Answered step by step

Verified Expert Solution

Question

1 Approved Answer

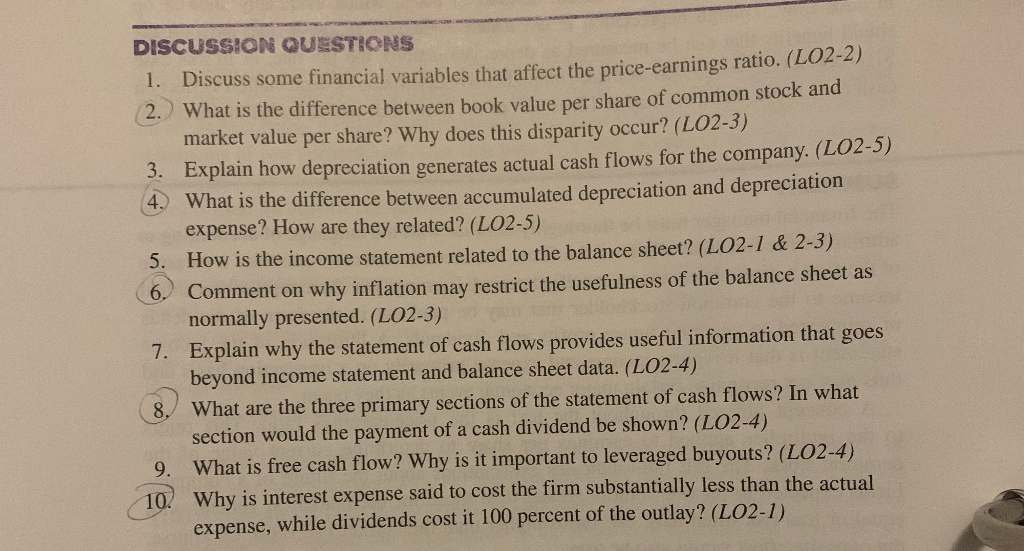

Directions: Answer all the Even Discussion Questions. DISCUSSION QUESTIONS 1. Discuss some financial variables that affect the price-earnings ratio. (L04-2) 2. What is the difference

Directions: Answer all the Even Discussion Questions.

DISCUSSION QUESTIONS 1. Discuss some financial variables that affect the price-earnings ratio. (L04-2) 2. What is the difference between book value per share of common stock and market value per share? Why does this disparity occur? (LO2-3) 3. Explain how depreciation generates actual cash flows for the company. (L02-)) 4.) What is the difference between accumulated depreciation and depreciation expense? How are they related? (LO2-5) 5. How is the income statement related to the balance sheet? (LO2-1 & 2-3) 6. Comment on why inflation may restrict the usefulness of the balance sheet as normally presented. (LO2-3) 7. Explain why the statement of cash flows provides useful information that goes beyond income statement and balance sheet data. (LO2-4) What are the three primary sections of the statement of cash flows? In what section would the payment of a cash dividend be shown? (LO2-4) 9. What is free cash flow? Why is it important to leveraged buyouts? (LO2-4) 102 Why is interest expense said to cost the firm substantially less than the actual expense, while dividends cost it 100 percent of the outlay? (LO2-1) DISCUSSION QUESTIONS 1. Discuss some financial variables that affect the price-earnings ratio. (L04-2) 2. What is the difference between book value per share of common stock and market value per share? Why does this disparity occur? (LO2-3) 3. Explain how depreciation generates actual cash flows for the company. (L02-)) 4.) What is the difference between accumulated depreciation and depreciation expense? How are they related? (LO2-5) 5. How is the income statement related to the balance sheet? (LO2-1 & 2-3) 6. Comment on why inflation may restrict the usefulness of the balance sheet as normally presented. (LO2-3) 7. Explain why the statement of cash flows provides useful information that goes beyond income statement and balance sheet data. (LO2-4) What are the three primary sections of the statement of cash flows? In what section would the payment of a cash dividend be shown? (LO2-4) 9. What is free cash flow? Why is it important to leveraged buyouts? (LO2-4) 102 Why is interest expense said to cost the firm substantially less than the actual expense, while dividends cost it 100 percent of the outlay? (LO2-1)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started