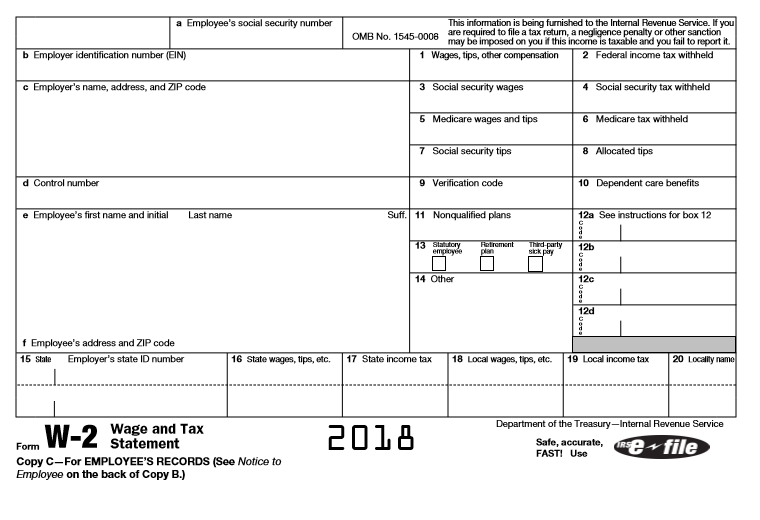

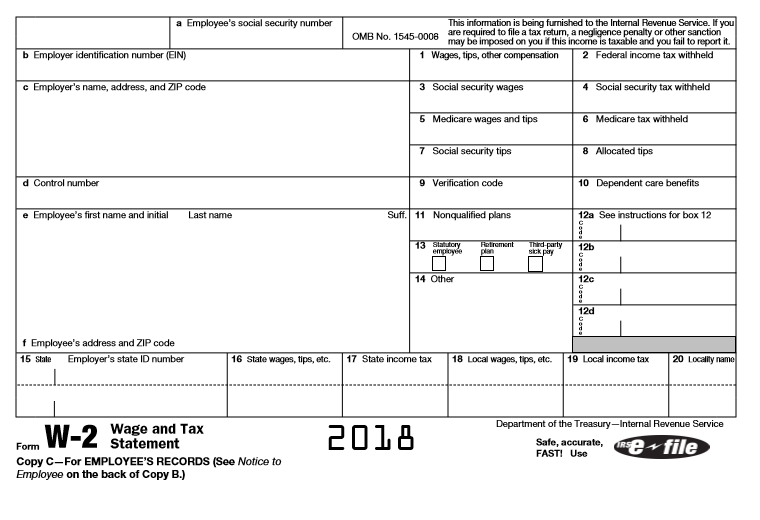

Directions 1. Initial Post: Choose one option below (i.e. Option A, Option B or Option C) and respond to all questions related to your selection. You may wish to reference Form W-2 with instructions Unit 6 Discussion.pdf for this discussion. Option A - Fringe Benefits Option B - Pre-Tax Deductions Option C-W-2 Code Employers often allow their employees to voluntarily elect to have certain amounts deducted from their paychecks (common examples of voluntary pre-tax deductions include your share of 401(k) contributions, health insurance premium payments, FSA or HSA contributions and commuting/parking costs). 1. Briefly explain using your own words how a pre-tax deduction will impact the following amounts: a. Form W-2 Box 1 b. Your income tax liability owed to the IRS c. Your take-home pay d. Your overall net cash flow 2. Name at least one non-tax consideration you should carefully consider before deciding to voluntarily elect to have your employer deduct amounts from your paycheck; explain what might go wrong if you fail to thoroughly think through the options. a. Hint: certain pre-tax deductions are nicknamed "use it or lose it" deductions b. Hint: typically, if you receive a future benefit (e.g. disability insurance proceeds) and you paid the related premiums with pre-tax deductions, the amount of the benefit must be included in your taxable income, and vice versa a Employee's social security number This information is being furnished to the Internal Revenue Service. If you OMB No 1545-0008 are required to file a tax retum, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it. 1 Wages, tips, other compensation 2 Federal income tax withheld b Employer identification number (EIN) c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 7 Social security tips 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 13 Stallory empre Retrament Third party sick pery 12b 14 Other 12c C 12d f Employee's address and ZIP code 15 Stato Employer's state ID number 16 State Wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 1 W-2 Wage and Tax Form Statement Copy C-For EMPLOYEE'S RECORDS (See Notice to Employee on the back of Copy B.) 2018 Department of the Treasury - Internal Revenue Service Safe, accurate, e-file FAST! Use Directions 1. Initial Post: Choose one option below (i.e. Option A, Option B or Option C) and respond to all questions related to your selection. You may wish to reference Form W-2 with instructions Unit 6 Discussion.pdf for this discussion. Option A - Fringe Benefits Option B - Pre-Tax Deductions Option C-W-2 Code Employers often allow their employees to voluntarily elect to have certain amounts deducted from their paychecks (common examples of voluntary pre-tax deductions include your share of 401(k) contributions, health insurance premium payments, FSA or HSA contributions and commuting/parking costs). 1. Briefly explain using your own words how a pre-tax deduction will impact the following amounts: a. Form W-2 Box 1 b. Your income tax liability owed to the IRS c. Your take-home pay d. Your overall net cash flow 2. Name at least one non-tax consideration you should carefully consider before deciding to voluntarily elect to have your employer deduct amounts from your paycheck; explain what might go wrong if you fail to thoroughly think through the options. a. Hint: certain pre-tax deductions are nicknamed "use it or lose it" deductions b. Hint: typically, if you receive a future benefit (e.g. disability insurance proceeds) and you paid the related premiums with pre-tax deductions, the amount of the benefit must be included in your taxable income, and vice versa a Employee's social security number This information is being furnished to the Internal Revenue Service. If you OMB No 1545-0008 are required to file a tax retum, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it. 1 Wages, tips, other compensation 2 Federal income tax withheld b Employer identification number (EIN) c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 7 Social security tips 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 13 Stallory empre Retrament Third party sick pery 12b 14 Other 12c C 12d f Employee's address and ZIP code 15 Stato Employer's state ID number 16 State Wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 1 W-2 Wage and Tax Form Statement Copy C-For EMPLOYEE'S RECORDS (See Notice to Employee on the back of Copy B.) 2018 Department of the Treasury - Internal Revenue Service Safe, accurate, e-file FAST! Use