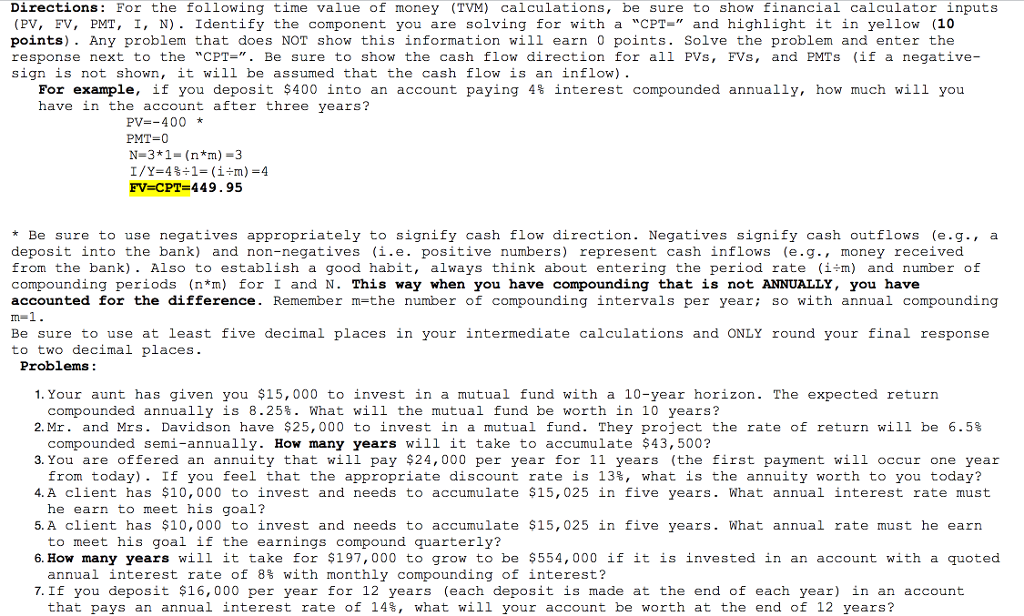

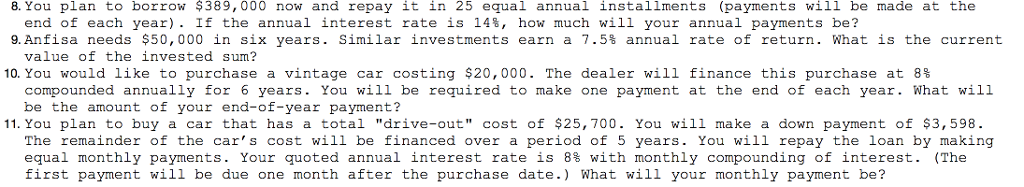

Directions: For the following time value of money (TVM) calculations, be sure to show financial calculator inputs (PV, ?V, PMT, I, N). Identify the component you are solving for with a "CPT-"and highlight it in yellow (10 points). Any problem that does NOT show this information will earn 0 points. Solve the problem and enter the response next to the "CPT=". Be sure to show the cash flow direction for all PVs, FVs, and PMTs (if a negative- sign is not shown, it will be assumed that the cash flow is an inflow) For example, if you deposit $400 into an account paying 4% interest compounded annually, how much will you have in the account after three years? PV=-400 PMT=0 * FV-CPT 449.95 *Be sure to use negatives appropriately to signifv cash flow direction. Negatives sianify cash outflows (e.g., a deposit into the bank) and non-negatives (i.e. positive numbers) represent cash inflows (e.g., money received from the bank). Also to establish a good habit, always think about entering the period rate (im) and number of compounding periods (n*m) for I and N. This way when you have compounding that is not ANNUALLY, you have accounted for the difference. Remember m=the number of compounding intervals per year; so with annual compounding Be sure to use at least five decimal places in your intermediate calculations and ONLY round your final response to two decimal places Problems 1. Your aunt has given you $15,000 to invest in a mutual fund with a 10-year horizon. The expected return 2, Mr. and Mrs. Davidson have $25,000 to inve st in a mutual fund. They project the rate of return will be 6.5% 3. You are offered an annuity that wi11 pay $24,000 per year for 11 years (the first payment will occur one year 4. A client has $10,000 to invest and needs to accumulate $15,025 in five years. What annual interest rate must 5. A client has $10,000 to invest and needs to accumulate $15,025 in five years. What annual rate must he earn 6. How many years will it take for $197,000 to grow to be $554,000 if it is invested in an account with a quoted 7. If you deposit $16,000 per year for 12 years (each deposit is made at the end of each year) in an account compounded annually is 8.25%. What will the mutual fund be worth in 10 years? compounded semi-annually. How many years will it take to accumulate $43,500? from today) . If you feel that the appropriate discount rate is 13%, what is the annuity worth to you today? he earn to meet his goal? to meet his goal if the earnings compound quarterly? annual interest rate of 8% with monthly compounding of interest? that pays an annual interest rate of 14%, what will your account be worth at the end of 12 years