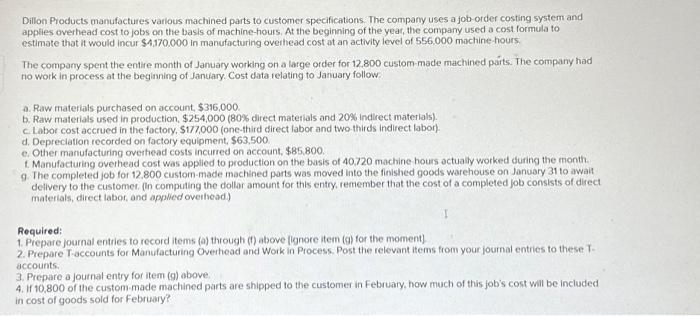

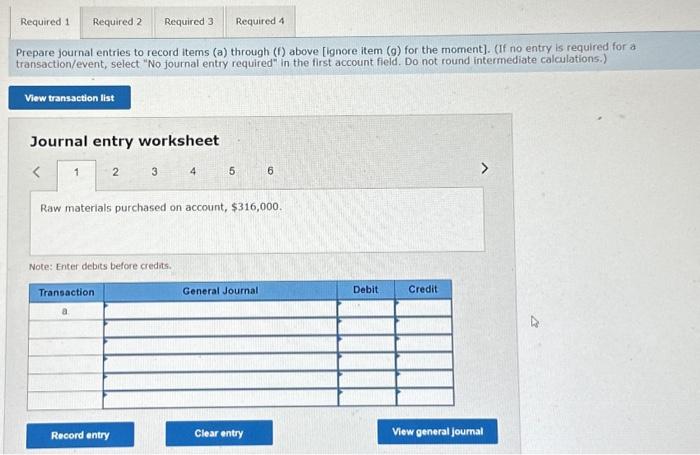

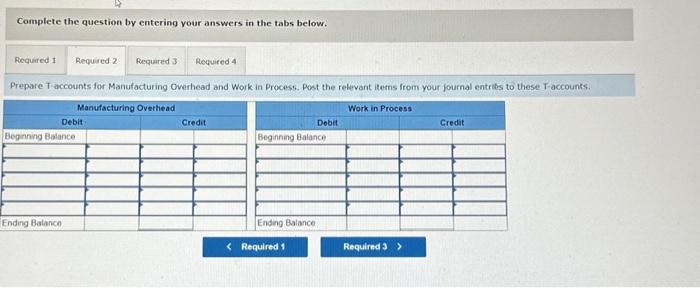

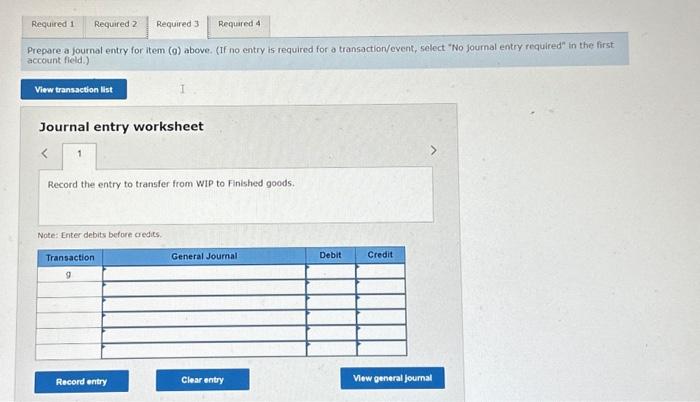

Dillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,170,000 in manufacturing overhead cost at an activity level of 556,000 machine hours? The company spent the entire month of January workang on a large order for 12.800 custom-made machined paits. The company had no wotk in process at the beginning of Jantary. Cost data relating to January follow: a. Raw riaterials purchased on account, $316,000 b. Raw materials used in production, $254,000 (80\% direct materials and 20% indirect materials). c. Labor cost accrued in the foctory, $177,000 (one-third direct labor and two thirds indirect labor) d. Depreciation recorded on factory equipment, $63,500 e. Other manufacturing overhead costs incurred on account, $85,800 t. Manufacturing overhead cost was applied to production on the basis of 40.720 machine hours actually worked during the month. 9. The completed job for 12.800 custom-made machined parts was moved into the finished goods warehouse on January 31 to awalt delivery to the customer. (in computing the dollar amount for this entry, remember that the cost of a completed job consists of direct materials, direct labor, and appled overhead) Required: 1. Prepare journal entries to record items (a) through (f) above (ignore item (g) for the moment] 2. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant items from your journal entries to these T. accounts. 3. Prepare a journal entry for item (g) above. 4. If 10.800 of the custom-made machined parts are shipped to the customer in February, how much of this job's cost will be included in cost of goods sold for February? repare journal entries to record items (a) through (f) above [ignore item (g) for the moment]. (If no entry is required for a ransaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) Journal entry worksheet 56 Raw materials purchased on account, $316,000. Note: Enter debits before credits. Complete the question by entering your answers in the tabs below. Prepare a journal entry for item (g) above. (If no entry is required for o transaction/event, select "No journal entry required" in the first. account field.) Journal entry worksheet Record the entry to transfer from WIp to Finished goods. Note: Enter debits before credirs. If 10,800 of the custom-made machined parts are shipped to the customer in February, how much of this job's cost will be included in cost of goods sold for February? (Round your intermediate cakculations to 2 decimal places and final answer to the nearest whole dollar amount.)