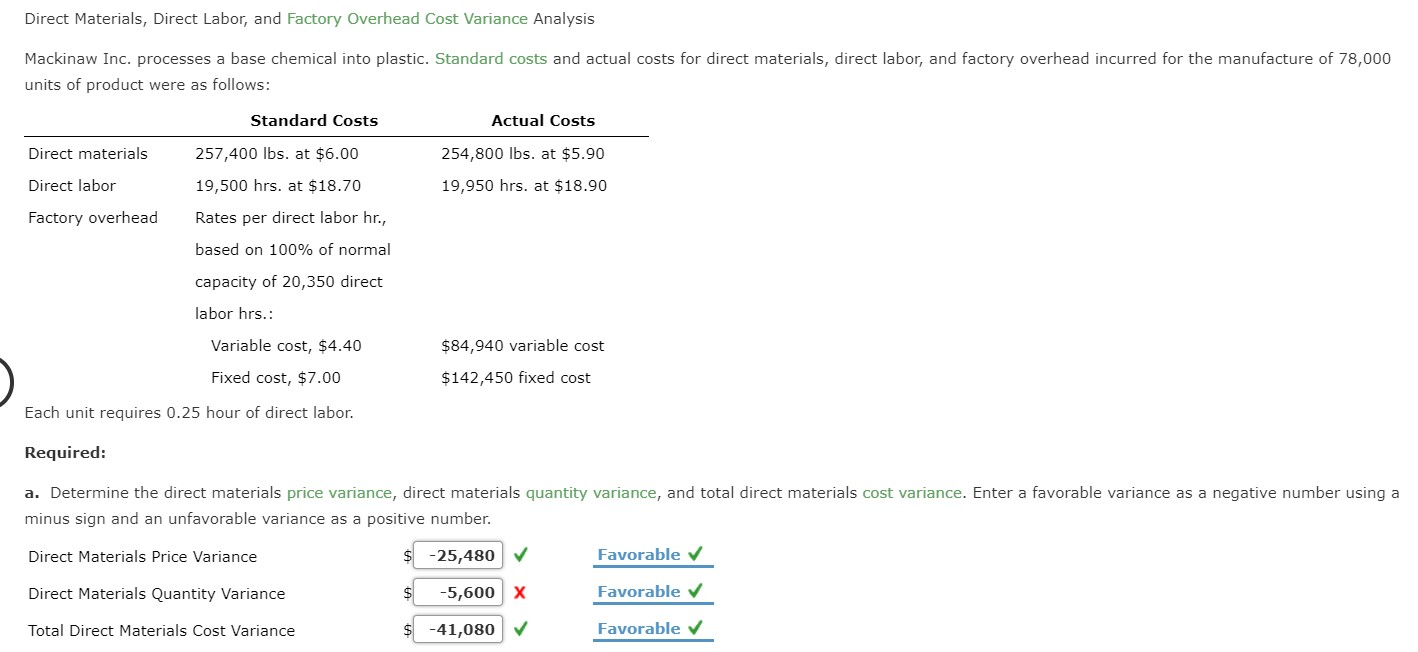

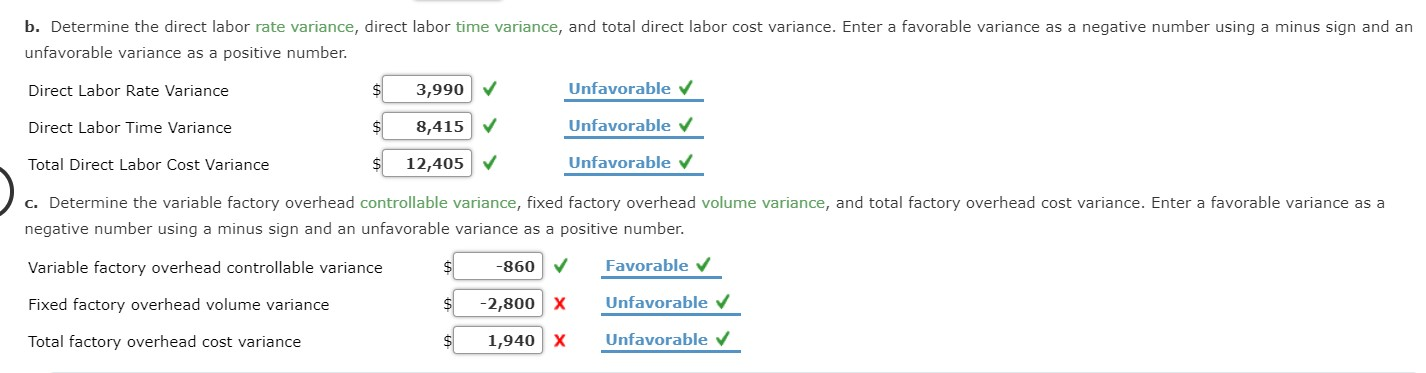

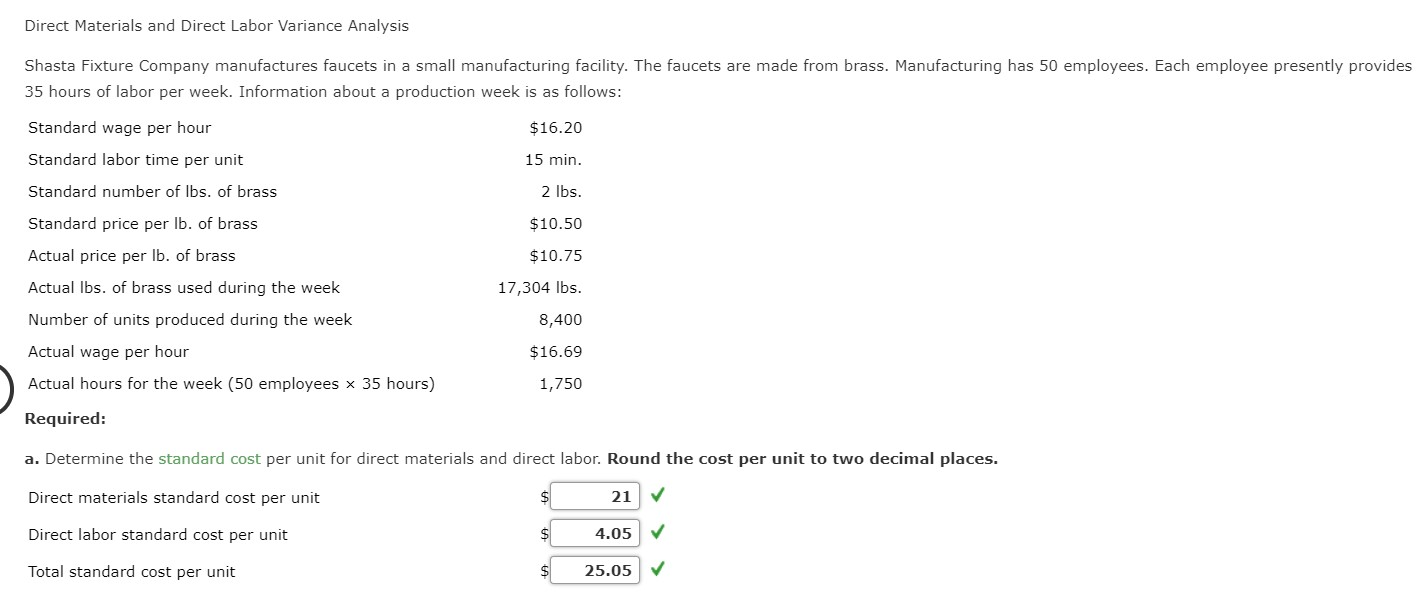

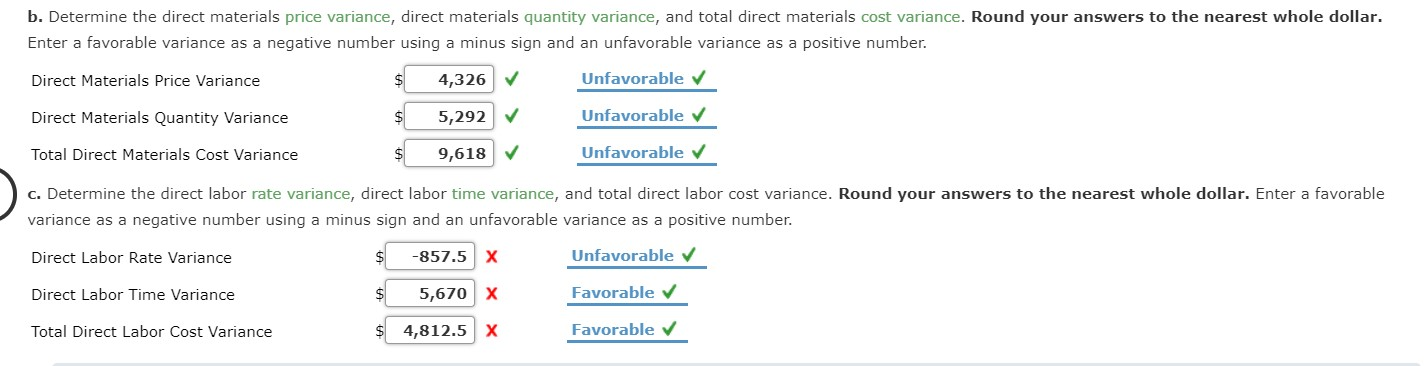

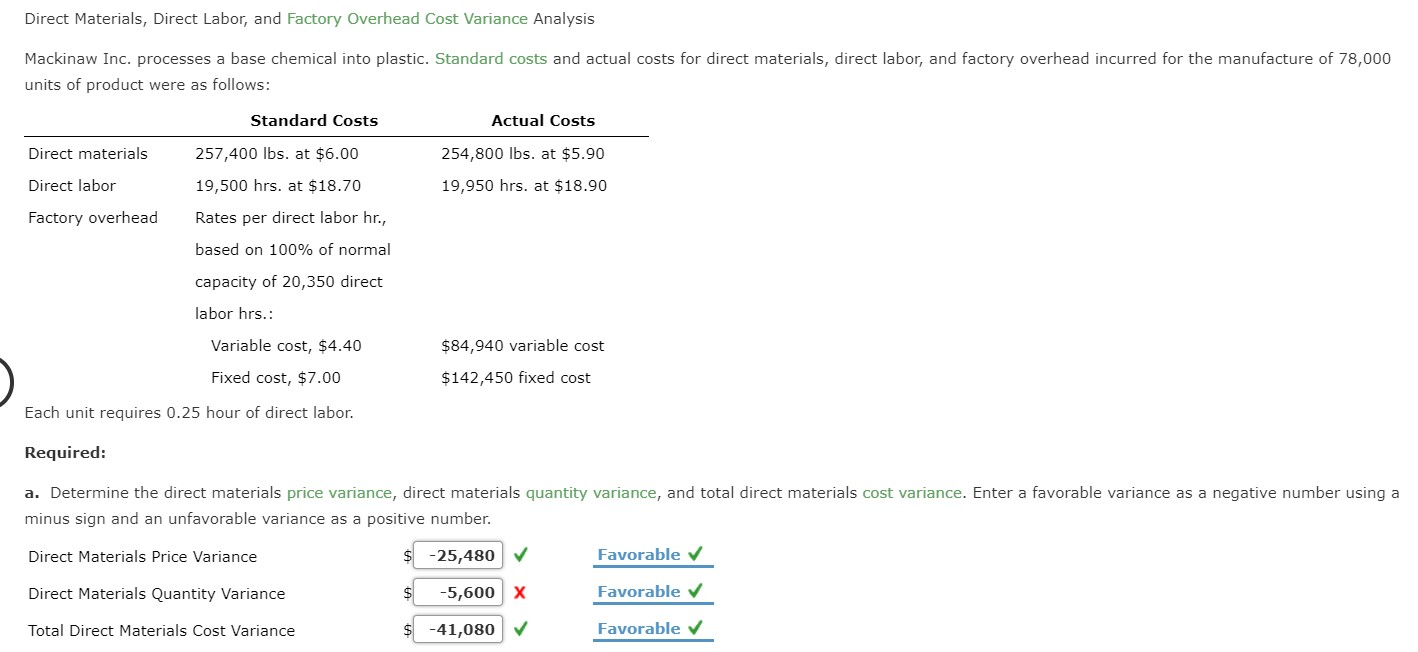

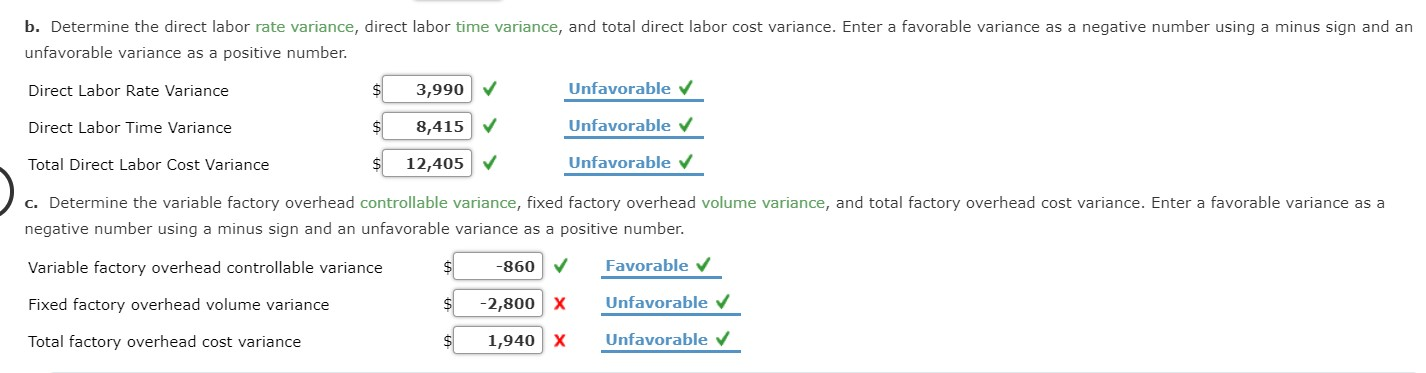

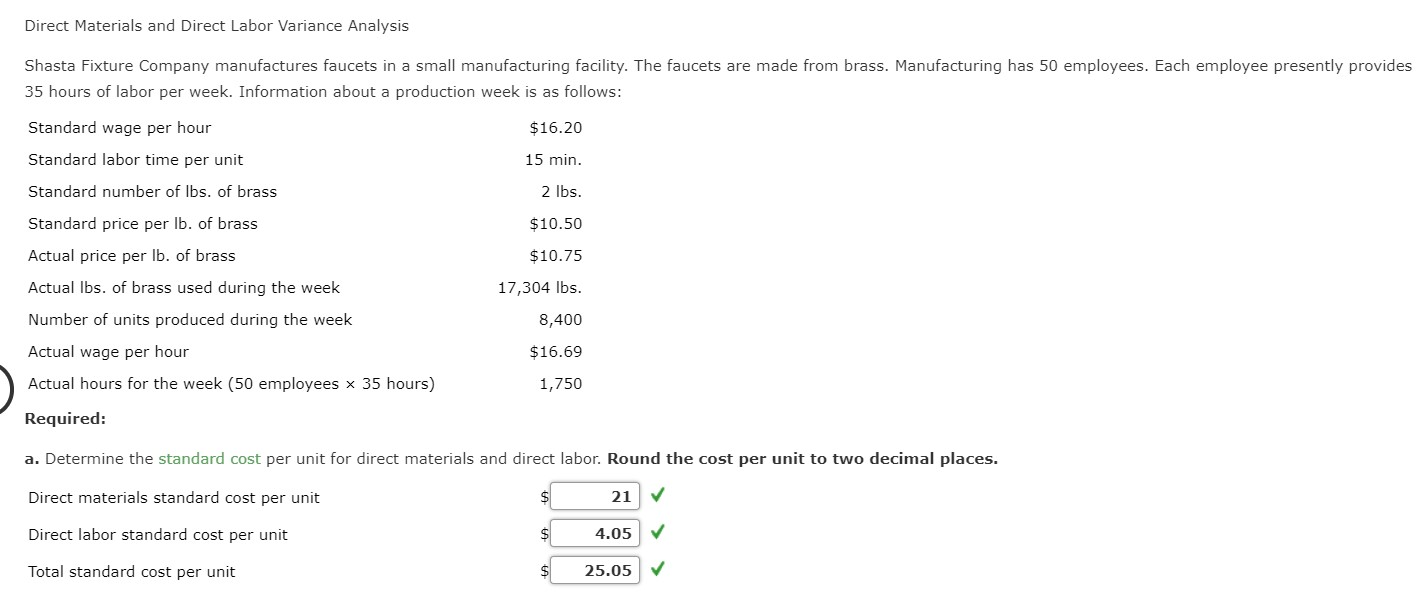

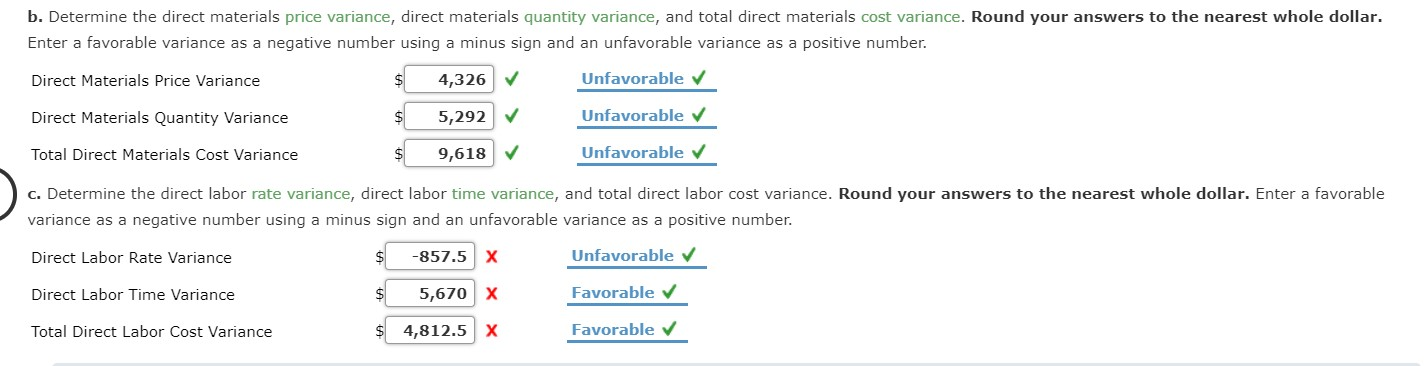

Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 78,000 units of product were as follows: Standard Costs Actual Costs Direct materials 257,400 lbs. at $6.00 254,800 lbs. at $5.90 Direct labor 19,950 hrs. at $18.90 Factory overhead 19,500 hrs. at $18.70 Rates