Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Directions: 1. The ledger should include each of the accounts from the Chart of Accounts, inspect the ledger. 2. Joumalize each transaction in November posting

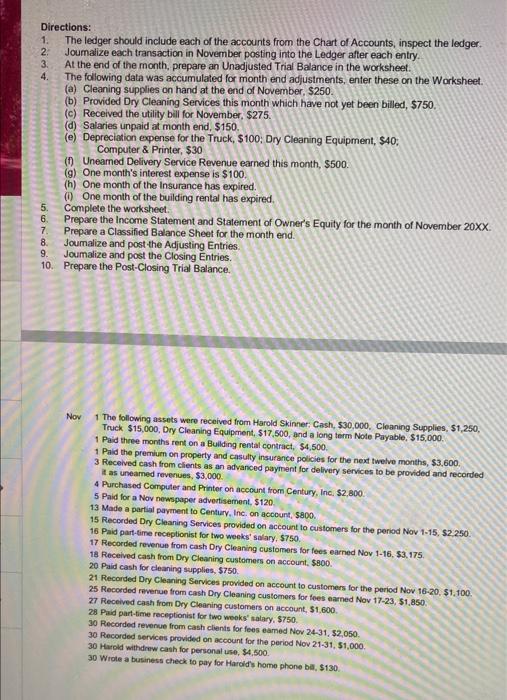

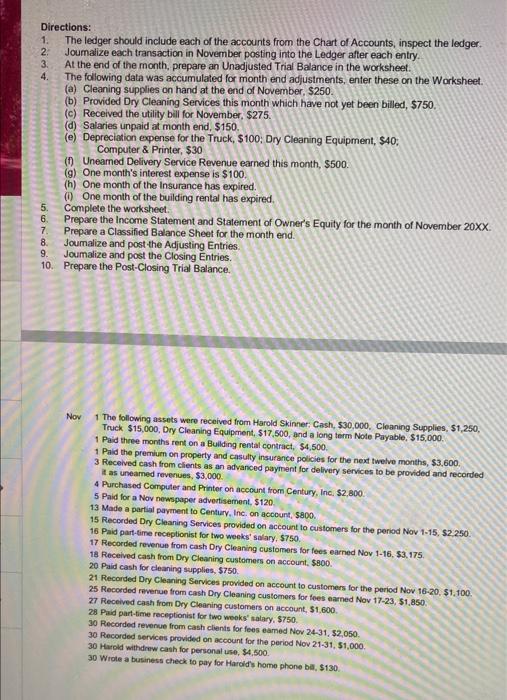

Directions: 1. The ledger should include each of the accounts from the Chart of Accounts, inspect the ledger. 2. Joumalize each transaction in November posting into the Ledger after each entry. 3. At the end of the month, prepare an Unadjusted Trial Balance in the worksheet. 4. The following data was accumulated for month end adjustments, enter these on the Worksheet. (a) Cleaning supplies on hand at the end of November, $250. (b) Provided Dry Cleaning Services this month which have not yet been billed, $750. (c) Received the utility bill for November, \$275. (d) Salaries unpaid at month end, \$150. (e) Depreciation expense for the Truck, \$100; Dry Cleaning Equipment, \$40; Computer \& Printer, $30 (f) Uneamed Delivery Service Revenue earned this month, $500. (g) One month's interest expense is $100. (h) One month of the Insurance has expired. (i) One month of the building rental has expired, 5. Complete the worksheet. 6. Prepare the Income Statement and Statement of Owner's Equity for the month of November 20XX. 7. Prepare a Classified Balance Sheet for the month end. 8. Joumalize and post the Adjusting Entries. 9. Joumalize and post the Closing Entries. 10. Prepare the Post-Closing Trial Balance. Now 1 The following assats were received from Harold Skinner: Cash, $30,000, Cleaning Supplies, $1,250, Truck \$15,000, Dry Cleaning Equipment, \$17,500, and a lang term Nole Payable, \$15,000. 1 Paid three months rent on a Bulding rental contract, $4,500. 1 Paid the premiurn on property and casulty insurance policies for the next twetve months, 53,600 . 3 Received cash from clients as an advanced payment for delivery servces to be provided and recorded to as uneamed revenues, $3,000. 4 Purchased Camputer and Printer on account from Century, Inc, $2,800. 5 Paid for a Nov newspaper advortisement, $120. 13 Made a partial payment to Century, Inc. an account, $800. 15 Recorded Dry Cleaning Services provided on account to customers for the period Nov 1.15, $2.250. 16 Paid part-time receptionist for two wenks' solary, 5750 . 17 Recorded revenus from cash Dry Cleaning customers for fees earned Nov 1-16, 53.175. 18 Received cash from Dry Cleaning customens on account, $800. 20 Paid cash for cleaning supplies, $750. 21 Recorded Dry cleaning Services prowided on account to customers for the period Nov 16-20, $1,100. 25 Recorded revenue from cash Dry Cleaning customers for foes earned Nov 17-23, $1,850. 27 Recoived cash from Dry Cleaning customers on account, $1,600. 28 Piid par-fime receptionist for two wooks' salary, $750. 30 Recorded revenue from cash clients for foes eamed Nov 24-31, 32,050. 30 Recorded services provided on account for the period Nov 2131,51,000. 