The following mistakes were lodated in the books of a concern after its Nu books were closed and a Suspense Account was opened in

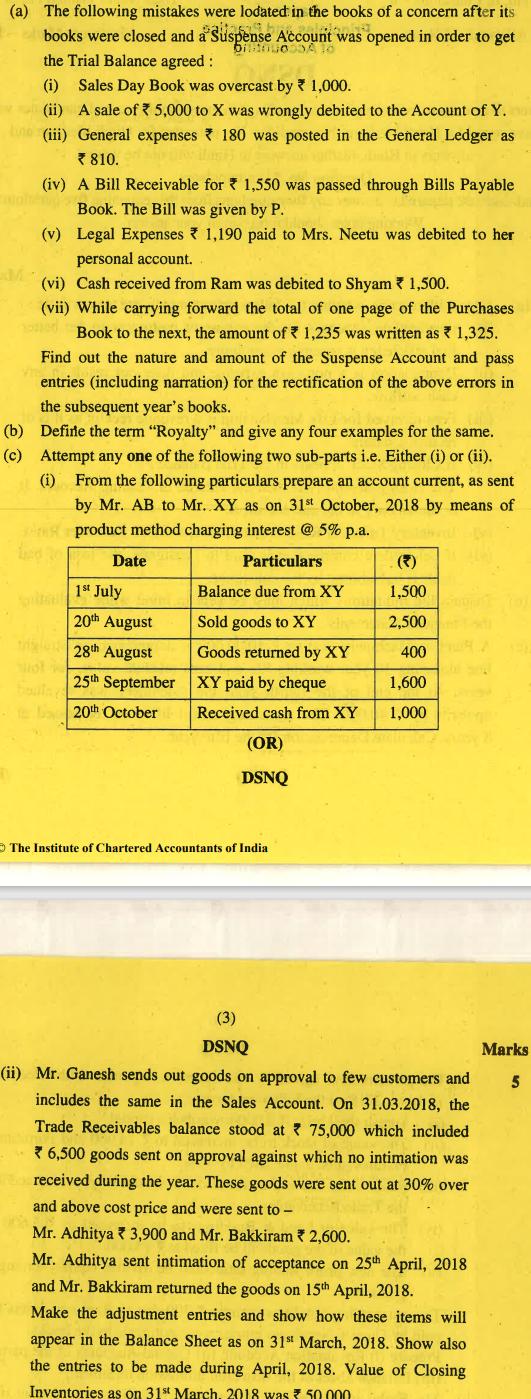

The following mistakes were lodated in the books of a concern after its Nu books were closed and a Suspense Account was opened in order to get bilinuo DA 16 the Trial Balance agreed : (i) Sales Day Book was overcast by 1,000. (ii) A sale of 5,000 to X was wrongly debited to the Account of Y. (iii) General expenses 180 was posted in the General Ledger as 810. (iv) A Bill Receivable for 1,550 was passed through Bills Payable Book. The Bill was given by P. (v) Legal Expenses 1,190 paid to Mrs. Neetu was debited to her personal account. (vi) Cash received from Ram was debited to Shyam * 1,500. (vii) While carrying forward the total of one page of the Purchases Book to the next, the amount of 1,235 was written as 1,325. Find out the nature and amount of the Suspense Account and pass entries (including narration) for the rectification of the above errors in the subsequent year's books. (b) Define the term "Royalty" and give any four examples for the same. (c) Attempt any one of the following two sub-parts i.e. Either (i) or (ii). (i) From the following particulars prepare an account current, as sent by Mr. AB to Mr. XY as on 31st October, 2018 by means of product method charging interest @ 5% p.a. Particulars Date Sorte 1st July 20th August 28th August 25th September 20th October Balance due from XY Sold goods to XY Goods returned by XY XY paid by cheque Received cash from XY (OR) DSNQ O The Institute of Chartered Accountants of India (3) DSNQ 1,500 2,500 400 1,600 1,000 (ii) Mr. Ganesh sends out goods on approval to few customers and includes the same in the Sales Account. On 31.03.2018, the Trade Receivables balance stood at 75,000 which included 6,500 goods sent on approval against which no intimation was arbon received during the year. These goods were sent out at 30% over and above cost price and were sent to - S Mr. Adhitya 3,900 and Mr. Bakkiram * 2,600. Mr. Adhitya sent intimation of acceptance on 25th April, 2018 and Mr. Bakkiram returned the goods on 15th April, 2018. Make the adjustment entries and show how these items will appear in the Balance Sheet as on 31st March, 2018. Show also the entries to be made during April, 2018. Value of Closing Inventories as on 31st March, 2018 was 50.000 Marks 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started