Question

Rove Inc. is a Canadian controlled private corporation (CCPC) that had a GRIP balance of $21,700 at the end of the previous taxation year.

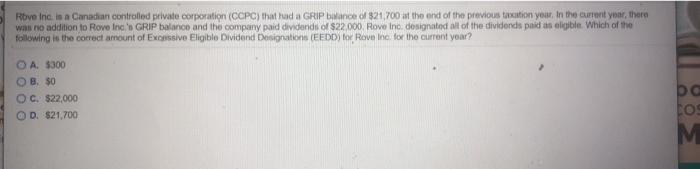

Rove Inc. is a Canadian controlled private corporation (CCPC) that had a GRIP balance of $21,700 at the end of the previous taxation year. In the current year, there was no addition to Rove Inc.'s GRIP balance and the company paid dividends of $22,000. Rove Inc. designated all of the dividends paid as eligible. Which of the following is the correct amount of Excessive Eligible Dividend Designations (EEDD) for Rove Inc. for the current year? OA. $300 OB. $0 OC. $22,000 D. $21,700 pa Cos M

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Option A 300 is correct Given Eligible dividends p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing and Assurance Services Understanding the Integrated Audit

Authors: Karen L. Hooks

1st edition

471726346, 978-0471726340

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App