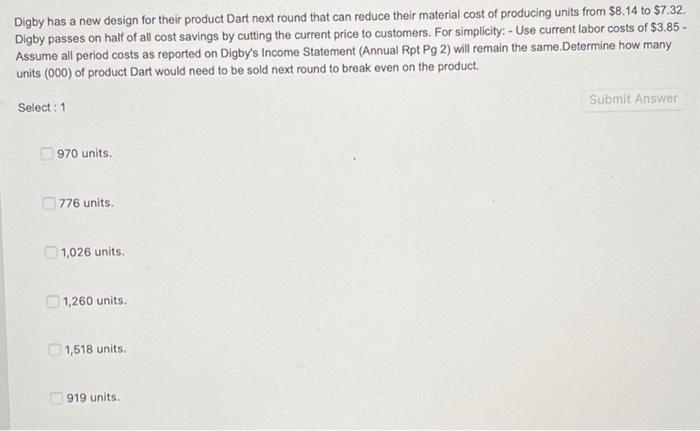

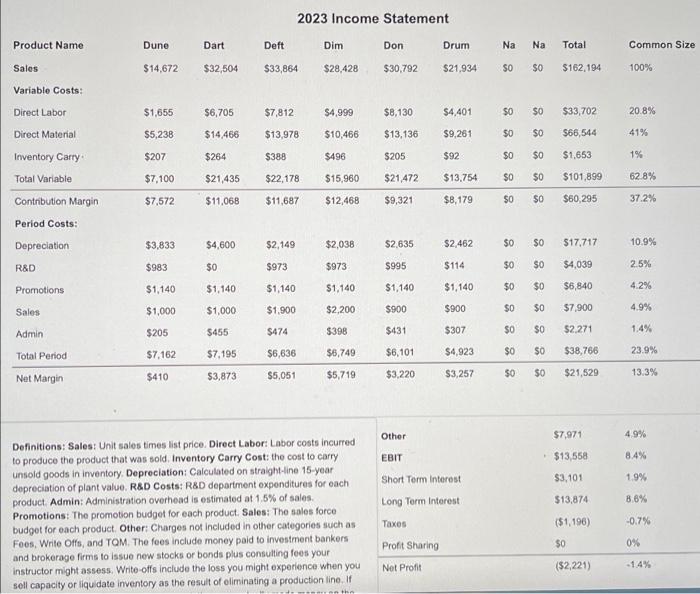

Digby has a new design for their product Dart next round that can reduce their material cost of producing units from $8.14 to $7.32. Digby passes on half of all cost savings by cutting the current price to customers. For simplicity: - Use current labor costs of $3.85 - Assume all perlod costs as reported on Digby's Income Statement (Annual Rpt Pg 2) will remain the same.Determine how many units (000) of product Dart would need to be sold next round to break even on the product Submit Answer Select : 1 970 units 776 units. 1,026 units 1,260 units 1,518 units 919 units 2023 Income Statement Product Name Dune Dart Deft Dim Don Drum Na Na Total Common Size $14,672 $32,504 $33,864 $28,428 $30,792 $21.934 so $0 $0 $162,194 100% $1,655 $6,705 $7,812 $4.999 $8,130 $4,401 $0 $0 $33,702 20.8% Sales Variable costs: Direct Labor Direct Material Inventory Carry Total Variable $5,238 $14,466 $13,978 $10,466 $13,136 $9,261 $0 $0 $66,544 41% $207 $264 $388 $496 $205 $92 $ $0 $1,653 1% 88 $7,100 $21,435 $22,178 $15.960 $13.754 $0 $101,899 62.8% $21,472 $9,321 Contribution Margin $7,572 $11,068 $11,687 $12,468 $8,179 $ 50 $0 $60,295 37.2% Period Costs: Depreciation $3,833 $4,600 $2,149 $2,038 $2,635 $2.462 8 $0 $0 $17,717 10.9% R&D $983 $0 $973 $973 $995 $114 $0 SO $4,039 2.5% $1,140 $1,140 $1,140 $1,140 $1,140 $1,140 $0 $0 $6,840 4.2% $1,000 $1,000 $1,900 $2,200 $900 $900 $0 $0 $7.900 4.9% Promotions Sales Admin Total Period $205 $455 $474 $398 $431 $307 $0 $0 $2,271 1.4% $7,162 $7.195 $6,749 $6,636 $4.923 $0 $0 $38,766 23.9% $6.101 $3,220 $410 $3,873 $5,051 $5,719 $3,257 Net Margin $0 $0 $21,529 13.3% Other $7.971 4.9% EBIT $13,558 8.4% Short Term Interest $3,101 1.9% Long Term Interest $13,874 8.6% Definitions: Sales: Unit sales times list price Direct Labor: Labor costs incurred to produce the product that was sold Inventory Carry Cost: the cost to carry unsold goods in inventory. Depreciation: Calculated on straight-line 15-year depreciation of plant value, R&D Costs: R&D department expenditures for each product Admin: Administration overhead is estimated at 1,5% of sales Promotions: The promotion budget for each product. Sales: The sales force budget for each product Other Charges not included in other categories such as Foos, Write Offs, and TOM. The foes include money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your Instructor might assess. Write-offs include the loss you might experience when you sell capacity or liquidate inventory as the result of eliminating a production line. If Taxes ($1,196) -0.7% Profit