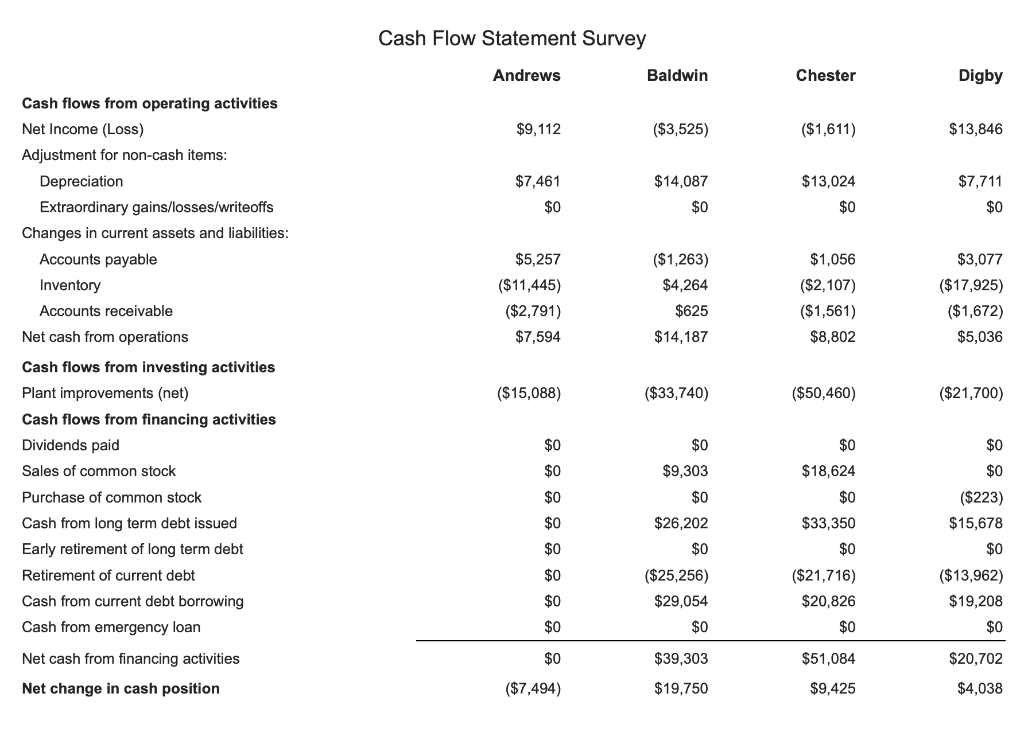

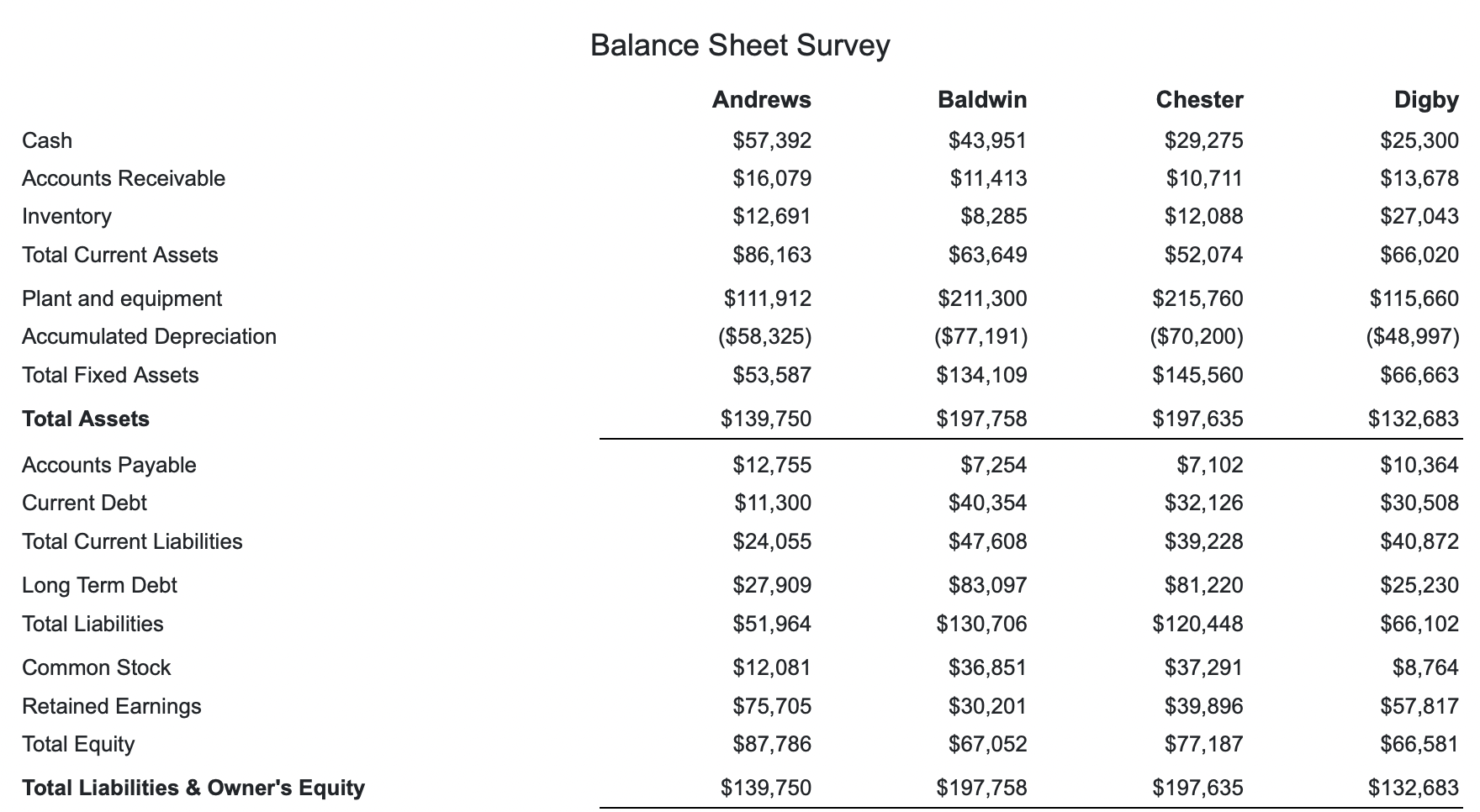

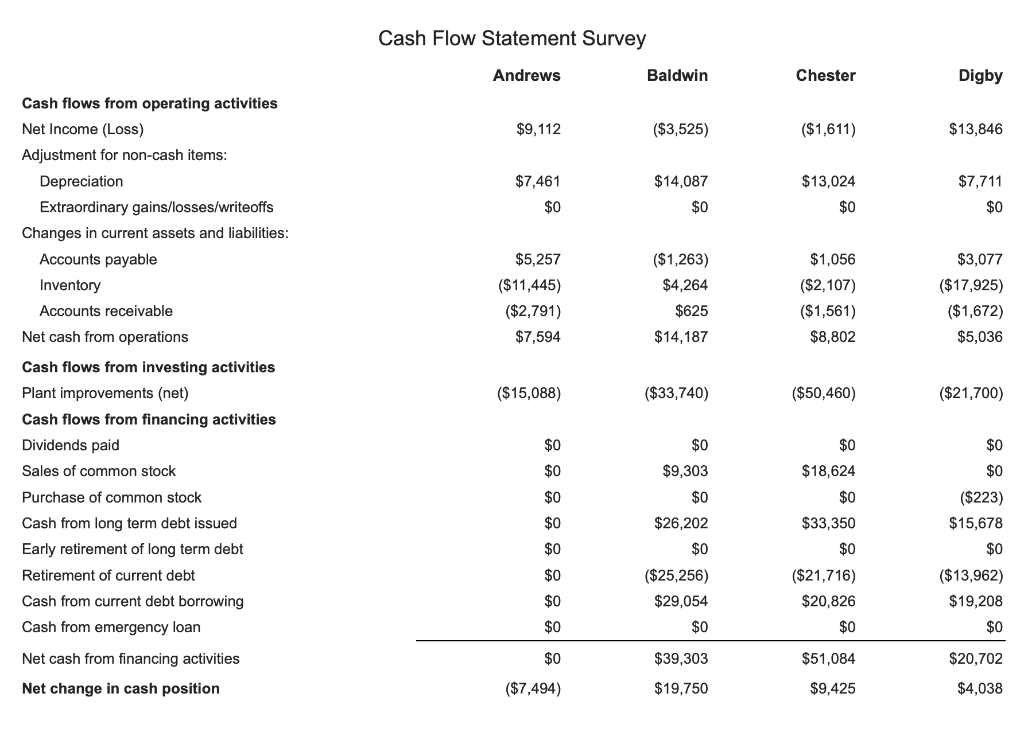

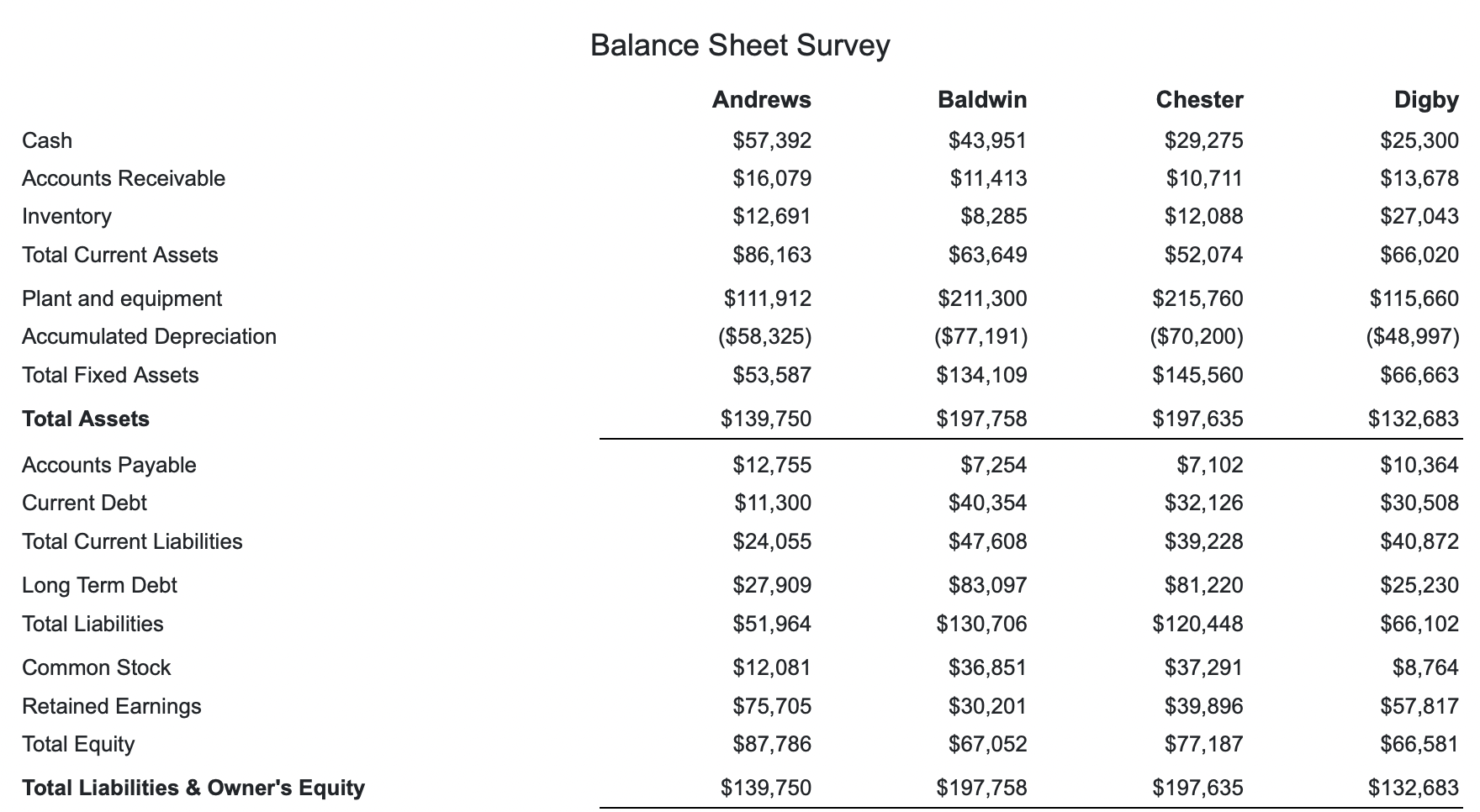

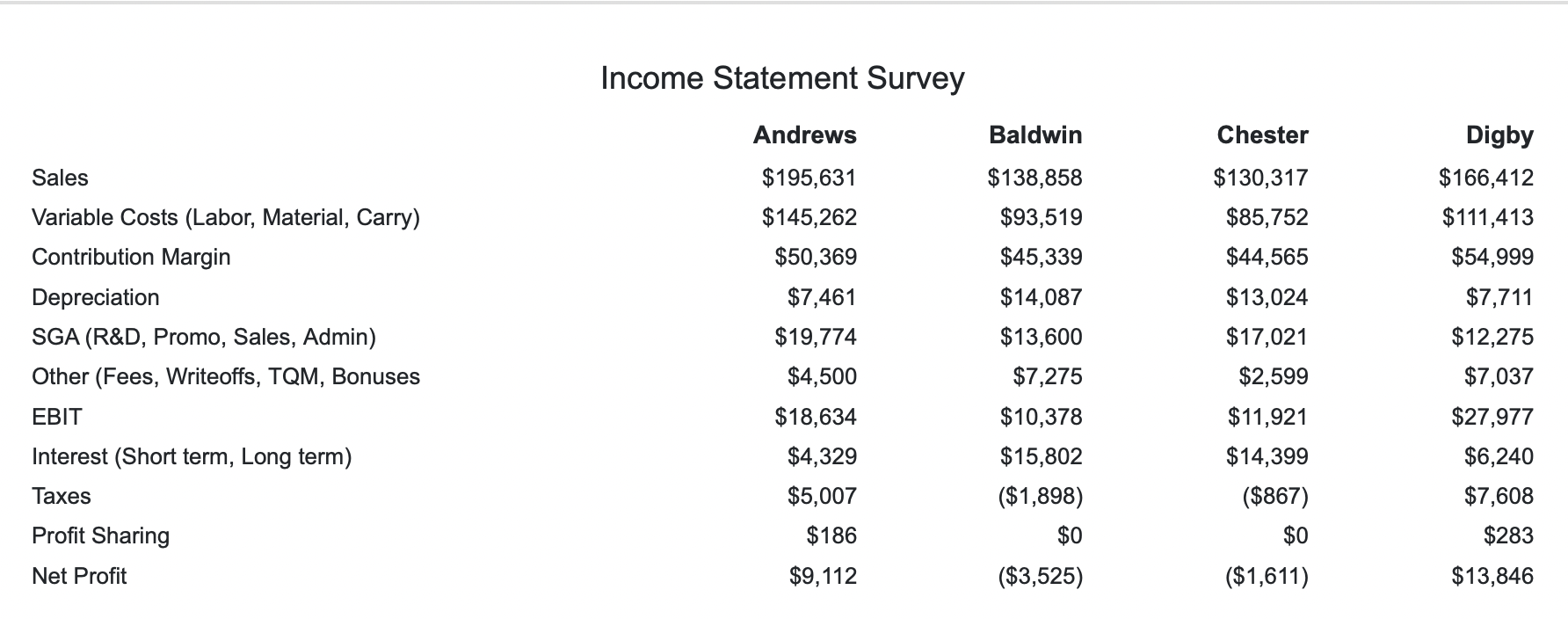

Cash Flow Statement Survey Andrews Baldwin Chester Digby $9,112 ($3,525) ($1,611) $13,846 $7,461 $14,087 $7,711 $13,024 $0 $0 $0 $0 Cash flows from operating activities Net Income (Loss) Adjustment for non-cash items: Depreciation Extraordinary gains/losses/writeoffs Changes in current assets and liabilities: Accounts payable Inventory Accounts