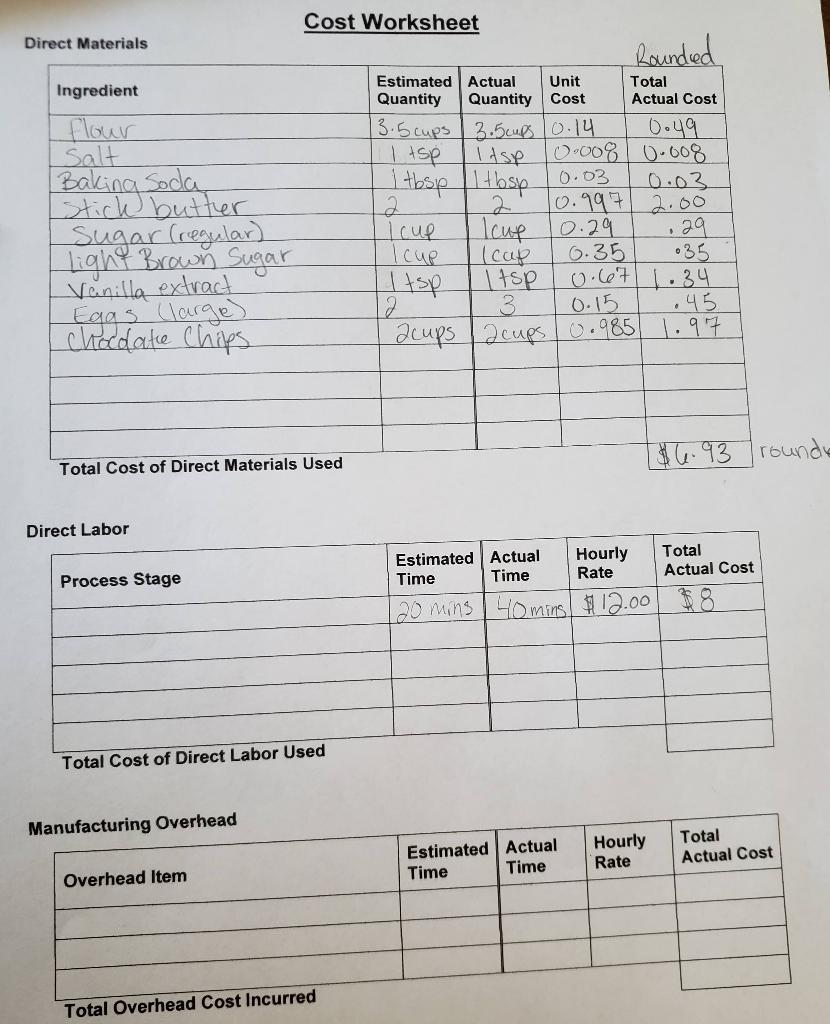

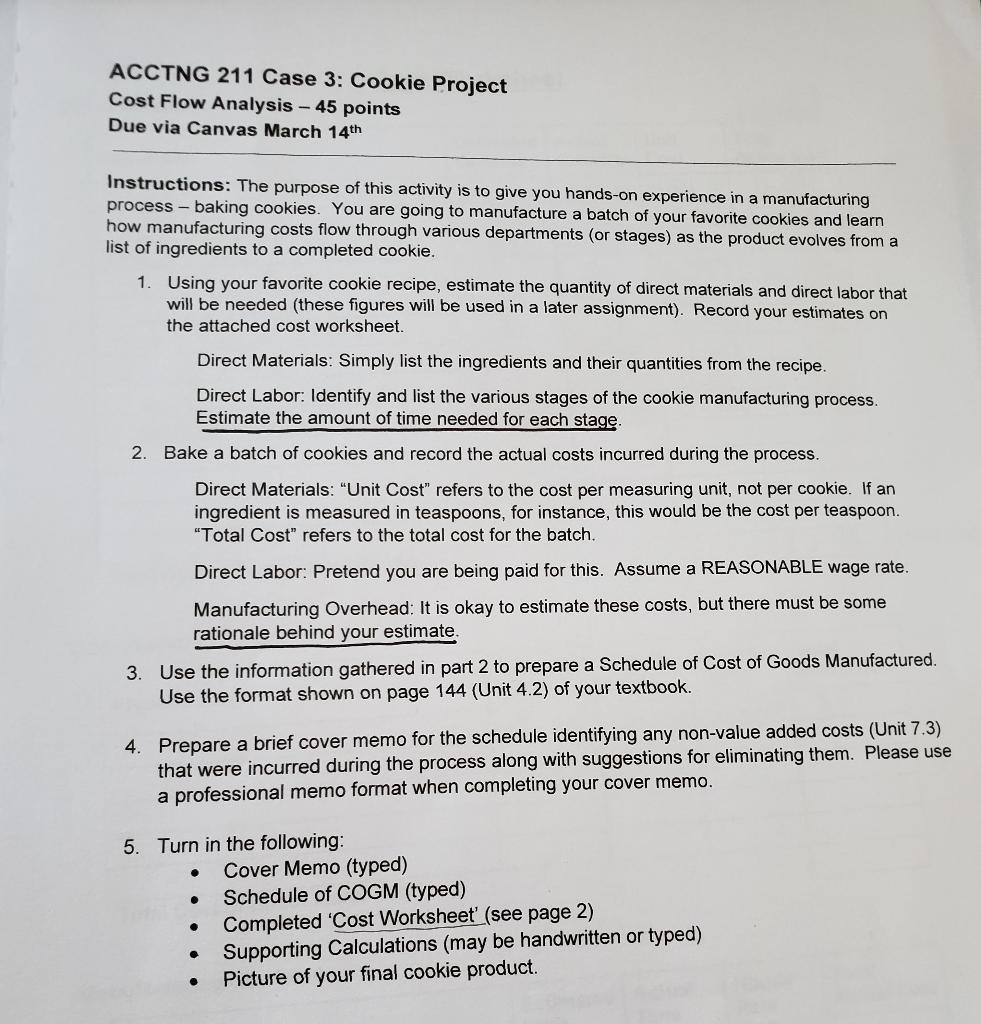

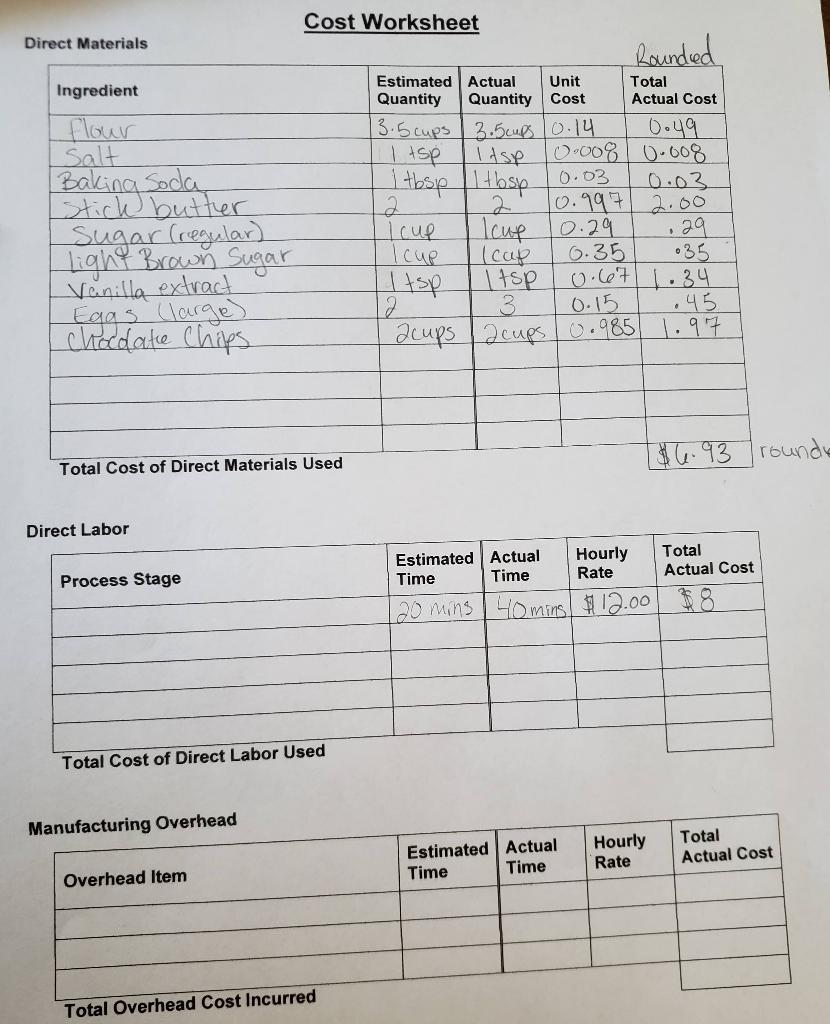

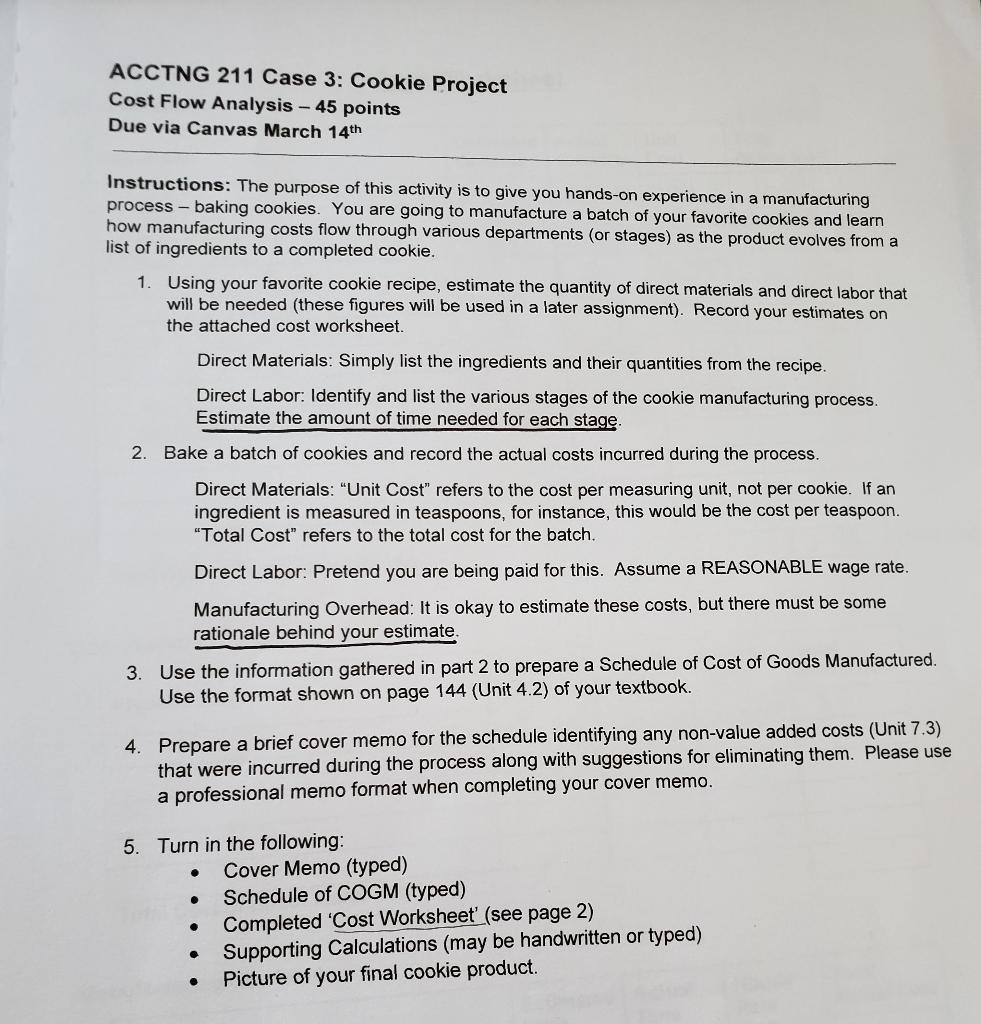

Direct Materials Total Ingredient flour Salt Baking Soda Stich butter Sugar (regular) light Brown Sugar Vanilla extract Eggs Clarge) chocolate Chips Cost Worksheet Rounded Estimated Actual Unit Quantity Quantity Cost Actual Cost 13.5 cups [3.5cups (0.14 0.49 1 tsp 1 Itsp 0.008 0.608 I tbsp (1 tbsp 0.03 0.03 10.997 2.00 1 I cup Icup 0.29 .29 Tcup ( 0.35 35 II tsp 1 tsp 0.67 1.34 2 0.15 .45 acups acups 0.985 1.97 $6.93 rounde Total Cost of Direct Materials Used Direct Labor Estimated Actual Time Time Hourly Rate Total Actual Cost Process Stage L20 mins 40 mins 12.00 $8. Total Cost of Direct Labor Used Manufacturing Overhead Estimated Actual Time Time Hourly Rate Total Actual Cost Overhead Item Total Overhead Cost Incurred ACCTNG 211 Case 3: Cookie Project Cost Flow Analysis 45 points Due via Canvas March 14th Instructions: The purpose of this activity is to give you hands-on experience in a manufacturing process - baking cookies. You are going to manufacture a batch of your favorite cookies and learn how manufacturing costs flow through various departments (or stages) as the product evolves from a list of ingredients to a completed cookie. 