Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Direction of the cash flows You will now have 3 different cash flow inputs in these problems. These cash flows can be cash outflows or

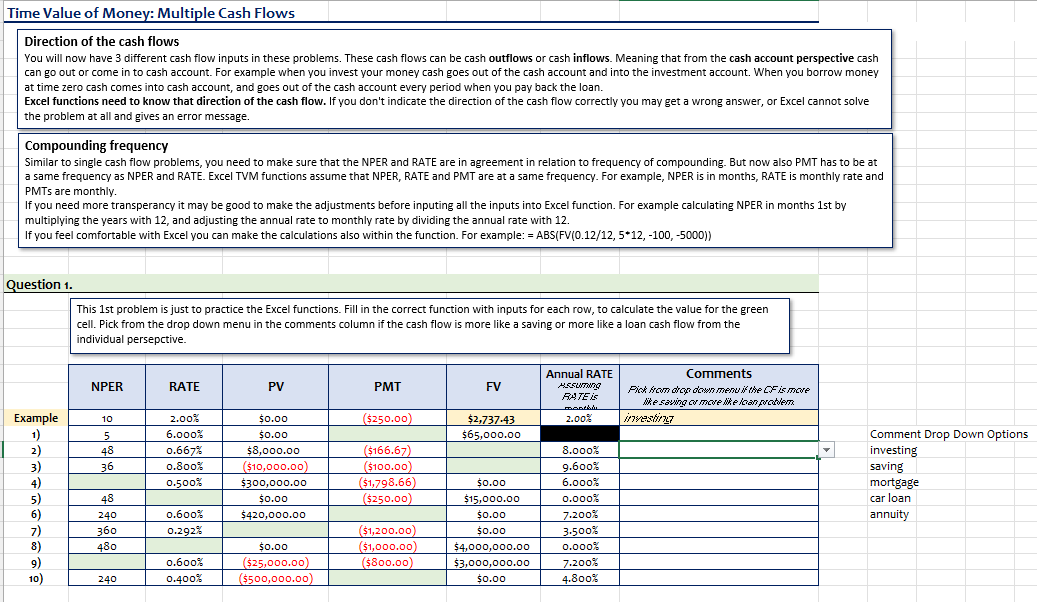

Direction of the cash flows You will now have 3 different cash flow inputs in these problems. These cash flows can be cash outflows or cash inflows. Meaning that from the cash account perspective cash can go out or come in to cash account. For example when you invest your money cash goes out of the cash account and into the investment account. When you borrow money at time zero cash comes into cash account, and goes out of the cash account every period when you pay back the loan. Excel functions need to know that direction of the cash flow. If you don't indicate the direction of the cash flow correctly you may get a wrong answer, or Excel cannot solve the problem at all and gives an error message. Compounding frequency Similar to single cash flow problems, you need to make sure that the NPER and RATE are in agreement in relation to frequency of compounding. But now also PMT has to be at a same frequency as NPER and RATE. Excel TVM functions assume that NPER, RATE and PMT are at a same frequency. For example, NPER is in months, RATE is monthly rate and PMTs are monthly. If you need more transperancy it may be good to make the adjustments before inputing all the inputs into Excel function. For example calculating NPER in months 1st by multiplying the years with 12 , and adjusting the annual rate to monthly rate by dividing the annual rate with 12 . If you feel comfortable with Excel you can make the calculations also within the function. For example: =ABS(FV(0.12/12,512,100,5000)) Question 1. This 1st problem is just to practice the Excel functions. Fill in the correct function with inputs for each row, to calculate the value for the green cell. Pick from the drop down menu in the comments column if the cash flow is more like a saving or more like a loan cash flow from the individual persepctive. Direction of the cash flows You will now have 3 different cash flow inputs in these problems. These cash flows can be cash outflows or cash inflows. Meaning that from the cash account perspective cash can go out or come in to cash account. For example when you invest your money cash goes out of the cash account and into the investment account. When you borrow money at time zero cash comes into cash account, and goes out of the cash account every period when you pay back the loan. Excel functions need to know that direction of the cash flow. If you don't indicate the direction of the cash flow correctly you may get a wrong answer, or Excel cannot solve the problem at all and gives an error message. Compounding frequency Similar to single cash flow problems, you need to make sure that the NPER and RATE are in agreement in relation to frequency of compounding. But now also PMT has to be at a same frequency as NPER and RATE. Excel TVM functions assume that NPER, RATE and PMT are at a same frequency. For example, NPER is in months, RATE is monthly rate and PMTs are monthly. If you need more transperancy it may be good to make the adjustments before inputing all the inputs into Excel function. For example calculating NPER in months 1st by multiplying the years with 12 , and adjusting the annual rate to monthly rate by dividing the annual rate with 12 . If you feel comfortable with Excel you can make the calculations also within the function. For example: =ABS(FV(0.12/12,512,100,5000)) Question 1. This 1st problem is just to practice the Excel functions. Fill in the correct function with inputs for each row, to calculate the value for the green cell. Pick from the drop down menu in the comments column if the cash flow is more like a saving or more like a loan cash flow from the individual persepctive

