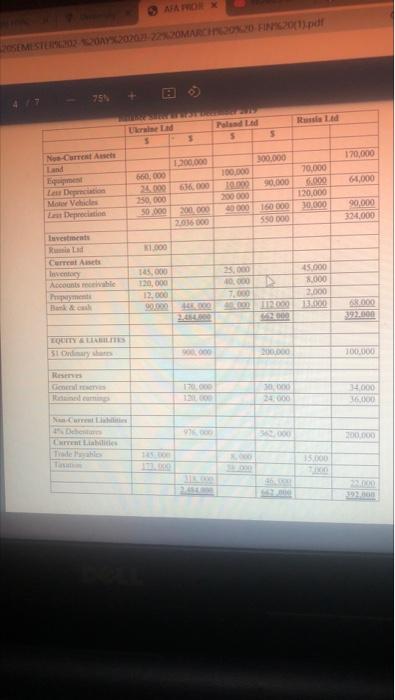

Digicel 35% 4 8:01 PM Expert Q&A Done The following are the balance sheets of Ukraine Limited, Poland Limited and Russia Limited, as at the 31 December 2019. The three companies are major players in the automotive industry. Max Limited acquired 75% of the shares in Poland Limited on January 1 2017 when the reserve balances were as follows: General reserves: $24,000 and retained earnings $60 000 The acquisition of Poland Limited consisted of a deferred cash payment of $300,000 and a share exchange of 2 shares in Ukraine Limited for every 5 shares acquired in Poland Limited. The market price for a Ukraine Limited share at that date was $4.50. The transaction has not been recorded on the books. On 1 July 2019 Ukraine Limited acquired 30,000 shares in Russia Limited for cash at a price of $2.70 per share. For the year ended 31 December 2019 Russia Limited reported a profit of $64,000 (assume profit accrued evenly during the year). This transaction was recorded on the books. ADDITIONAL INFORMATION: 1. At the date of the acquisition the directors of Ukraine Limited determined that the fair market value of land owned by Poland Ltd was $450 000, however no adjustments were made. 2. At December 31 2018, goodwill was impaired by $90,000 3. During the year Ukraine Limited sold goods to Poland Ltd for $140 000, after charging a mark-up of 40%. At 31 December 2014 only 70% of the goods were sold. 4. During the year Poland Limited transferred a motor vehicle to Ukraine Ltd at a price of $30,000, the motor vehicle was new and cost Poland Limited $20,000. Ukraine Limited depreciated the motor vehicle at 10% of the cost to them. 5. Non-Controlling Interest should be valued at $3 per share at acquisition date. 6 The investment in Poland limited was impaired by 15% of cost price Required: Prepare the Consolidated Balance Sheet for the Ukraine Limited Group as at 31 December 2019 AFARON X SEMESTINY 2001, 2X COMARCINOX FINK.2013.pdf 751 Led Pald 5 5 5 3 NA 1.200.000 300.000 170,000 90000 000 00019 70,000 6.000 120,000 660,000 24000 350.00 50 000 200 000 Mar Vahid Los Depreciation 000 DE 0000 000 000 000 091 000 OSS 90,000 324.000 2015 300 uvestments 1.000 Currat Aset Invents Account ble 45.000 8.000 10 120,000 12.000 90.00 Bank LEO OUTRO 0 000 L 3922000 LOCITY LILLES 31 Only 000 200.000 100.000 Ree icon 17 00 000 F 1000 300.000 Letti Tadelle 35.000 TO Digicel 35% 4 8:01 PM Expert Q&A Done The following are the balance sheets of Ukraine Limited, Poland Limited and Russia Limited, as at the 31 December 2019. The three companies are major players in the automotive industry. Max Limited acquired 75% of the shares in Poland Limited on January 1 2017 when the reserve balances were as follows: General reserves: $24,000 and retained earnings $60 000 The acquisition of Poland Limited consisted of a deferred cash payment of $300,000 and a share exchange of 2 shares in Ukraine Limited for every 5 shares acquired in Poland Limited. The market price for a Ukraine Limited share at that date was $4.50. The transaction has not been recorded on the books. On 1 July 2019 Ukraine Limited acquired 30,000 shares in Russia Limited for cash at a price of $2.70 per share. For the year ended 31 December 2019 Russia Limited reported a profit of $64,000 (assume profit accrued evenly during the year). This transaction was recorded on the books. ADDITIONAL INFORMATION: 1. At the date of the acquisition the directors of Ukraine Limited determined that the fair market value of land owned by Poland Ltd was $450 000, however no adjustments were made. 2. At December 31 2018, goodwill was impaired by $90,000 3. During the year Ukraine Limited sold goods to Poland Ltd for $140 000, after charging a mark-up of 40%. At 31 December 2014 only 70% of the goods were sold. 4. During the year Poland Limited transferred a motor vehicle to Ukraine Ltd at a price of $30,000, the motor vehicle was new and cost Poland Limited $20,000. Ukraine Limited depreciated the motor vehicle at 10% of the cost to them. 5. Non-Controlling Interest should be valued at $3 per share at acquisition date. 6 The investment in Poland limited was impaired by 15% of cost price Required: Prepare the Consolidated Balance Sheet for the Ukraine Limited Group as at 31 December 2019 AFARON X SEMESTINY 2001, 2X COMARCINOX FINK.2013.pdf 751 Led Pald 5 5 5 3 NA 1.200.000 300.000 170,000 90000 000 00019 70,000 6.000 120,000 660,000 24000 350.00 50 000 200 000 Mar Vahid Los Depreciation 000 DE 0000 000 000 000 091 000 OSS 90,000 324.000 2015 300 uvestments 1.000 Currat Aset Invents Account ble 45.000 8.000 10 120,000 12.000 90.00 Bank LEO OUTRO 0 000 L 3922000 LOCITY LILLES 31 Only 000 200.000 100.000 Ree icon 17 00 000 F 1000 300.000 Letti Tadelle 35.000 TO