1. Using your favorite cookie recipe, estimate the quantity of direct materials and direct labor that will be needed (these figures will be used in a later assignment). Record your estimates on the attached cost worksheet. Direct Materials: Simply list the ingredients and their quantities from the recipe. Direct Labor: Identify and list the various stages of the cookie manufacturing process. Estimate the amount of time needed for each stage. 2. Bake a batch of cookies and record the actual costs incurred during the process. Direct Materials: "Unit Cost" refers to the cost per measuring unit, not per cookie. If an ingredient is measured in teaspoons, for instance, this would be the cost per teaspoon. "Total Cost refers to the total cost for the batch. Direct Labor: Pretend you are being paid for this. Assume a REASONABLE wage rate. Manufacturing Overhead: It is okay to estimate these costs, but there must be some rationale behind your estimate 3. Use the information gathered in part 2 to prepare a Schedule of Cost of Goods Manufactured. Use the format shown on page 144 (Unit 4.2) of your textbook. 4. Prepare a brief cover memo for the schedule identifying any non-value added costs (Unit 7.3) that were incurred during the process along with suggestions for eliminating them. Please use a professional memo format when completing your cover memo. 5. Turn in the following: Cover Memo (typed) Schedule of COGM (typed) Completed 'Cost Worksheet' (see page 2) Supporting