Direction of the cash flows You will now have 3 different cash flow inputs in these problems. These cash flows can be cash outflows or cash inflows. Meaning that from the cash account perspective cash can go out or come in to cash account. For example when you invest your money cash goes out of the cash account and into the investment account. When you borrow money at time zero cash comes into cash account, and goes out of the cash account every period when you pay back the loan. Excel functions need to know that direction of the cash flow. If you don't indicate the direction of the cash flow correctly you may get a wrong answer, or Excel cannot solve the problem at all and gives an error message. Compounding frequency Similar to single cash flow problems, you need to make sure that the NPER and RATE are in agreement in relation to frequency of compounding. But now also PMT has to be at a same frequency as NPER and RATE. Excel TVM functions assume that NPER, RATE and PMT are at a same frequency. For example, NPER is in months, RATE is monthly rate and PMTs are monthly. If you need more transperancy it may be good to make the adjustments before inputing all the inputs into Excel function. For example calculating NPER in months 1st by multiplying the years with 12 , and adjusting the annual rate to monthly rate by dividing the annual rate with 12 . If you feel comfortable with Excel you can make the calculations also within the function. For example: =ABS(FV(0.12/12,512,100,5000)) Question 1. This 1st problem is just to practice the Excel functions. Fill in the correct function with inputs for each row, to calculate the value for the green cell. Pick from the drop down menu in the comments column if the cash flow is more like a saving or more like a loan cash flow from the individual persepctive. Direction of the cash flows You will now have 3 different cash flow inputs in these problems. These cash flows can be cash outflows or cash inflows. Meaning that from the cash account perspective cash can go out or come in to cash account. For example when you invest your money cash goes out of the cash account and into the investment account. When you borrow money at time zero cash comes into cash account, and goes out of the cash account every period when you pay back the loan. Excel functions need to know that direction of the cash flow. If you don't indicate the direction of the cash flow correctly you may get a wrong answer, or Excel cannot solve the problem at all and gives an error message. Compounding frequency Similar to single cash flow problems, you need to make sure that the NPER and RATE are in agreement in relation to frequency of compounding. But now also PMT has to be at a same frequency as NPER and RATE. Excel TVM functions assume that NPER, RATE and PMT are at a same frequency. For example, NPER is in months, RATE is monthly rate and PMTs are monthly. If you need more transperancy it may be good to make the adjustments before inputing all the inputs into Excel function. For example calculating NPER in months 1st by multiplying the years with 12 , and adjusting the annual rate to monthly rate by dividing the annual rate with 12 . If you feel comfortable with Excel you can make the calculations also within the function. For example: =ABS(FV(0.12/12,512,100,5000)) Question 1. This 1st problem is just to practice the Excel functions. Fill in the correct function with inputs for each row, to calculate the value for the green cell. Pick from the drop down menu in the comments column if the cash flow is more like a saving or more like a loan cash flow from the individual persepctive Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started