Sharing $0 0% Not Profit ($2,221) Digby has a new design for their product Dart next round that can reduce their material cost of producing units from $8.14 to $7.32. Digby passes on half of all cost savings by cutting the current price to customers. For simplicity: - Use current labor costs of $3.85 - Assume all perlod costs as reported on Digby's Income Statement (Annual Rpt Pg 2) will remain the same.Determine how many units (000) of product Dart would need to be sold next round to break even on the product Submit Answer Select : 1 970 units 776 units. 1,026 units 1,260 units 1,518 units 919 units 2023 Income Statement Product Name Dune Dart Deft Dim Don Drum Na Na Total Common Size $14,672 $32,504 $33,864 $28,428 $30,792 $21.934 so $0 $0 $162,194 100% $1,655 $6,705 $7,812 $4.999 $8,130 $4,401 $0 $0 $33,702 20.8% Sales Variable costs: Direct Labor Direct Material Inventory Carry Total Variable $5,238 $14,466 $13,978 $10,466 $13,136 $9,261 $0 $0 $66,544 41% $207 $264 $388 $496 $205 $92 $ $0 $1,653 1% 88 $7,100 $21,435 $22,178 $15.960 $13.754 $0 $101,899 62.8% $21,472 $9,321 Contribution Margin $7,572 $11,068 $11,687 $12,468 $8,179 $ 50 $0 $60,295 37.2% Period Costs: Depreciation $3,833 $4,600 $2,149 $2,038 $2,635 $2.462 8 $0 $0 $17,717 10.9% R&D $983 $0 $973 $973 $995 $114 $0 SO $4,039 2.5% $1,140 $1,140 $1,140 $1,140 $1,140 $1,140 $0 $0 $6,840 4.2% $1,000 $1,000 $1,900 $2,200 $900 $900 $0 $0 $7.900 4.9% Promotions Sales Admin Total Period $205 $455 $474 $398 $431 $307 $0 $0 $2,271 1.4% $7,162 $7.195 $6,749 $6,636 $4.923 $0 $0 $38,766 23.9% $6.101 $3,220 $410 $3,873 $5,051 $5,719 $3,257 Net Margin $0 $0 $21,529 13.3% Other $7.971 4.9% EBIT $13,558 8.4% Short Term Interest $3,101 1.9% Long Term Interest $13,874 8.6% Definitions: Sales: Unit sales times list price Direct Labor: Labor costs incurred to produce the product that was sold Inventory Carry Cost: the cost to carry unsold goods in inventory. Depreciation: Calculated on straight-line 15-year depreciation of plant value, R&D Costs: R&D department expenditures for each product Admin: Administration overhead is estimated at 1,5% of sales Promotions: The promotion budget for each product. Sales: The sales force budget for each product Other Charges not included in other categories such as Foos, Write Offs, and TOM. The foes include money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your Instructor might assess. Write-offs include the loss you might experience when you sell capacity or liquidate inventory as the result of eliminating a production line. If Taxes ($1,196) -0.7% Profit Sharing $0 0% Not Profit ($2,221)