Answered step by step

Verified Expert Solution

Question

1 Approved Answer

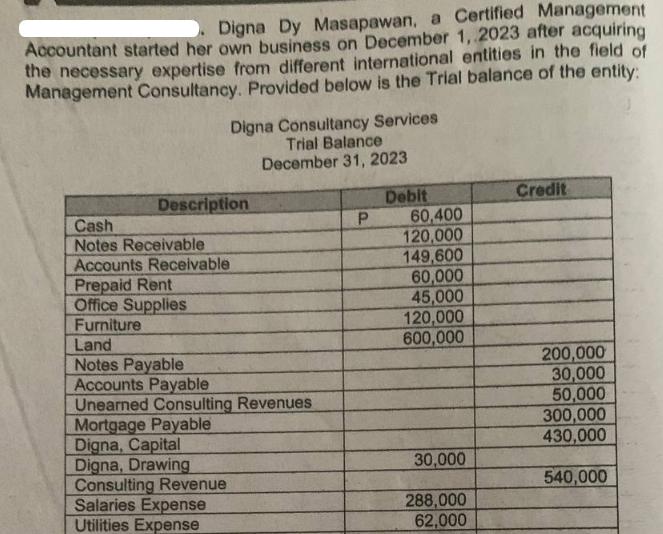

Digna Dy Masapawan, a Certified Management Accountant started her own business on December 1, 2023 after acquiring the necessary expertise from different international entities

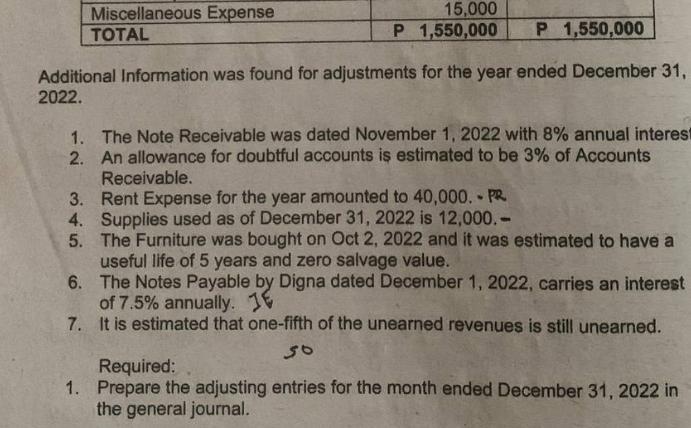

Digna Dy Masapawan, a Certified Management Accountant started her own business on December 1, 2023 after acquiring the necessary expertise from different international entities in the field of Management Consultancy. Provided below is the Trial balance of the entity: Description Cash Notes Receivable Accounts Receivable Prepaid Rent Office Supplies Furniture Digna Consultancy Services Trial Balance December 31, 2023 Land Notes Payable Accounts Payable Unearned Consulting Revenues Mortgage Payable Digna, Capital Digna, Drawing Consulting Revenue Salaries Expense Utilities Expense P Debit 60,400 120,000 149,600 60,000 45,000 120,000 600,000 30,000 288,000 62,000 Credit 200,000 30,000 50,000 300,000 430,000 540,000 Miscellaneous Expense TOTAL 15,000 P 1,550,000 P 1,550,000 Additional Information was found for adjustments for the year ended December 31, 2022. 1. The Note Receivable was dated November 1, 2022 with 8% annual interest 2. An allowance for doubtful accounts is estimated to be 3% of Accounts Receivable. 3. Rent Expense for the year amounted to 40,000.- PR 4. Supplies used as of December 31, 2022 is 12,000.- 5. The Furniture was bought on Oct 2, 2022 and it was estimated to have a useful life of 5 years and zero salvage value. 6. The Notes Payable by Digna dated December 1, 2022, carries an interest of 7.5% annually. 16 7. It is estimated that one-fifth of the unearned revenues is still unearned. 30 Required: 1. Prepare the adjusting entries for the month ended December 31, 2022 in the general journal.

Step by Step Solution

★★★★★

3.30 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the adjusting entries for the month ended December 31 2022 based on the additional inform...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started