per direct labor hr., based on 100% of normal capacity of 20,350 direct labor hrs.: Variable cost, $4.40 $84,940 variable cost Fixed cost, $7.00 $142,450 fixed cost Each unit requires 0.25 hour of direct labor. Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct Materials Price Variance -25,480 Favorable Direct Materials Quantity Variance -5,600 X Favorable Total Direct Materials Cost Variance $ -41,080 Favorable b. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct Labor Rate Variance 3,990 Unfavorable Direct Labor Time Variance 8,415 Unfavorable Total Direct Labor Cost Variance 12,405 Unfavorable c. Determine the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Variable factory overhead controllable variance -860 Favorable Fixed factory overhead volume variance -2,800 x Unfavorable Total factory overhead cost variance 1,940 X Unfavorable Direct Materials and Direct Labor Variance Analysis Shasta Fixture Company manufactures faucets in a small manufacturing facility. The faucets are made from brass. Manufacturing has 50 employees. Each employee presently provides 35 hours of labor per week. Information about a production week is as follows: Standard wage per hour $16.20 Standard labor time per unit 15 min. 2 lbs. $10.50 $10.75 17,304 lbs. Standard number of lbs. of brass Standard price per lb. of brass Actual price per lb. of brass Actual lbs. of brass used during the week Number of units produced during the week Actual wage per hour Actual hours for the week (50 employees x 35 hours) Required: 8,400 $16.69 1,750 a. Determine the standard cost per unit for direct materials and direct labor. Round the cost per unit to two decimal places. Direct materials standard cost per unit 21 Direct labor standard cost per unit $ 4.05 Total standard cost per unit 25.05 b. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Round your answers to the nearest whole dollar. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct Materials Price Variance 4,326 Unfavorable Direct Materials Quantity Variance 5,292 Unfavorable Total Direct Materials Cost Variance 9,618 Unfavorable c. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Round your answers to the nearest whole dollar. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct Labor Rate Variance -857.5 x Unfavorable Direct Labor Time Variance $ 5,670 x Favorable Total Direct Labor Cost Variance $ 4,812.5 X Favorable