Question

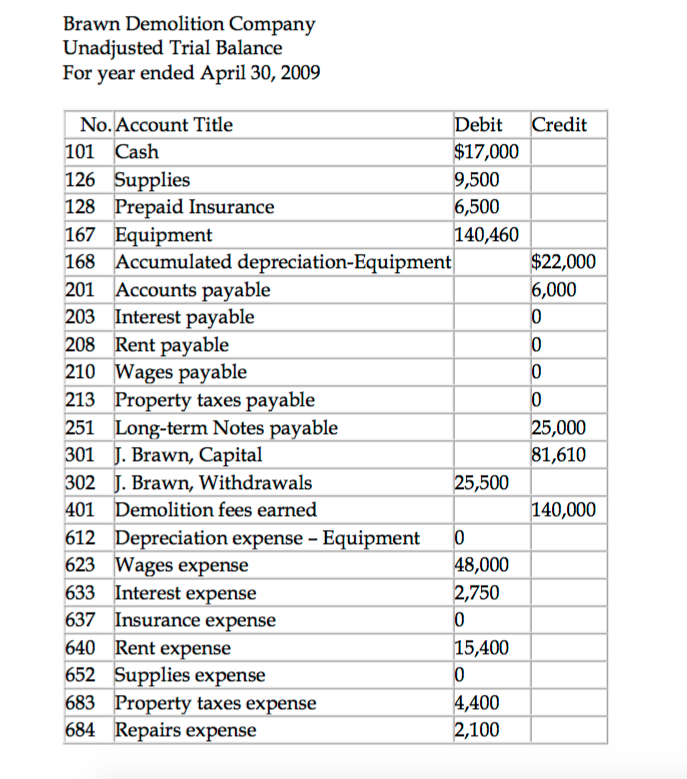

Directions: Once you have your adjusted trial balance, you can move the totals to the Income Statement columns for all revenue and expense accounts and

Directions: Once you have your adjusted trial balance, you can move the totals to the Income Statement columns for all revenue and expense accounts and to the Balance Sheet and owners equity columns for all asset, liability, and equity accounts. When you total the columns for the income statement, it will not balance. The difference is your net income. Be sure to review the worksheet in Chapter 4 to see how it presents the net income and make the two columns balance. The same will happen when you total the Balance Sheet columns.

Directions: Once you have your adjusted trial balance, you can move the totals to the Income Statement columns for all revenue and expense accounts and to the Balance Sheet and owners equity columns for all asset, liability, and equity accounts. When you total the columns for the income statement, it will not balance. The difference is your net income. Be sure to review the worksheet in Chapter 4 to see how it presents the net income and make the two columns balance. The same will happen when you total the Balance Sheet columns.

Missing worksheet, closing entries, and statements in correct format. Please see textbook for the formatting of the income statement, statement of owners equity, and classified balance sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started