Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Directions: Submitting insurance claims, particularly Medicare claims, involves a bit of arithmetic. Several problems are given here so that you will gain experience with situations

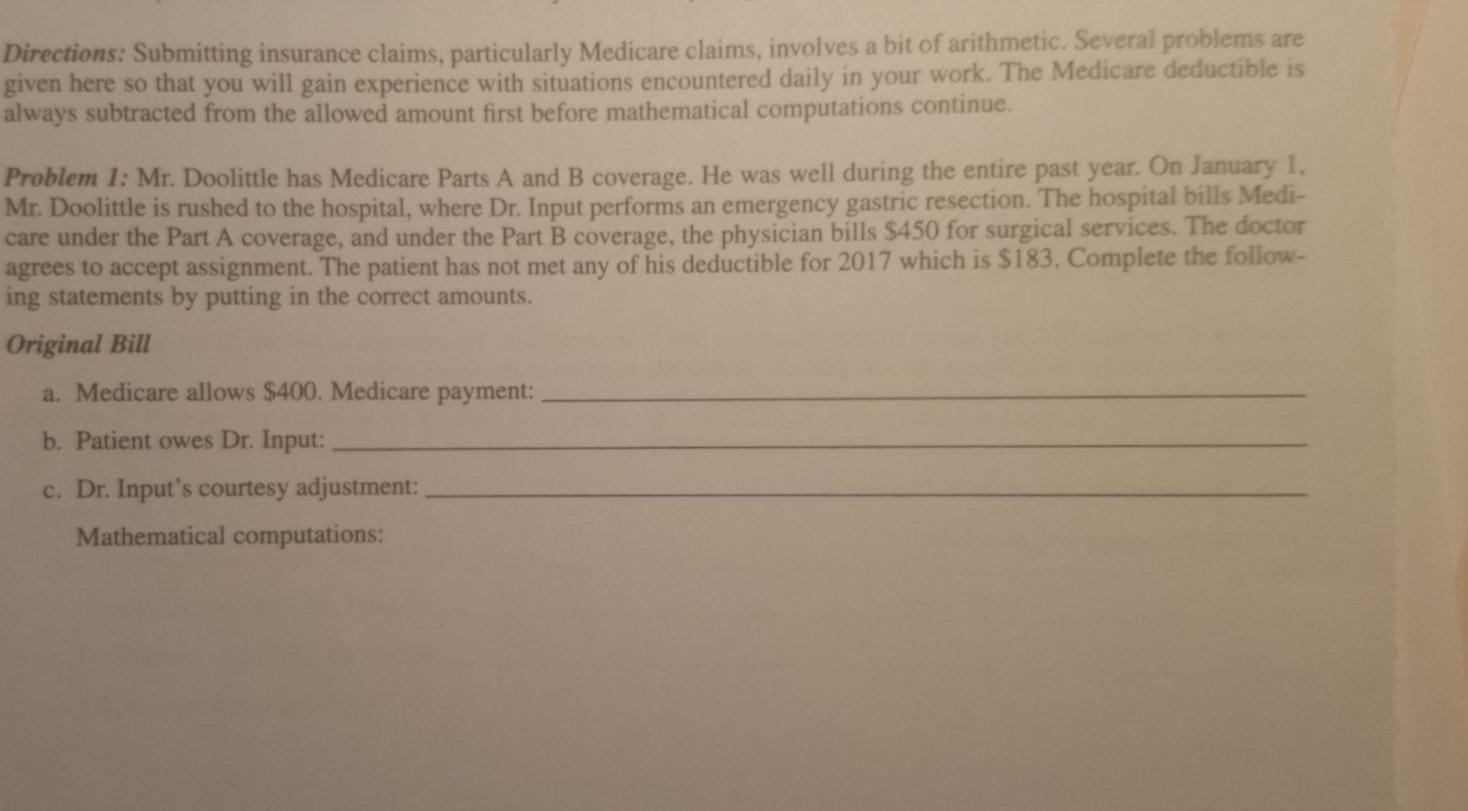

Directions: Submitting insurance claims, particularly Medicare claims, involves a bit of arithmetic. Several problems are given here so that you will gain experience with situations encountered daily in your work. The Medicare deductible is always subtracted from the allowed amount first before mathematical computations continue. Problem 1: Mr. Doolittle has Medicare Parts A and B coverage. He was well during the entire past year. On January 1, Mr. Doolittle is rushed to the hospital, where Dr. Input performs an emergency gastric resection. The hospital bills Medi- care under the Part A coverage, and under the Part B coverage, the physician bills $450 for surgical services. The doctor agrees to accept assignment. The patient has not met any of his deductible for 2017 which is $183. Complete the follow- ing statements by putting in the correct amounts. Original Bill a. Medicare allows $400. Medicare payment: b. Patient owes Dr. Input: c. Dr. Input's courtesy adjustment: Mathematical computations: Directions: Submitting insurance claims, particularly Medicare claims, involves a bit of arithmetic. Several problems are given here so that you will gain experience with situations encountered daily in your work. The Medicare deductible is always subtracted from the allowed amount first before mathematical computations continue. Problem 1: Mr. Doolittle has Medicare Parts A and B coverage. He was well during the entire past year. On January 1, Mr. Doolittle is rushed to the hospital, where Dr. Input performs an emergency gastric resection. The hospital bills Medi- care under the Part A coverage, and under the Part B coverage, the physician bills $450 for surgical services. The doctor agrees to accept assignment. The patient has not met any of his deductible for 2017 which is $183. Complete the follow- ing statements by putting in the correct amounts. Original Bill a. Medicare allows $400. Medicare payment: b. Patient owes Dr. Input: c. Dr. Input's courtesy adjustment: Mathematical computations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started