receivable Net cash from operations Cash flows from investing activities Plant improvements (net) Cash flows from financing activities Dividends paid Sales of common stock $5,257 ($11,445) ($2,791) $7,594 ($1,263) $4,264 $625 $14,187 $1,056 ($2,107) ($1,561) $8,802 $3,077 ($17,925) ($1,672) $5,036 ($15,088) ($33,740) ($50,460) ($21,700) $0 $0 $0 $0 $9,303 $0 $0 Purchase of common stock $0 $0 $0 $26,202 $18,624 $0 $33,350 $0 ($21,716) $20,826 $0 Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan $0 ($223) $15,678 $0 ($13,962) $19,208 $0 ($25,256) $29,054 $0 $0 $0 $0 $0 Net cash from financing activities $0 $39,303 $51,084 $20,702 Net change in cash position ($7,494) $19,750 $9,425 $4,038 Balance Sheet Survey Andrews Baldwin Chester Cash Accounts Receivable $57,392 $16,079 $12,691 $86,163 $43,951 $11,413 $8,285 $63,649 $29,275 $10,711 $12,088 $52,074 Inventory Digby $25,300 $13,678 $27,043 $66,020 $115,660 ($48,997) $66,663 Total Current Assets Plant and equipment Accumulated Depreciation $111,912 ($58,325) $53,587 $211,300 ($77,191) $134,109 $215,760 ($70,200) $145,560 Total Fixed Assets