Answered step by step

Verified Expert Solution

Question

1 Approved Answer

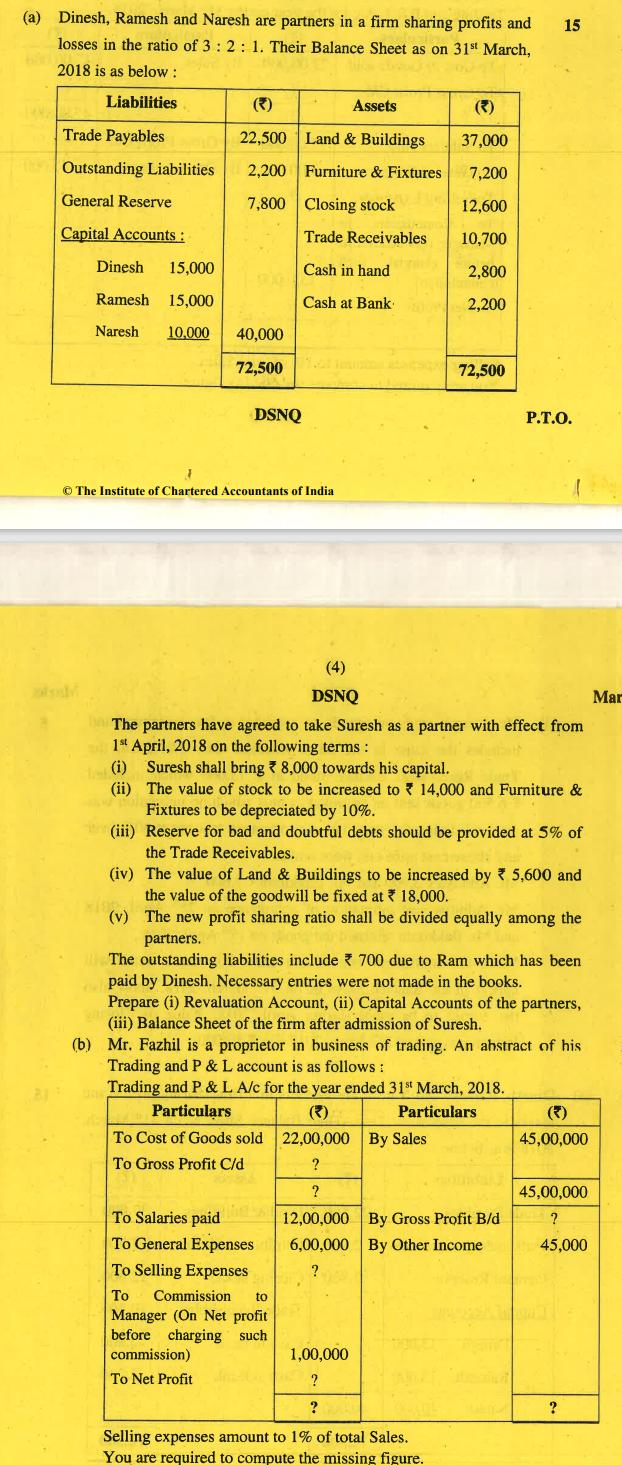

Dinesh, Ramesh and Naresh are partners in a firm sharing profits and losses in the ratio of 3: 2: 1. Their Balance Sheet as

Dinesh, Ramesh and Naresh are partners in a firm sharing profits and losses in the ratio of 3: 2: 1. Their Balance Sheet as on 31st March, 2018 is as below: Liabilities Trade Payables The Outstanding Liabilities General Reserve Capital Accounts: 1482 (3) 22,500 Land & Buildings 2,200 7,800 Closing stock Dinesh 15,000 Ramesh 15,000 Naresh 10,000 40,000 72,500 DSNQ The Institute of Chartered Accountants of India Furniture & Fixtures Assets Trade Receivables Cash in hand Cash at Bank To Cost of Goods sold To Gross Profit C/d To Salaries paid To General Expenses To Selling Expenses To Commission to Manager (On Net profit before charging such commission) To Net Profit (4) DSNQ 37,000 7,200 12,600 10,700 2,800 2,200 The partners have agreed to take Suresh as a partner with effect from 1st April, 2018 on the following terms: 72,500 (i) Suresh shall bring 8,000 towards his capital. (ii) The value of stock to be increased to 14,000 and Furniture & COLE Fixtures to be depreciated by 10%. (iii) Reserve for bad and doubtful debts should be provided at 5% of the Trade Receivables. (iv) The value of Land & Buildings to be increased by * 5,600 and the value of the goodwill be fixed at 18,000. (v) The new profit sharing ratio shall be divided equally among the partners. The outstanding liabilities include 700 due to Ram which has been paid by Dinesh. Necessary entries were not made in the books. Prepare (i) Revaluation Account, (ii) Capital Accounts of the partners, (iii) Balance Sheet of the firm after admission of Suresh. 1,00,000 ? ? (b) Mr. Fazhil is a proprietor in business of trading. An abstract of his Trading and P & L account is as follows: Trading and P & L A/c for the year ended 31st March, 2018. Particulars (3) Particulars 22,00,000 By Sales ? ? 12,00,000 By Gross Profit B/d 6,00,000 By Other Income ? Selling expenses amount to 1% of total Sales. You are required to compute the missing figure. 15 P.T.O. 45,00,000 45,00,000 ? 45,000 ? Mar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started