On January 1, 2020, Xiamen Company made amendments to its defined benefit pension plan that resulted in 62,800 yuan of past service cost. The

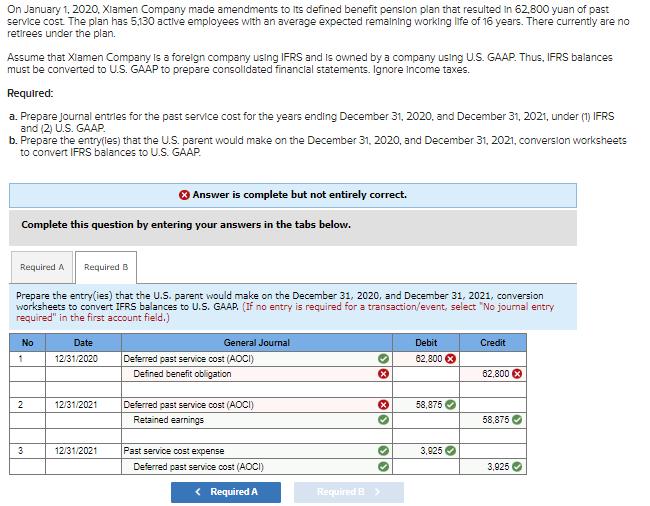

On January 1, 2020, Xiamen Company made amendments to its defined benefit pension plan that resulted in 62,800 yuan of past service cost. The plan has 5,130 active employees with an average expected remaining working life of 16 years. There currently are no retirees under the plan. Assume that Xiamen Company is a foreign company using IFRS and is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: a. Prepare journal entries for the past service cost for the years ending December 31, 2020, and December 31, 2021, under (1) IFRS and (2) U.S. GAAP. b. Prepare the entry(les) that the U.S. parent would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert IFRS balances to U.S. GAAP. Complete this question by entering your answers in the tabs below. Required A No Prepare the entry (ies) that the U.S. parent would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert IFRS balances to U.S. GAAP. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1 2 Required B 3 Date 12/31/2020 Answer is complete but not entirely correct. 12/31/2021 12/31/2021 General Journal Deferred past service cost (AOCI) Defined benefit obligation Deferred past service cost (AOCI) Retained earnings Past service cost expense Deferred past service cost (AOCI) < Required A ** (* 00 Required B: > Debit 82,800 X 58,875 3,925 Credit 62,800 x 58,875 3,925

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started