Answered step by step

Verified Expert Solution

Question

1 Approved Answer

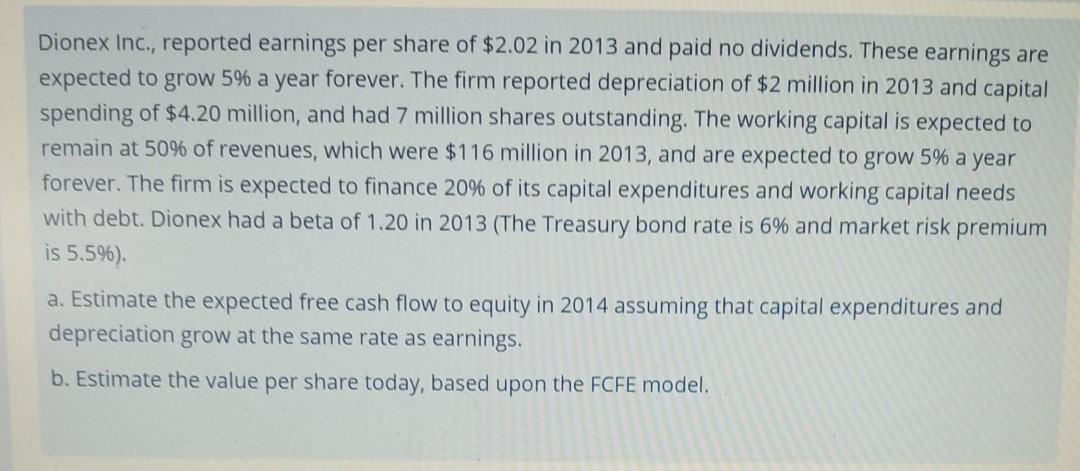

Dionex Inc., reported earnings per share of $2.02 in 2013 and paid no dividends. These earnings are expected to grow 5% a year forever. The

Dionex Inc., reported earnings per share of $2.02 in 2013 and paid no dividends. These earnings are expected to grow 5% a year forever. The firm reported depreciation of $2 million in 2013 and capital spending of $4.20 million, and had 7 million shares outstanding. The working capital is expected to remain at 50% of revenues, which were $116 million in 2013, and are expected to grow 5% a year forever. The firm is expected to finance 20% of its capital expenditures and working capital needs with debt. Dionex had a beta of 1.20 in 2013 (The Treasury bond rate is 6% and market risk premium is 5.5%). a. Estimate the expected free cash flow to equity in 2014 assuming that capital expenditures and depreciation grow at the same rate as earnings. b. Estimate the value per share today, based upon the FCFE model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started