Calculations (may be handwritten or typed) Picture of your final cookie product. . . Direct Materials Total Ingredient flour Salt Baking Soda Stich butter Sugar (regular) light Brown Sugar Vanilla extract Eggs Clarge) chocolate Chips Cost Worksheet Rounded Estimated Actual Unit Quantity Quantity Cost Actual Cost 13.5 cups [3.5cups (0.14 0.49 1 tsp 1 Itsp 0.008 0.608 I tbsp (1 tbsp 0.03 0.03 10.997 2.00 1 I cup Icup 0.29 .29 Tcup ( 0.35 35 II tsp 1 tsp 0.67 1.34 2 0.15 .45 acups acups 0.985 1.97 $6.93 rounde Total Cost of Direct Materials Used Direct Labor Estimated Actual Time Time Hourly Rate Total Actual Cost Process Stage L20 mins 40 mins 12.00 $8. Total Cost of Direct Labor Used Manufacturing Overhead Estimated Actual Time Time Hourly Rate Total Actual Cost Overhead Item Total Overhead Cost Incurred ACCTNG 211 Case 3: Cookie Project Cost Flow Analysis 45 points Due via Canvas March 14th Instructions: The purpose of this activity is to give you hands-on experience in a manufacturing process - baking cookies. You are going to manufacture a batch of your favorite cookies and learn how manufacturing costs flow through various departments (or stages) as the product evolves from a list of ingredients to a completed cookie. 