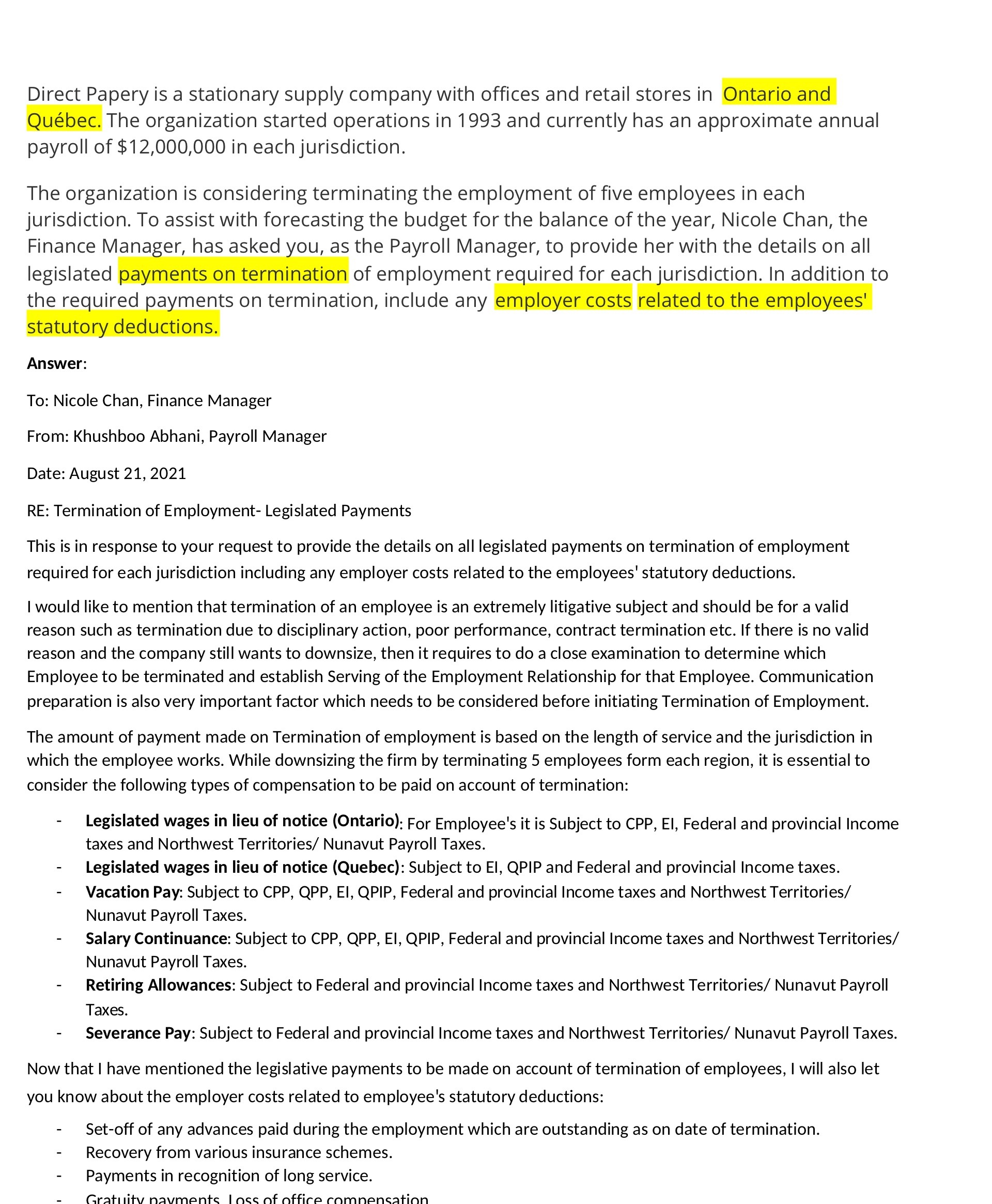

Direct Papery is a stationary supply company with offices and retail stores in Ontario and Qubec. The organization started operations in 1993 and currently has an approximate annual payroll of $12,000,000 in each jurisdiction. The organization is considering terminating the employment of five employees in each jurisdiction. To assist with forecasting the budget for the balance of the year, Nicole Chan, the Finance Manager, has asked you, as the Payroll Manager, to provide her with the details on all legislated payments on termination of employment required for each jurisdiction. In addition to the required payments on termination, include any employer costs related to the employees' statutory deductions. Answer: To: Nicole Chan, Finance Manager From: Khushboo Abhani, Payroll Manager Date: August 21, 2021 RE: Termination of Employment- Legislated Payments This is in response to your request to provide the details on all legislated payments on termination of employment required for each jurisdiction including any employer costs related to the employees' statutory deductions. I would like to mention that termination of an employee is an extremely litigative subject and should be for a valid reason such as termination due to disciplinary action, poor performance, contract termination etc. If there is no valid reason and the company still wants to downsize, then it requires to do a close examination to determine which Employee to be terminated and establish Serving of the Employment Relationship for that Employee. Communication preparation is also very important factor which needs to be considered before initiating Termination of Employment. The amount of payment made on Termination of employment is based on the length of service and the jurisdiction in which the employee works. While downsizing the firm by terminating 5 employees form each region, it is essential to consider the following types of compensation to be paid on account of termination: ' Legislated wages in lieu 0f notice (Ontario); For Employee's it is Subject to CPP, El, Federal and provincial Income taxes and Northwest Territories/ Nunavut Payroll Taxes. - Legislated wages in lieu of notice (Quebec): Subject to El, QPIP and Federal and provincial Income taxes. - Vacation Pay: Subject to CPP, QPP, El, QPIP, Federal and provincial Income taxes and Northwest Territories/ Nunavut Payroll Taxes. - Salary Continuance: Subject to CPP, QPP, El, QPIP, Federal and provincial Income taxes and Northwest Territories/ Nunavut Payroll Taxes. - Retiring Allowances: Subject to Federal and provincial Income taxes and Northwest Territories/ Nunavut Payroll Taxes. - Severance Pay: Subject to Federal and provincial Income taxes and Northwest Territories/ Nunavut Payroll Taxes. Now that l have mentioned the legislative payments to be made on account of termination of employees, I will also let you know about the employer costs related to employee's statutory deductions: - Set-off of any advances paid during the employment which are outstanding as on date of termination. - Recovery from various insurance schemes. - Payments in recognition of long service. - Grntl ll'l'U hnvmpnts I ncs nf nffirp rnmnpnsntinn