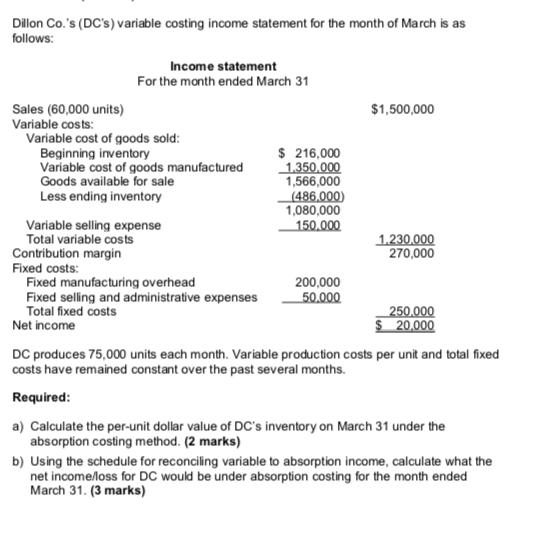

Dillon Co.'s (DC's) variable costing income statement for the month of March is as follows: Sales (60,000 units) Variable costs: Income statement For the

Dillon Co.'s (DC's) variable costing income statement for the month of March is as follows: Sales (60,000 units) Variable costs: Income statement For the month ended March 31 Variable cost of goods sold: Beginning inventory Variable cost of goods manufactured Goods available for sale Less ending inventory Variable selling expense Total variable costs Contribution margin Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expenses Total fixed costs Net income $ 216,000 1,350,000 1,566,000 (486,000) 1,080,000 150.000 200,000 50.000 $1,500,000 1.230.000 270,000 250.000 $ 20,000 DC produces 75,000 units each month. Variable production costs per unit and total fixed costs have remained constant over the past several months. Required: a) Calculate the per-unit dollar value of DC's inventory on March 31 under the absorption costing method. (2 marks) b) Using the schedule for reconciling variable to absorption income, calculate what the net income/loss for DC would be under absorption costing for the month ended March 31. (3 marks)

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a The perunit dollar value of DCs inventory on March 31 under the absorption costing method is 48...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started