1. Using your favorite cookie recipe, estimate the quantity of direct materials and direct labor that will be needed (these figures will be used in a later assignment). Record your estimates on the attached cost worksheet. Direct Materials: Simply list the ingredients and their quantities from the recipe. Direct Labor: Identify and list the various stages of the cookie manufacturing process. Estimate the amount of time needed for each stage. 2. Bake a batch of cookies and record the actual costs incurred during the process. Direct Materials: "Unit Cost" refers to the cost per measuring unit, not per cookie. If an ingredient is measured in teaspoons, for instance, this would be the cost per teaspoon. "Total Cost refers to the total cost for the batch. Direct Labor: Pretend you are being paid for this. Assume a REASONABLE wage rate. Manufacturing Overhead: It is okay to estimate these costs, but there must be some rationale behind your estimate 3. Use the information gathered in part 2 to prepare a Schedule of Cost of Goods Manufactured. Use the format shown on page 144 (Unit 4.2) of your textbook. 4. Prepare a brief cover memo for the schedule identifying any non-value added costs (Unit 7.3) that were incurred during the process along with suggestions for eliminating them. Please use a professional memo format when completing your cover memo. 5. Turn in the following: Cover Memo (typed) Schedule of COGM (typed) Completed 'Cost Worksheet' (see page 2) Supporting Calculations (may be handwritten or typed) Picture of your final cookie product