Answered step by step

Verified Expert Solution

Question

1 Approved Answer

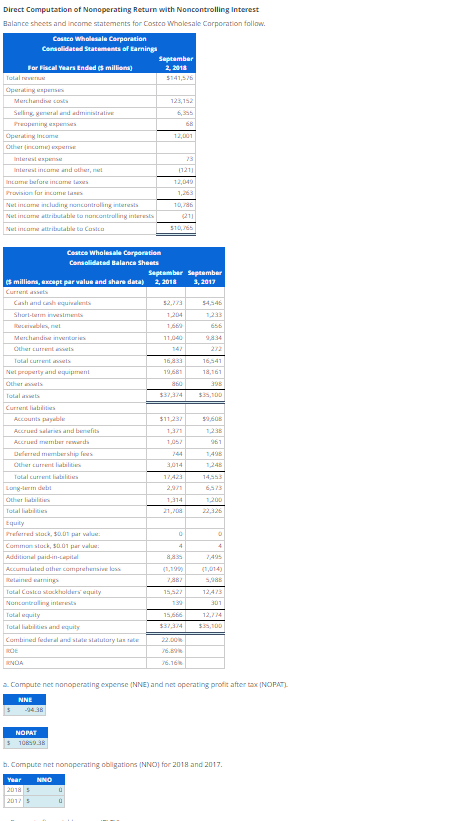

Direct Computation of Nonoperating Return with Noncontrolling Interest Balance sheets and income statements for Costco Wholesale Corporation follow. table [ [ table [

Direct Computation of Nonoperating Return with Noncontrolling Interest

Balance sheets and income statements for Costco Wholesale Corporation follow.

tabletableCaste Whaltasle CerporationCemstlidated Stathmats of EarningPor Peveal Yars Ended of milliant,tableSeptamberatTolal reveriue,Operating enpertsis,Merchandies centa,Selifye general and adiministative, sisTrecpeniry espenses,Operating Intarne,Ouher incume expertive,Intereal esperise,Interent inturne and other, net,Inturne before inturne tacoes,Frovision fur incume lanes,Net intume including noncontroling interesta, rabNet insume attribulatale to Cuslea,

tabletableCentes Wholeuthe CerparationCemplidated Balanes Shests milliant, eseapt par value and share detap,tablegeftembar atittabletableEnptambirCurrent assertsCash and conh equivelunts,Shertlemingestrumts,theceivablia nel,Menthandoe invertaries,Ouher turrent acosels,Iolal currant inouels,Nel property and equipment,Cuther mavels,Iolal anvels,Curtent liatilibesAccounta paysable,$Accrued salaries and bensefits,Accrual member rewerth,Duberred membership feas.,Other current latalian,Iolal current labilies,Lanylerm debal,Ouher hatilitus,Iolal liabitioes,tquilyPreferred alock, $ par value.,Common alock, $ par values,Additional paidinLapital,Accumulated ather comprehemiver loss,Beviainud varnings;,iBIolal Cosilu stockholdern' aquity,Nuntontruling inlernals,tolal equity,Tolal latalities and equity,$$Combined federal and shate shatulury bate tale, sDtBrVOA

a Compute net nonoperating cxpense NNE and net operating profit after tax NOPAT

nopar

b Compute net nonoperating oblgations NNO for and

tableYearNaNO a Compute net nonoperating expense NNE and net operating profit after tax NOPAT

NNE

b Compute net nonoperating obligations NNO for and

c Compute financial leverage FLEV

d Compute NNEP and Spread.

e Compute the noncontrolling interest ratio NCl ratio

f Confirm the relation: Spread

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started