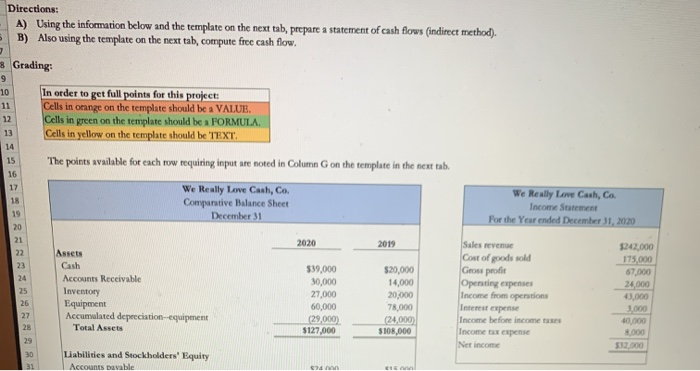

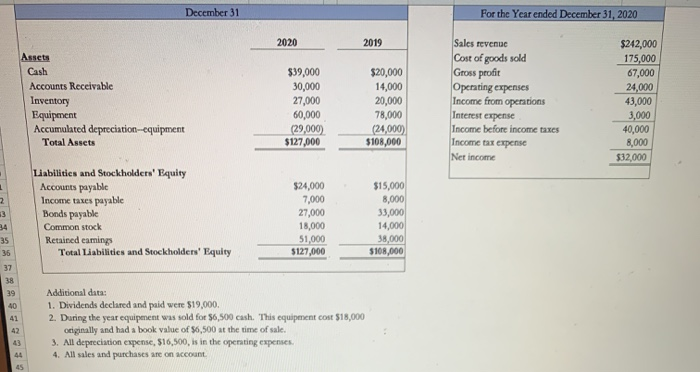

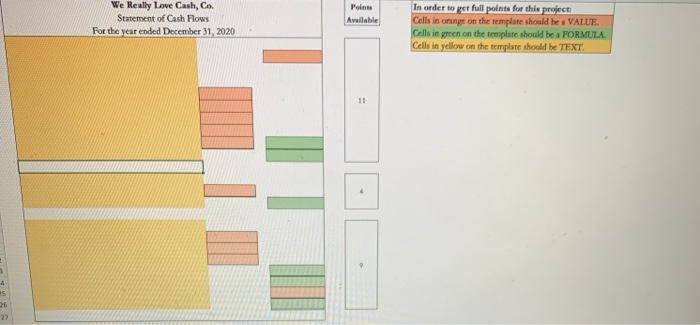

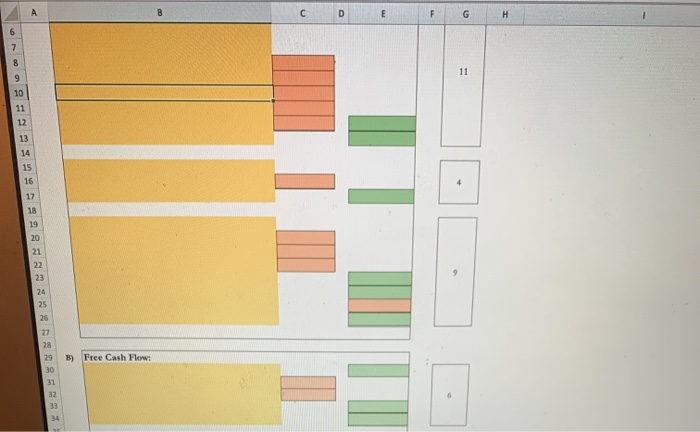

Directions: A) Using the information below and the template on the next tab, prepare a statement of cash flows (indirect method). 5 B) Also using the template on the next tab, compute free cash flow. 3 3 Grading: 9 10 In order to get full points for this project: 11 Cells in orange on the template should be a VALUE. Cells in green on the template should be a FORMULA Cells in yellow on the template should be TEXT. The points available for each row requiring input are noted in Column G on the template in the next tab, We Really Love Cash, Co. We Really Love Cash, Co. 18 Comparative Balance Sheet Income Statement December 31 For the Year ended December 31, 2020 12 13 14 15 16 17 2020 2019 19 20 21 22 23 24 25 26 27 5242,000 175.000 67.000 24,000 Assets Cash Accounts Receivable Inventory Equipment Accumulated depreciation equipment Total Assets $39,000 30,000 27,000 60,000 (29.000) $127,000 $20,000 14,000 20,000 78,000 (24,000) $108,000 Sales revenue Cost of goods sold Gross profit Opening expenses Income from operations Interest expense Income before income taxes Income tax expense Net income 28 3.000 0.000 8.000 512000 29 30 Liabilities and Stockholders' Equity Accounts payable 31 524 CI December 31 For the Year ended December 31, 2020 2020 2019 Assets Cash Accounts Receivable Inventory Equipment Accumulated depreciation--equipment Total Assets $39,000 30,000 27,000 60,000 (29,000) $127,000 $20,000 14,000 20,000 78,000 (24,000) $108,000 Sales revenue Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before income taxes Income tax expense Ner income $242,000 175,000 67,000 24,000 43,000 3,000 40,000 8,000 $32,000 1 2 Liabilities and Stockholders' Equity Accounts payable Income taxes payable Bonds payable Common stock Retained earings Total Liabilities and Stockholders' Equity $24,000 7,000 27,000 18,000 51,000 $127,000 $15,000 8,000 33,000 14,000 38,000 5108,000 35 36 37 38 39 40 41 Additional data: 1. Dividends declared and paid were $19,000. 2. During the year equipment was sold for $6,500 cash. This equipment cost $18,000 Originally and had a book value of $6,500 at the time of sale. 3. All depreciation expense, $16,500, is in the operating expenses 4. All sales and purchases are on account 44 45 Pointe We Really Love Cash, Co. Statement of Cash Flows For the year ended December 31, 2020 Available In order to get full points for this project Cells in one on the template should be a VALUE Cells in green on the template should be a FORMULA Cells in yellow on the template should be TEXT. 11 4 45 26 27 D E F G H 7 8 9 10 11 12 13 14 15 16 4 17 18 19 20 21 22 23 24 25 26 27 28 B) Free Cash Flow: 29 30 31 32 33 6 34