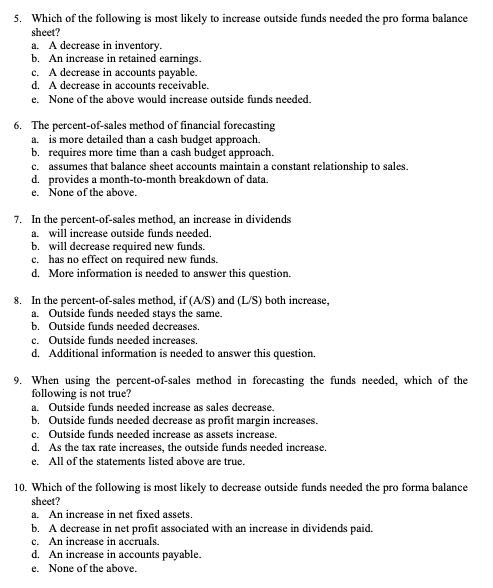

Directions: Determine an answer to every question on this problem set. AFTER you determine an answer to every question, record your answers only on the THPS-2 Answer Submission Form (which will be posted on iCollege a couple of days before the due date). I STRONGLY suggest that you keep your worked-out solutions to every problem in order to check your work against the solution key that I will post after the Answer Submission Form closes. That way you can learn from any mistakes that you make, and not repeat those same mistakes on the Midterm or Final Exam. All questions/problems are equally weighted. Part I: Multiple Choice Questions (choose the BEST multiple-choice answer for each question). 1. The key initial element in developing all pro forma statements is a. a cash budget. b. an income statement. c. a sales forecast. d. a collections schedule. e. None of the above. 2. In the development of pro forma financial statements, the last step in the process is the development of the a. cash budget. b. pro forma balance sheet. c. pro forma income statement. d. statement of cash flows e. None of the above. 3. A rapid rate of growth in sales may require a. higher dividend payments to shareholders. b. increased borrowing by the firm to support the sales increase. c. the firm to be more lenient with credit customers. d. sales forecasts to be made less frequently. e. None of the above. 4. The pro forma income statement is important to the overall process of constructing the pro forma balance sheet because it allows us to determine a value for a. change in retained earnings. b. gross profit. c. interest expense. d. prepaid expenses. e. None of the above. 5. Which of the following is most likely to increase outside funds needed the pro forma balance sheet? a. A decrease in inventory. b. An increase in retained earnings. c. A decrease in accounts payable. d. A decrease in accounts receivable. e. None of the above would increase outside funds needed. 6. The percent-of-sales method of financial forecasting a. is more detailed than a cash budget approach. b. requires more time than a cash budget approach. c. assumes that balance sheet accounts maintain a constant relationship to sales. d. provides a month-to-month breakdown of data. e. None of the above. 7. In the percent-of-sales method, an increase in dividends a. will increase outside funds needed. b. will decrease required new funds. c. has no effect on required new funds. d. More information is needed to answer this question. 8. In the percent-of-sales method, if (A/S) and (L/S) both increase, a. Outside funds needed stays the same. b. Outside funds needed decreases. c. Outside funds needed increases. d. Additional information is needed to answer this question. 9. When using the percent-of-sales method in forecasting the funds needed, which of the following is not true? a. Outside funds needed increase as sales decrease. b. Outside funds needed decrease as profit margin increases. c. Outside funds needed increase as assets increase. d. As the tax rate increases, the outside funds needed increase. e. All of the statements listed above are true. 10. Which of the following is most likely to decrease outside funds needed the pro forma balance sheet? a. An increase in net fixed assets. b. A decrease in net profit associated with an increase in dividends paid. c. An increase in accruals. d. An increase in accounts payable. e. None of the above