Question

Directions 1. Below is a worksheet to complete. 2. Record on the Worksheet an Adjusting Entry that reflects ending enventory on hand at 12.31.2020 as

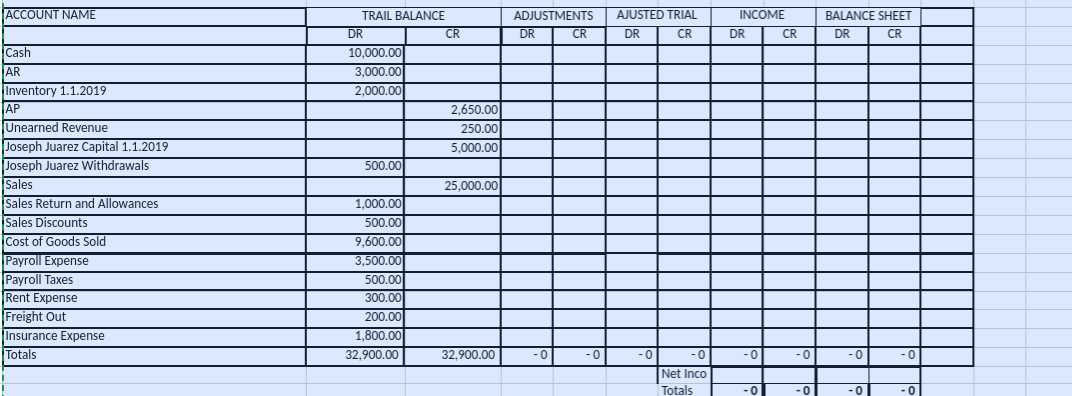

Directions 1. Below is a worksheet to complete. 2. Record on the Worksheet an Adjusting Entry that reflects ending enventory on hand at 12.31.2020 as $2,500.00 3. Record on the Worksheet an Adjusting Entry that reflects $100.00 of Unearned Revnue has been earned. 4. Complete the Worksheet 5. Check Figure: Net Income $8,200.00 Look at Worksheets in Chapter 5. Prepare the Adjustments Column first. Then prepare the Adjusted Trial Blance Columns. Then prepare the Income Stament and Balance Sheet columns. Uearned revenue is recorded when someone pays you in advace for work or a sale and you have not yet done the work or transacted the sale. Uneared Revenue is a liability representsing the obligation you have to do the work or transact a sale in the future. So when you receive the money you DR Cash and CR Unearned Revenue. This Journal Entry does not affect the Income Statement. When you earn rhe revenue you DR Unearned Revenue and CR Revenue or Sales. This reduces the liability account and moves to the Income Statement the amount of Revenue earned or Sales transacted. When inventory AJE's are made at year en they are recorded to Cost of Goods Sold (CGS)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started