30 Harold withdruw cash for personal vse, $4,500. 30 Wrote a business check to pay for Hardids home phone ba, $130. Directions: 1. The ledger should include each of the accounts from the Chart of Accounts, inspect the ledger. 2. Joumalize each transaction in November posting into the Ledger after each entry. 3. At the end of the month, prepare an Unadjusted Trial Balance in the worksheet. 4. The following data was accumulated for month end adjustments, enter these on the Worksheet. (a) Cleaning supplies on hand at the end of November, $250. (b) Provided Dry Cleaning Services this month which have not yet been billed, $750. (c) Received the utility bill for November, \$275. (d) Salaries unpaid at month end, \$150. (e) Depreciation expense for the Truck, \$100; Dry Cleaning Equipment, \$40; Computer \& Printer, $30 (f) Uneamed Delivery Service Revenue earned this month, $500. (g) One month's interest expense is $100. (h) One month of the Insurance has expired. (i) One month of the building rental has expired, 5. Complete the worksheet. 6. Prepare the Income Statement and Statement of Owner's Equity for the month of November 20XX. 7. Prepare a Classified Balance Sheet for the month end. 8. Joumalize and post the Adjusting Entries. 9. Joumalize and post the Closing Entries. 10. Prepare the Post-Closing Trial Balance. Now 1 The following assats were received from Harold Skinner: Cash, $30,000, Cleaning Supplies, $1,250, Truck \$15,000, Dry Cleaning Equipment, \$17,500, and a lang term Nole Payable, \$15,000. 1 Paid three months rent on a Bulding rental contract, $4,500. 1 Paid the premiurn on property and casulty insurance policies for the next twetve months, 53,600 . 3 Received cash from clients as an advanced payment for delivery servces to be provided and recorded to as uneamed revenues, $3,000. 4 Purchased Camputer and Printer on account from Century, Inc, $2,800. 5 Paid for a Nov newspaper advortisement, $120. 13 Made a partial payment to Century, Inc. an account, $800. 15 Recorded Dry Cleaning Services provided on account to customers for the period Nov 1.15, $2.250. 16 Paid part-time receptionist for two wenks' solary, 5750 . 17 Recorded revenus from cash Dry Cleaning customers for fees earned Nov 1-16, 53.175. 18 Received cash from Dry Cleaning customens on account, $800. 20 Paid cash for cleaning supplies, $750. 21 Recorded Dry cleaning Services prowided on account to customers for the period Nov 16-20, $1,100. 25 Recorded revenue from cash Dry Cleaning customers for foes earned Nov 17-23, $1,850. 27 Recoived cash from Dry Cleaning customers on account, $1,600. 28 Piid par-fime receptionist for two wooks' salary, $750. 30 Recorded revenue from cash clients for foes eamed Nov 24-31, 32,050. 30 Recorded services provided on account for the period Nov 2131,51,000. 30 Harold withdruw cash for personal vse, $4,500. 30 Wrote a business check to pay for Hardids home phone ba, $130

