Answered step by step

Verified Expert Solution

Question

1 Approved Answer

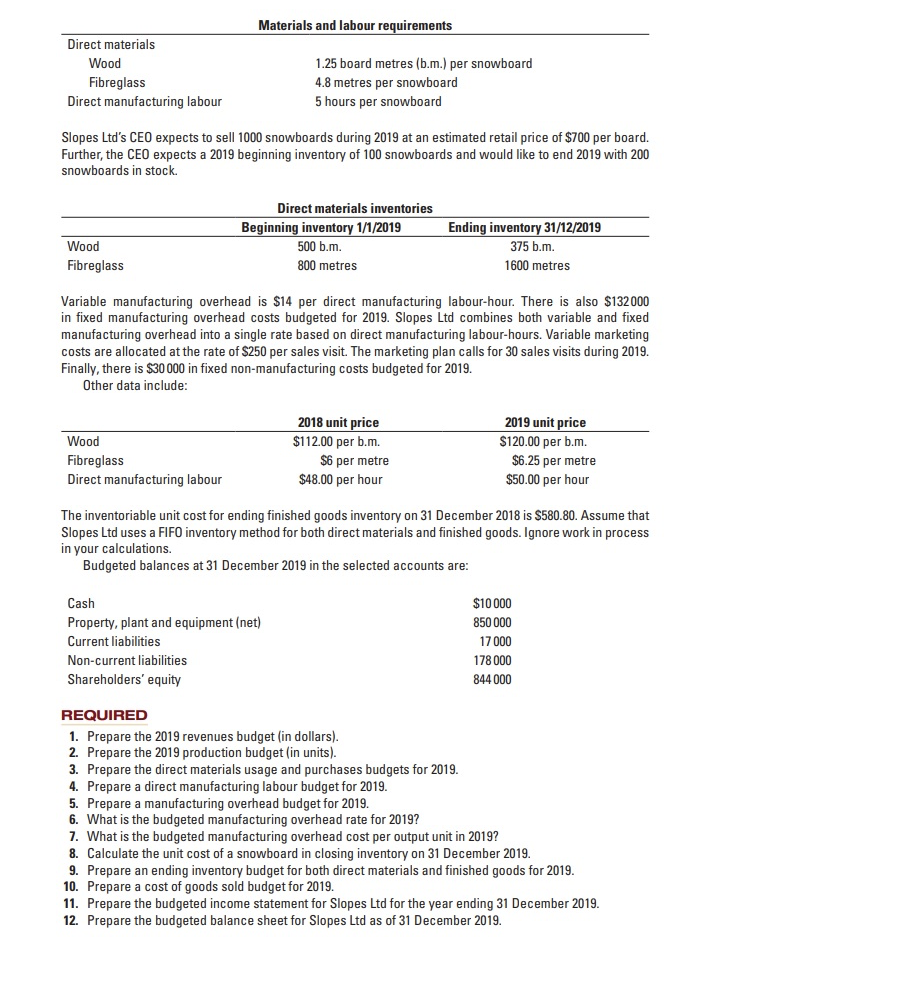

Direct materials Wood , 1 . 2 5 board metres ( b . m . ) per snowboard Fibreglass Direct manufacturing labour 1 . 2

Direct materials

Wood board metres bm per snowboard

Fibreglass

Direct manufacturing labour

board metres bm per

metres per snowboard

hours per snowboard

Slopes Ltds CEO expects to sell snowboards during at an estimated retail price of $ per board.

Further, the CEO expects a beginning inventory of snowboards and would like to end with

snowboards in stock.

Variable manufacturing overhead is $ per direct manufacturing labourhour. There is also $

in fixed manufacturing overhead costs budgeted for Slopes Ltd combines both variable and fixed

manufacturing overhead into a single rate based on direct manufacturing labourhours. Variable marketing

costs are allocated at the rate of $ per sales visit. The marketing plan calls for sales visits during

Finally, there is $ in fixed nonmanufacturing costs budgeted for

Other data include:

The inventoriable unit cost for ending finished goods inventory on December is $ Assume that

Slopes Ltd uses a FIFO inventory method for both direct materials and finished goods. Ignore work in process

in your calculations.

Budgeted balances at December in the selected accounts are:

REQUIRED

Prepare the revenues budget in dollars

Prepare the production budget in units

Prepare the direct materials usage and purchases budgets for

Prepare a direct manufacturing labour budget for

Prepare a manufacturing overhead budget for

What is the budgeted manufacturing overhead rate for

What is the budgeted manufacturing overhead cost per output unit in

Calculate the unit cost of a snowboard in closing inventory on December

Prepare an ending inventory budget for both direct materials and finished goods for

Prepare a cost of goods sold budget for

Prepare the budgeted income statement for Slopes Ltd for the year ending December

Prepare the budgeted balance sheet for Slopes Ltd as of December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started