Answered step by step

Verified Expert Solution

Question

1 Approved Answer

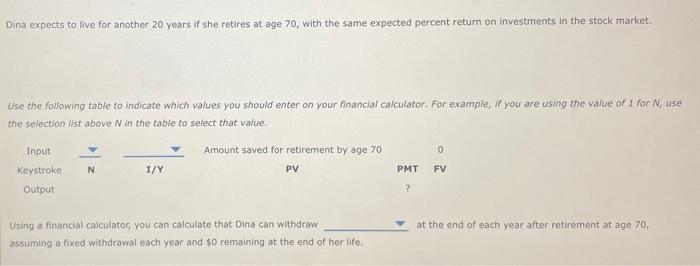

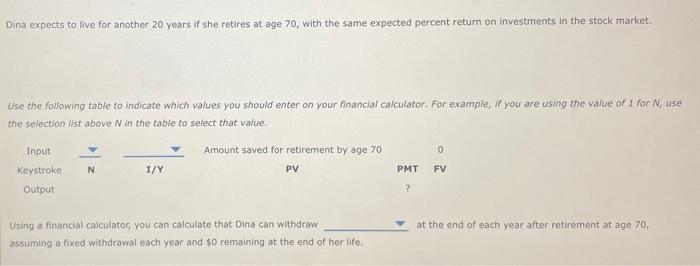

Dina is 45 yeaors old. No retirement savings. First payment coming one year from now for retirement saving. she can save 15,000 per year. will

Dina is 45 yeaors old. No retirement savings. First payment coming one year from now for retirement saving. she can save 15,000 per year. will invest that amount in stock, expected to yield and average annual amount return of 12.00%. rate constant for the rest of her life. ordinary annuity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started