Question

Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Eastern Polymers, Inc., processes a base chemical into plastic. Standard costs and actual costs for

Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis

Eastern Polymers, Inc., processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 7,200 units of product were as follows:

| Standard Costs | Actual Costs | ||

| Direct materials | 9,400 lbs. at $5.6 | 9,300 lbs. at $5.5 | |

| Direct labor | 1,800 hrs. at $18.4 | 1,840 hrs. at $18.7 | |

| Factory overhead | Rates per direct labor hr., | ||

| based on 100% of normal | |||

| capacity of 1,880 direct | |||

| labor hrs.: | |||

| Variable cost, $4.5 | $8,020 variable cost | ||

| Fixed cost, $7.1 | $13,348 fixed cost | ||

Each unit requires 0.25 hour of direct labor.

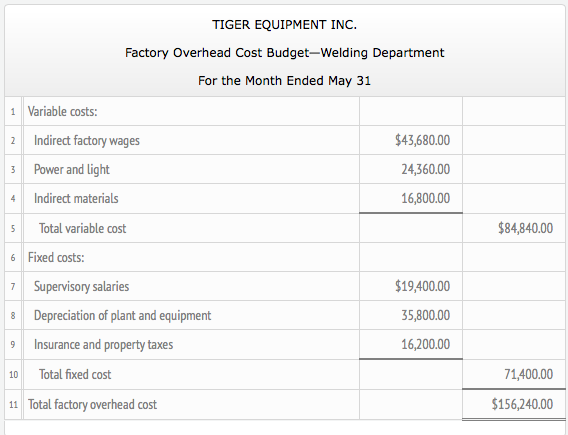

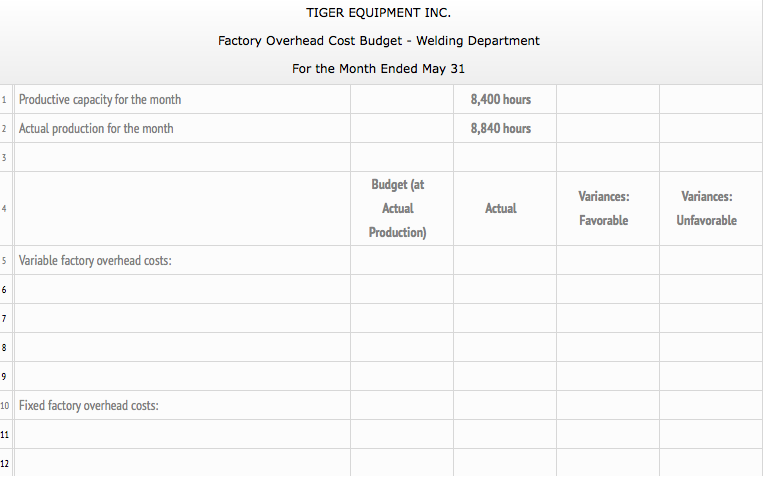

Tiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the Welding Department for May of the current year. The company expected to operate the department at 100% of normal capacity of 8,400 hours.

During May, the department operated at 8,840 standard hours, and the factory overhead costs incurred were indirect factory wages, $46,528; power and light, $25,368; indirect materials, $18,300; supervisory salaries, $19,400; depreciation of plant and equipment, $35,800; and insurance and property taxes, $16,200.

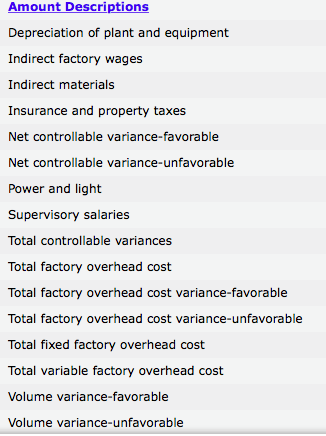

Prepare a factory overhead cost variance report for May. To be useful for cost control, the budgeted amounts should be based on 8,860 hours. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. Enter all variances as positive amounts.

Standards for Nonmanufacturing Expenses

CodeHead Software Inc. does software development. One important activity in software development is writing software code. The manager of the WordPro Development Team determined that the average software programmer could write 25 lines of code in an hour. The plan for the first week in May called for 4,650 lines of code to be written on the WordPro product. The WordPro Team has five programmers. Each programmer is hired from an employment firm that requires temporary employees to be hired for a minimum of a 40-hour week. Programmers are paid $32.00 per hour. The manager offered a bonus if the team could generate more lines for the week, without overtime. Due to a project emergency, the programmers wrote more code in the first week of May than planned. The actual amount of code written in the first week of May was 5,650 lines, without overtime. As a result, the bonus caused the average programmer's hourly rate to increase to $40.00 per hour during the first week in May.

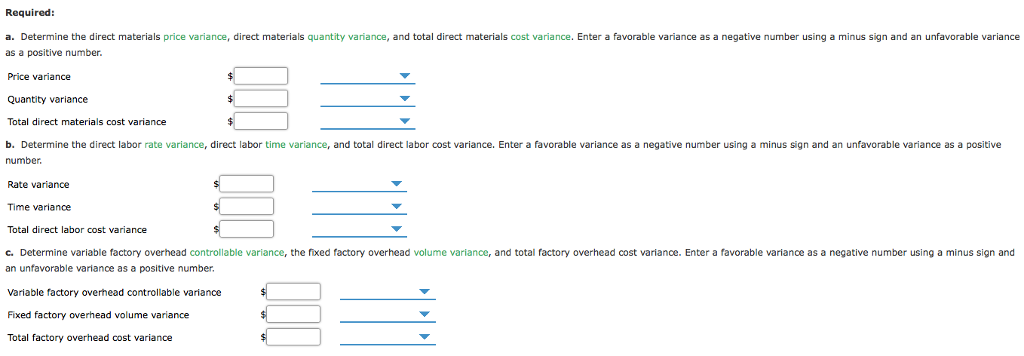

Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. If an amount is zero, enter "0" and choose "Not applicable" from the dropdown.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started