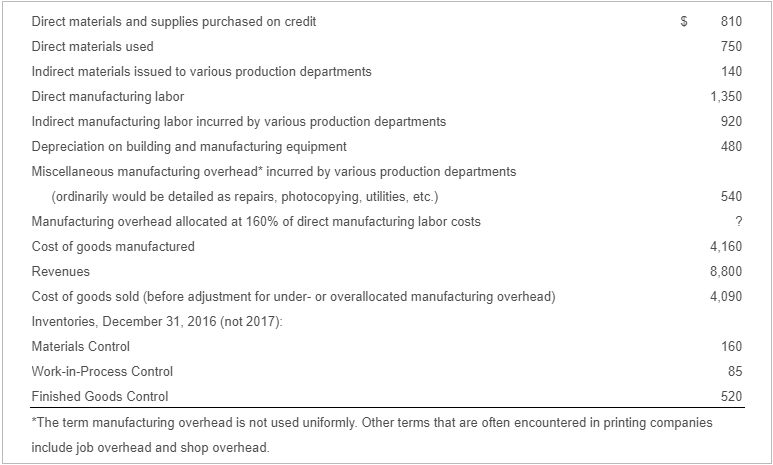

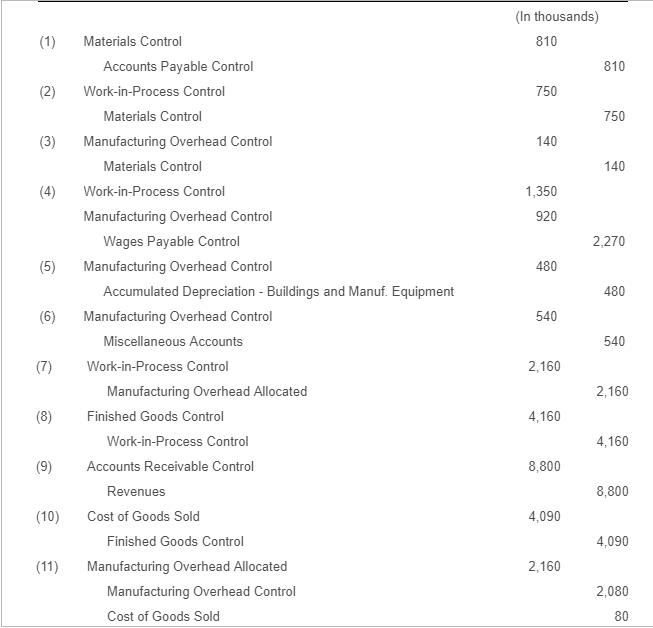

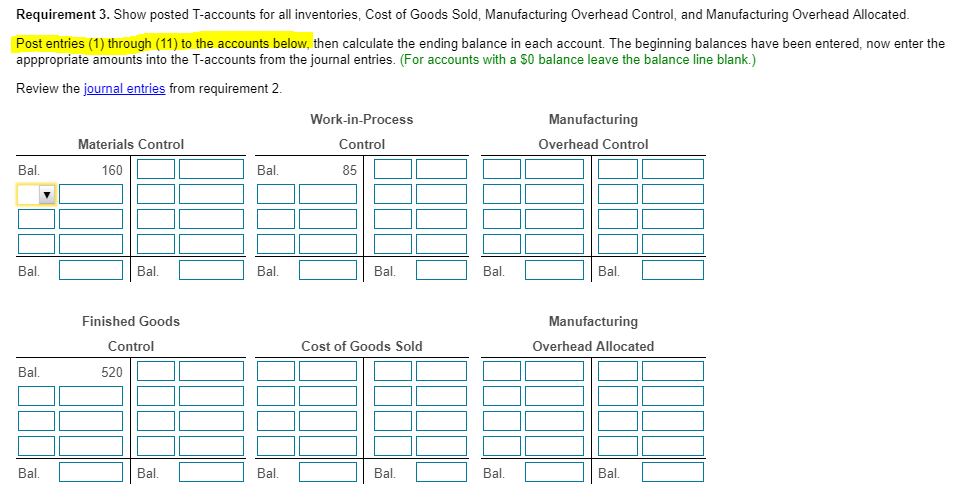

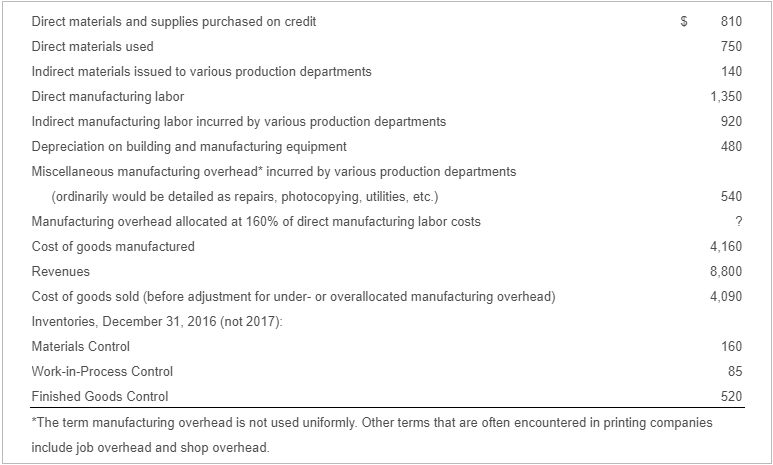

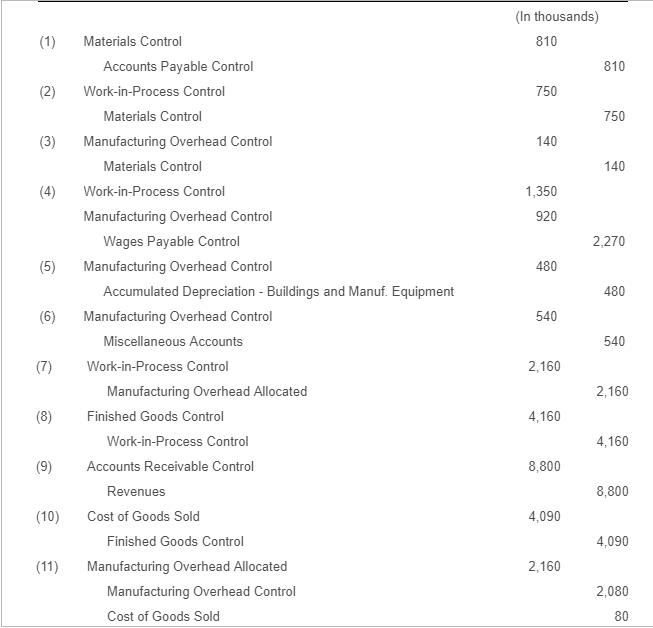

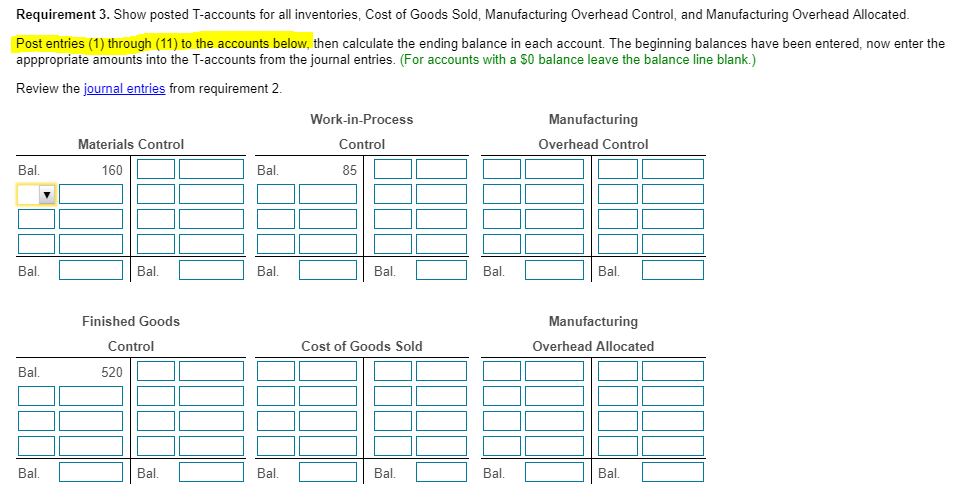

Direct materials and supplies purchased on credit Direct materials used Indirect materials issued to various production departments Direct manufacturing labor Indirect manufacturing labor incurred by various production departments Depreciation on building and manufacturing equipment Miscellaneous manufacturing overhead incurred by various production departments $ 810 750 140 1,350 920 480 540 ordinarily would be detailed as repairs, photocopying, utilities, etc.) Manufacturing overhead allocated at 160% of direct manufacturing labor costs Cost of goods manufactured Revenues Cost of goods sold (before adjustment for under- or overallocated manufacturing overhead) Inventories, December 31, 2016 (not 2017) Materials Control Work-in-Process Control Finished Goods Control The term manufacturing overhead is not used uniformly. Other terms that are often encountered in printing companies include job overhead and shop overhead. 