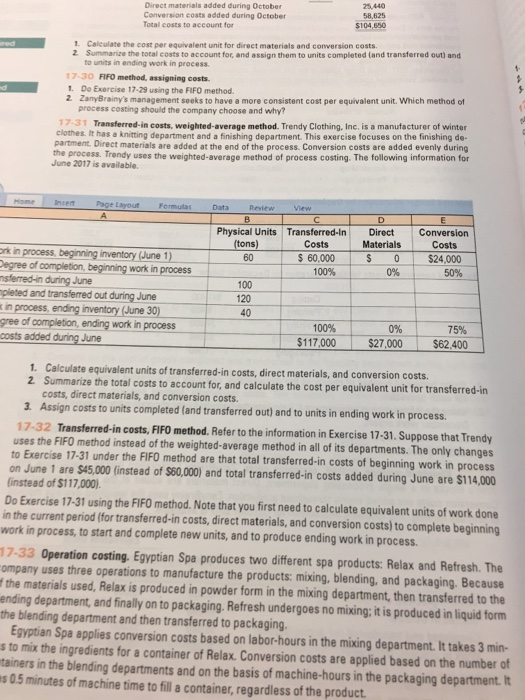

Direct materials added during October Conversion costs added during October Total costs to account for 25.440 58,625 104,650 1. Calculate the cost per equivalent unit for direct materials and conversion costs. 2 Summanize the total costs to account for, and assign them to units completed (and transterred out) and units in ending work in process 7-30 FIFO method, assigning costs. d. Do Exercise 17-29 using the FIFO method. 2 ZanyBrainy's management seeks to have a more consistent cost per equivalent unit. Which method of process costing should the company choose and why? 17-31 Transferred-in costs, weighted-average method. Trendy Clothing, Inc. is a manufacturer of winter clothes. It has a knitting department and a finishing department. This exercise focuses on the finishing de partment. Direct materials are added at the end of the process. Conversion costs are added evenly during e process. Trendy uses the weighted-average method of process costing. The following information for June 2017 is available. Page Layout Formulas Physical Units Transferred-In Direct Conversion Costs 60,000 Costs $24,000 Materials 60 egree of completion, beginning work in process sferred-in during June 100% 50% 100 120 40 pleted and transferred out during June process, ending inventory (June 30) gree of completion, ending work in process costs added during June 75% 100% $117,000 0% S27,000 $62 400 1. Calculate equivalent units of transferred-in costs, direct materials, and conversion costs. 2 costs to account for, and calculate the cost per equivalent unit for transferred-in costs, direct materials, and conversion costs. Assign costs to units completed (and transferred out) and to units in ending work in process. 3 Transferred-in costs, FIFO method. Refer to the information in Exercise 17-31. Suppose that Trendy s the FIFO method instead of the weighted-average method in all of its departments. The only changes 17-32 uses to Exercise 17-31 under the FIFO method are that total transferred-in costs of beginning work in process on June 1 are $45,000 (instead of $60,000) and total transferred-in costs added during June are $114,000 linstead of $117,000 Do Exercise 17-31 using the FIFO method. Note that you first need to calculate equivalent units of work done in the current period (for transferred-in costs, direct materials, and conversion costs) to complete beginning work in process, to start and complete new units, and to produce ending work in process Operation costing. Egyptian Spa produces two different spa products: Relax and Refresh. The ompany uses three operations to manufacture the products: mixing, blending, and packaging. Because fthe materials used, Relax is produced in powder form in the mixing department, then transferred to the ending department, and finally on to packaging. Refresh undergoes no mixing; itis produced in liquid form the blending department and then transferred to packaging Egyptian Spa applies conversion costs based on labor-hours in the mixing department. It takes 3 min- s to mix the ingredients for a container of Relax. Conversion costs are applied based on the number of tainers in the blending departments and on the basis of machine-hours in the packaging department.t s 05 minutes of machine time to fill a container, regardless of the product