Answered step by step

Verified Expert Solution

Question

1 Approved Answer

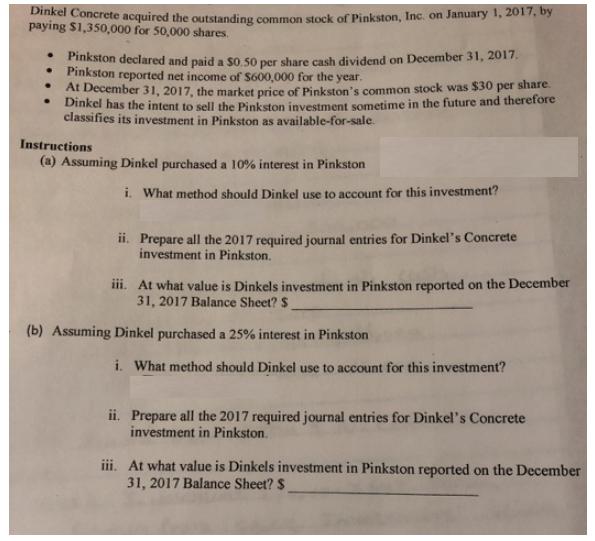

Dinkel Concrete acquired the outstanding common stock of Pinkston, Inc. on January 1, 2017, by paying S1,350,000 for 50,000 shares. Pinkston declared and paid

Dinkel Concrete acquired the outstanding common stock of Pinkston, Inc. on January 1, 2017, by paying S1,350,000 for 50,000 shares. Pinkston declared and paid a $o 50 per share cash dividend on December 31, 2017. Pinkston reported net income of S600,000 for the year. At December 31, 2017. the market price of Pinkston's common stock was $30 per share. * Dinkel has the intent to sell the Pinkston investment sometime in the future and therefore classifies its investment in Pinkston as available-for-sale. Instructions (a) Assuming Dinkel purchased a 10% interest in Pinkston i. What method should Dinkel use to account for this investment? ii. Prepare all the 2017 required journal entries for Dinkel's Concrete investment in Pinkston. iii. At what value is Dinkels investment in Pinkston reported on the December 31, 2017 Balance Sheet? $ (b) Assuming Dinkel purchased a 25% interest in Pinkston i. What method should Dinkel use to account for this investment? ii. Prepare all the 2017 required journal entries for Dinkel's Concrete investment in Pinkston. iii. At what value is Dinkels investment in Pinkston reported on the December 31, 2017 Balance Sheet? $

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Required solution Answer A When the company does not have significance control ie investment is less ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635df94b936d3_180423.pdf

180 KBs PDF File

635df94b936d3_180423.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started