4,160 8,800 4,090 160 85 520 (In thousands) (1) Materials Control 810 Accounts Payable Control 810 (2) Work-in-Process Control 750 Materials Control 750 (3) Manufacturing Overhead Control 140 Materials Control 140 (4) Work-in-Process Control 1,350 Manufacturing Overhead Control Wages Payable Control Manufacturing Overhead Control 920 2,270 (5) 480 Accumulated Depreciation - Buildings and Manuf. Equipment 480 (6) Manufacturing Overhead Control 540 Miscellaneous Accounts 540 (7) Work-in-Process Control 2,160 Manufacturing Overhead Allocated 2,160 (8) Finished Goods Control 4,160 Work-in-Process Control 4,160 (9) Accounts Receivable Control 8,800 Revenues 8,800 (10) Cost of Goods Sold 4,090 Finished Goods Control 4,090 (11) Manufacturing Overhead Allocated 2,160 Manufacturing Overhead Control Cost of Goods Sold 2,080 80 Requirement 3. Show posted T-accounts for all inventories, Cost of Goods Sold, Manufacturing Overhead Control, and Manufacturing Overhead Allocated Post entries (1) through (11) to the accounts below, then calculate the ending balance in each account. The beginning balances have been entered, now enter the apppropriate amounts into the T-accounts from the journal entries. (For accounts with a $0 balance leave the balance line blank.) Review the journal entries from requirement 2. Work-in-Process Manufacturing Materials Control Control Overhead Control Bal 160 Bal. 85 Bal Bal. Bal. Bal Bal. Bal Finished Goods Manufacturing Control Cost of Goods Sold Overhead Allocated Bal 520 Bal Bal Bal. Bal Bal. Bal