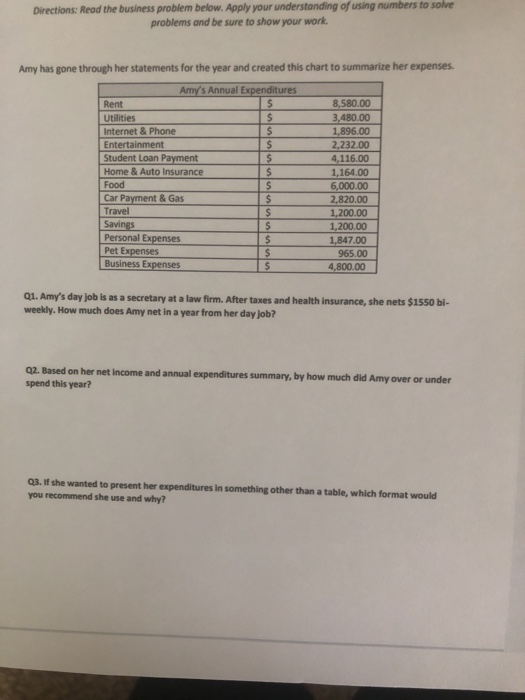

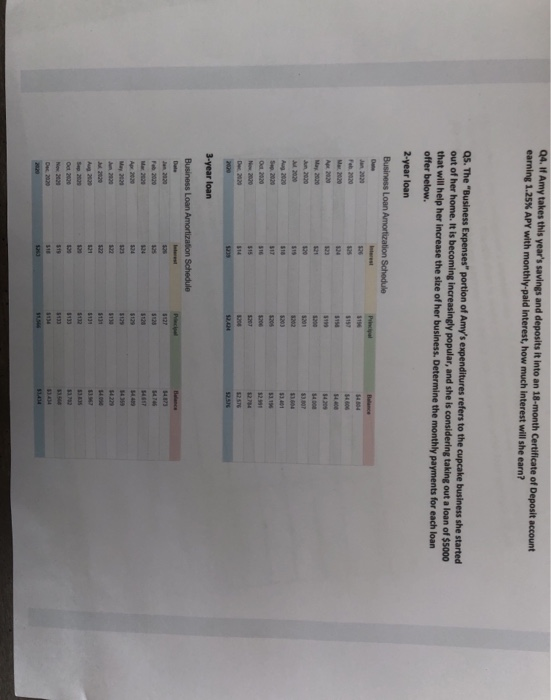

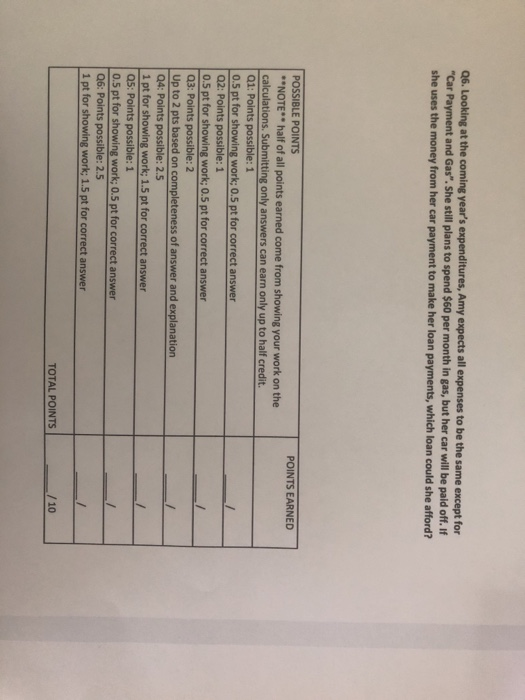

Directions: Read the business problem below. Apply your understanding of using numbers to solve problems and be sure to show your work. Amy has gone through her statements for the year and created this chart to summarize her expenses. Amy's Annual Expenditures Rent $ Utilities $ Internet & Phone $ Entertainment $ Student Loan Payment $ Home & Auto Insurance S Food $ Car Payment & Gas S Travel $ Savings $ Personal Expenses $ Pet Expenses $ Business Expenses $ 8,580.00 3,480.00 1,896.00 2.232.00 4,116.00 1,164.00 6,000.00 ,820.00 1,200.00 1,200.00 1,847.00 965.00 4,800.00 2 Q1. Amy's day job is as a secretary at a law firm. After taxes and health insurance, she nets $1550 bl- weekly. How much does Amy net in a year from her day job? Q2. Based on her net income and annual expenditures summary, by how much did Amy over or under spend this year? Q3. If she wanted to present her expenditures in something other than a table, which format would you recommend she use and why? Q4.8 Amy takes this year's savings and deposits it into an 18-month Certificate of Deposit account earning 1.25% APY with monthly paid Interest, how much Interest will she earn? Q5. The "Business Expenses" portion of Amy's expenditures refers to the cupcake business she started out of her home. It is becoming increasingly popular, and she is considering taking out a loan of $5000 that will help her increase the size of her business. Determine the monthly payments for each loan offer below. 2-year loan Business Loan Amortization Schedule Principal Jan 2020 Feb. 2020 Mar2020 Apt 2020 1200 Jun 2000 50.2020 Oct 2020 Dec. 2020 3-year loan Business Loan Amortization Schedule Place Jan 2020 HOS Q6. Looking at the coming year's expenditures, Amy expects all expenses to be the same except for "Car Payment and as". She still plans to spend $60 per month in gas, but her car will be paid off. If she uses the money from her car payment to make her loan payments, which loan could she afford? POINTS EARNED POSSIBLE POINTS *NOTE half of all points earned come from showing your work on the calculations. Submitting only answers can earn only up to half credit. Q1: Points possible: 1 0.5 pt for showing work: 0.5 pt for correct answer Q2: Points possible: 1 0.5 pt for showing work; 0.5 pt for correct answer Q3: Points possible: 2 Up to 2 pts based on completeness of answer and explanation Q4: Points possible: 2.5 1 pt for showing work; 1.5 pt for correct answer Q5: Points possible: 1 0.5 pt for showing work; 0.5 pt for correct answer Q6: Points possible: 2.5 1 pt for showing work; 1.5 pt for correct