Directions: 1. The ledger should include each of the accounts from the Chart of Accounts, inspect the ledger. 2. Joumalize each transaction in November posting into the Ledger after each entry. 3. At the end of the month, prepare an Unadjusted Trial Balance in the worksheet. 4. The following data was accumulated for month end adjustments, enter these on the Worksheet. (a) Cleaning supplies on hand at the end of November, $250. (b) Provided Dry Cleaning Services this month which have not yet been billed, $750. (c) Received the utility bill for November, \$275. (d) Salaries unpaid at month end, \$150. (e) Depreciation expense for the Truck, \$100; Dry Cleaning Equipment, \$40; Computer \& Printer, $30 (f) Uneamed Delivery Service Revenue earned this month, $500. (g) One month's interest expense is $100. (h) One month of the Insurance has expired. (i) One month of the building rental has expired, 5. Complete the worksheet. 6. Prepare the Income Statement and Statement of Owner's Equity for the month of November 20XX. 7. Prepare a Classified Balance Sheet for the month end. 8. Joumalize and post the Adjusting Entries. 9. Joumalize and post the Closing Entries. 10. Prepare the Post-Closing Trial Balance. Now 1 The following assats were received from Harold Skinner: Cash, $30,000, Cleaning Supplies, $1,250, Truck \$15,000, Dry Cleaning Equipment, \$17,500, and a lang term Nole Payable, \$15,000. 1 Paid three months rent on a Bulding rental contract, $4,500. 1 Paid the premiurn on property and casulty insurance policies for the next twetve months, 53,600 . 3 Received cash from clients as an advanced payment for delivery servces to be provided and recorded to as uneamed revenues, $3,000. 4 Purchased Camputer and Printer on account from Century, Inc, $2,800. 5 Paid for a Nov newspaper advortisement, $120. 13 Made a partial payment to Century, Inc. an account, $800. 15 Recorded Dry Cleaning Services provided on account to customers for the period Nov 1.15, $2.250. 16 Paid part-time receptionist for two wenks' solary, 5750 . 17 Recorded revenus from cash Dry Cleaning customers for fees earned Nov 1-16, 53.175. 18 Received cash from Dry Cleaning customens on account, $800. 20 Paid cash for cleaning supplies, $750. 21 Recorded Dry cleaning Services prowided on account to customers for the period Nov 16-20, $1,100. 25 Recorded revenue from cash Dry Cleaning customers for foes earned Nov 17-23, $1,850. 27 Recoived cash from Dry Cleaning customers on account, $1,600. 28 Piid par-fime receptionist for two wooks' salary, $750. 30 Recorded revenue from cash clients for foes eamed Nov 24-31, 32,050. 30 Recorded services provided on account for the period Nov 2131,51,000. 30 Harold withdruw cash for personal vse, $4,500. 30 Wrote a business check to pay for Hardids home phone ba, $130. Directions: 1. The ledger should include each of the accounts from the Chart of Accounts, inspect the ledger. 2. Joumalize each transaction in November posting into the Ledger after each entry. 3. At the end of the month, prepare an Unadjusted Trial Balance in the worksheet. 4. The following data was accumulated for month end adjustments, enter these on the Worksheet. (a) Cleaning supplies on hand at the end of November, $250. (b) Provided Dry Cleaning Services this month which have not yet been billed, $750. (c) Received the utility bill for November, \$275. (d) Salaries unpaid at month end, \$150. (e) Depreciation expense for the Truck, \$100; Dry Cleaning Equipment, \$40; Computer \& Printer, $30 (f) Uneamed Delivery Service Revenue earned this month, $500. (g) One month's interest expense is $100. (h) One month of the Insurance has expired. (i) One month of the building rental has expired, 5. Complete the worksheet. 6. Prepare the Income Statement and Statement of Owner's Equity for the month of November 20XX. 7. Prepare a Classified Balance Sheet for the month end. 8. Joumalize and post the Adjusting Entries. 9. Joumalize and post the Closing Entries. 10. Prepare the Post-Closing Trial Balance. Now 1 The following assats were received from Harold Skinner: Cash, $30,000, Cleaning Supplies, $1,250, Truck \$15,000, Dry Cleaning Equipment, \$17,500, and a lang term Nole Payable, \$15,000. 1 Paid three months rent on a Bulding rental contract, $4,500. 1 Paid the premiurn on property and casulty insurance policies for the next twetve months, 53,600 . 3 Received cash from clients as an advanced payment for delivery servces to be provided and recorded to as uneamed revenues, $3,000. 4 Purchased Camputer and Printer on account from Century, Inc, $2,800. 5 Paid for a Nov newspaper advortisement, $120. 13 Made a partial payment to Century, Inc. an account, $800. 15 Recorded Dry Cleaning Services provided on account to customers for the period Nov 1.15, $2.250. 16 Paid part-time receptionist for two wenks' solary, 5750 . 17 Recorded revenus from cash Dry Cleaning customers for fees earned Nov 1-16, 53.175. 18 Received cash from Dry Cleaning customens on account, $800. 20 Paid cash for cleaning supplies, $750. 21 Recorded Dry cleaning Services prowided on account to customers for the period Nov 16-20, $1,100. 25 Recorded revenue from cash Dry Cleaning customers for foes earned Nov 17-23, $1,850. 27 Recoived cash from Dry Cleaning customers on account, $1,600. 28 Piid par-fime receptionist for two wooks' salary, $750. 30 Recorded revenue from cash clients for foes eamed Nov 24-31, 32,050. 30 Recorded services provided on account for the period Nov 2131,51,000. 30 Harold withdruw cash for personal vse, $4,500. 30 Wrote a business check to pay for Hardids home phone ba, $130

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started