Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dior Company purchased an 8-floor building as an investment on January 3, 2016 for $2,000,000 cash. The building is intended to earn rentals and

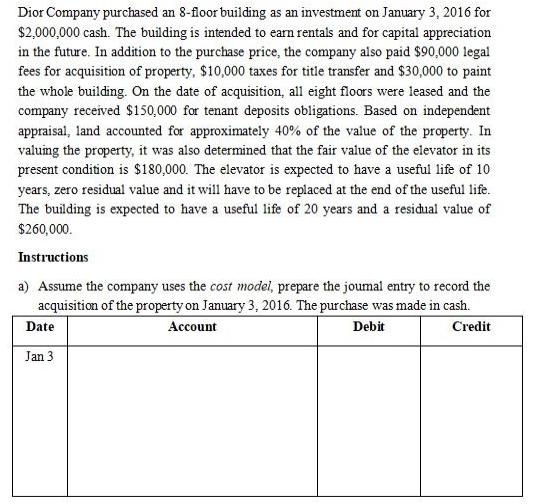

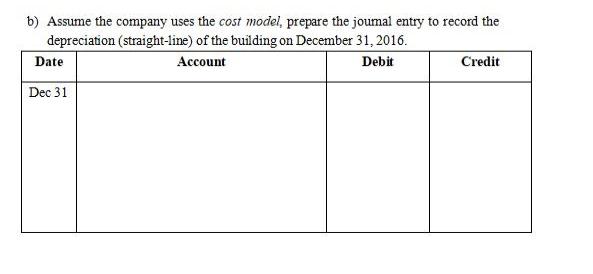

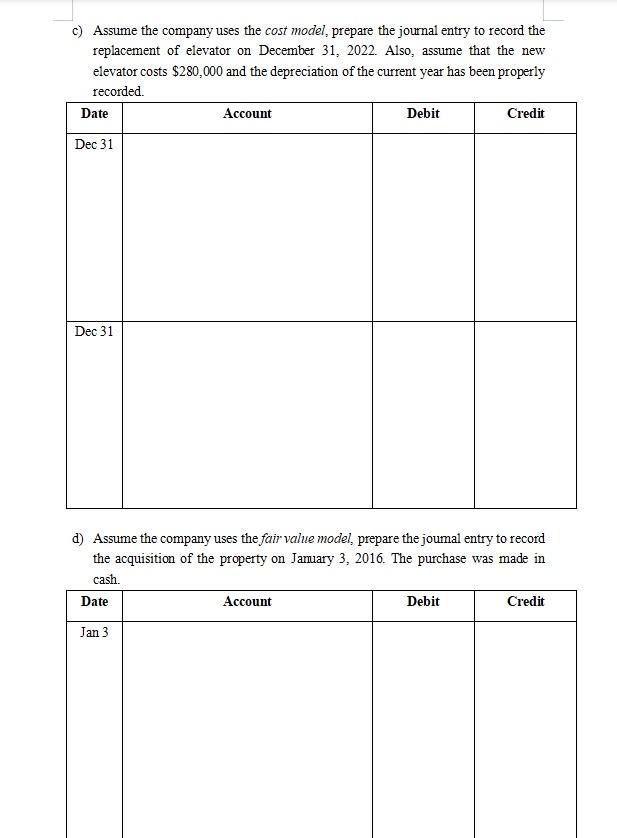

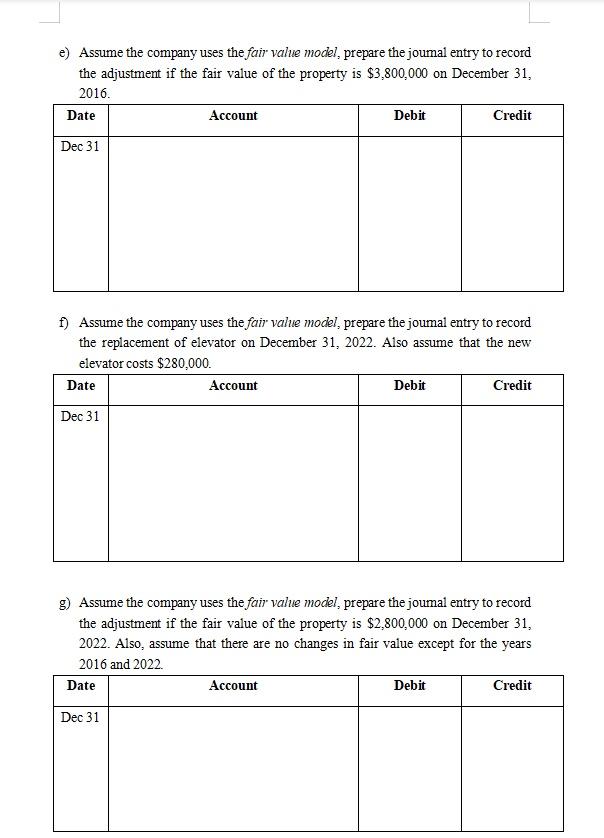

Dior Company purchased an 8-floor building as an investment on January 3, 2016 for $2,000,000 cash. The building is intended to earn rentals and for capital appreciation in the future. In addition to the purchase price, the company also paid $90,000 legal fees for acquisition of property, $10,000 taxes for title transfer and $30,000 to paint the whole building. On the date of acquisition, all eight floors were leased and the company received $150,000 for tenant deposits obligations. Based on independent appraisal, land accounted for approximately 40% of the value of the property. In valuing the property, it was also determined that the fair value of the elevator in its present condition is $180,000. The elevator is expected to have a useful life of 10 years, zero residual value and it will have to be replaced at the end of the useful life. The building is expected to have a useful life of 20 years and a residual value of $260,000. Instructions a) Assume the company uses the cost model, prepare the journal entry to record the acquisition of the property on January 3, 2016. The purchase was made in cash. Account Date Debit Credit Jan 3 b) Assume the company uses the cost model, prepare the joumal entry to record the depreciation (straight-line) of the building on December 31, 2016. Debit Account Date Dec 31 Credit c) Assume the company uses the cost model, prepare the journal entry to record the replacement of elevator on December 31, 2022. Also, assume that the new elevator costs $280,000 and the depreciation of the current year has been properly recorded. Date Dec 31 Dec 31 Account Debit Account d) Assume the company uses the fair value model, prepare the journal entry to record the acquisition of the property on January 3, 2016. The purchase was made in cash. Date Jan 3 Credit Debit Credit e) Assume the company uses the fair value model, prepare the journal entry to record the adjustment if the fair value of the property is $3,800,000 on December 31, 2016. Date Dec 31 Account Dec 31 f) Assume the company uses the fair value model, prepare the journal entry to record the replacement of elevator on December 31, 2022. Also assume that the new elevator costs $280,000. Date Dec 31 Account Debit Account Debit Credit g) Assume the company uses the fair value model, prepare the journal entry to record the adjustment if the fair value of the property is $2,800,000 on December 31, 2022. Also, assume that there are no changes fair value except for the years 2016 and 2022. Date Debit Credit Credit

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

DATE JOURNAL ENTRY DEBIT CREDIT 03JAN2016 BUILDING ACCOUNTDEBIT 2000000 LEAGAL FEES 90000 TAX 10000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started