Total Assets $139,750 $197,758 $197,635 $132,683 Accounts Payable $12,755 Current Debt $11,300 $24,055 $7,254 $40,354 $47,608 $7,102 $32,126 $39,228 $10,364 $30,508 $40,872 Total Current Liabilities Long Term Debt $27,909 $83,097 $130,706 $81,220 $120,448 $25,230 $66,102 Total Liabilities $51,964 Common Stock $37,291 $8,764 $12,081 $75,705 $87,786 $36,851 $30,201 Retained Earnings Total Equity $39,896 $77,187 $57,817 $66,581 $67,052 Total Liabilities & Owner's Equity $139,750 $197,758 $197,635 $132,683 Income Statement Survey Baldwin Chester Sales Variable Costs (Labor, Material, Carry) Contribution Margin Depreciation SGA (R&D, Promo, Sales, Admin) Other (Fees, Writeoffs, TQM, Bonuses Andrews $195,631 $145,262 $50,369 $7,461 $19,774 $4,500 $18,634 $4,329 $5,007 $186 $9,112 $138,858 $93,519 $45,339 $14,087 $13,600 $7,275 $10,378 $15,802 ($1,898) $0 ($3,525) $130,317 $85,752 $44,565 $13,024 $17,021 $2,599 $11,921 $14,399 ($867) $0 ($1,611) Digby $166,412 $111,413 $54,999 $7,711 $12,275 $7,037 $27,977 $6,240 $7,608 $283 EBIT Interest (Short term, Long term) Taxes Profit Sharing Net Profit $13,846