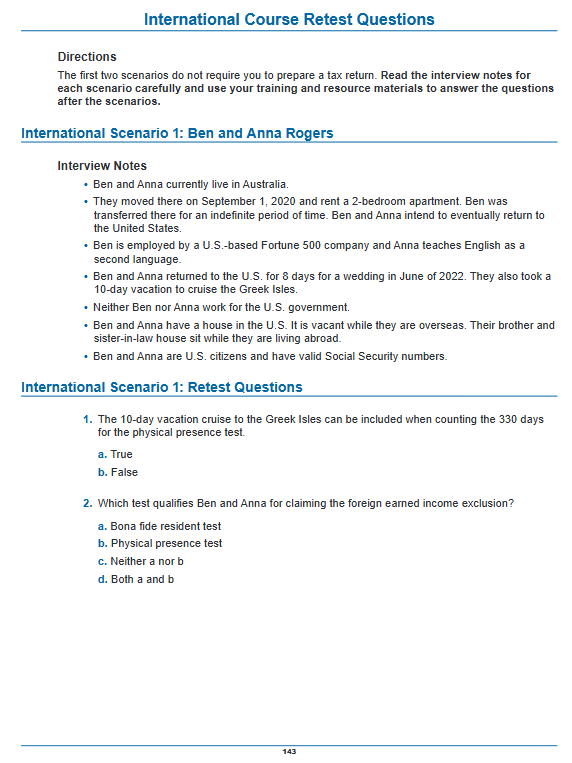

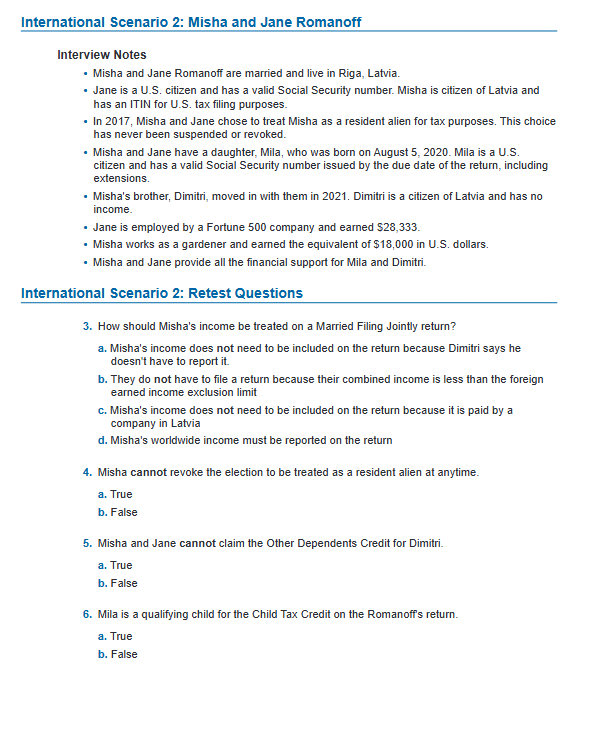

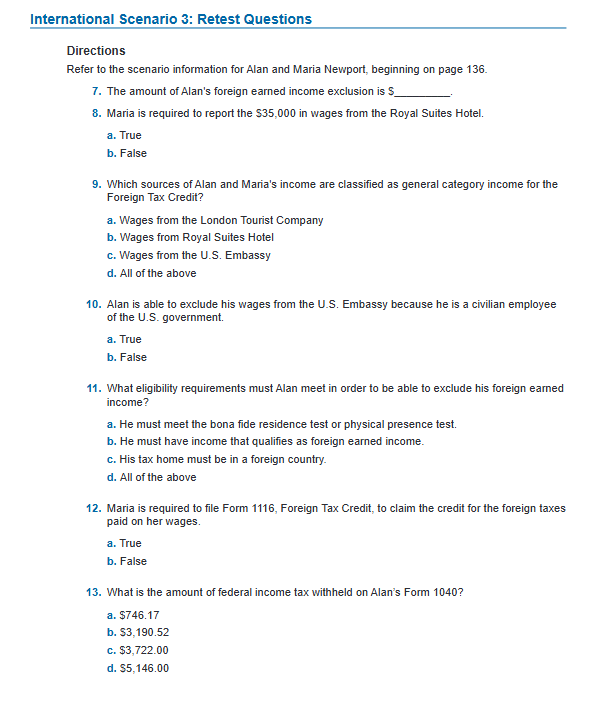

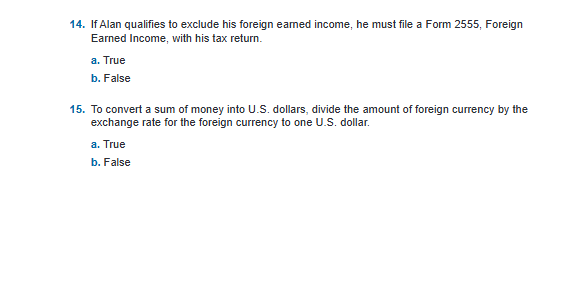

Directions The first two scenarios do not require you to prepare a tax return. Read the interview notes for each scenario carefully and use your training and resource materials to answer the questions after the scenarios. nternational Scenario 1: Ben and Anna Rogers Interview Notes - Ben and Anna currently live in Australia. - They moved there on September 1, 2020 and rent a 2-bedroom apartment. Ben was transferred there for an indefinite period of time. Ben and Anna intend to eventually return to the United States. - Ben is employed by a U.S.-based Fortune 500 company and Anna teaches English as a second language. - Ben and Anna returned to the U.S. for 8 days for a wedding in June of 2022. They also took a 10-day vacation to cruise the Greek Isles. - Neither Ben nor Anna work for the U.S. government. - Ben and Anna have a house in the U.S. It is vacant while they are overseas. Their brother and sister-in-law house sit while they are living abroad. - Ben and Anna are U.S. citizens and have valid Social Security numbers. nternational Scenario 1: Retest Questions 1. The 10-day vacation cruise to the Greek Isles can be included when counting the 330 days for the physical presence test. a. True b. False 2. Which test qualifies Ben and Anna for claiming the foreign earned income exclusion? a. Bona fide resident test b. Physical presence test c. Neither a nor b d. Both a and b Interview Notes - Misha and Jane Romanoff are married and live in Riga, Latvia. - Jane is a U.S. citizen and has a valid Social Security number. Misha is citizen of Latvia and has an ITIN for U.S. tax filing purposes. - In 2017, Misha and Jane chose to treat Misha as a resident alien for tax purposes. This choice has never been suspended or revoked. - Misha and Jane have a daughter, Mila, who was born on August 5, 2020. Mila is a U.S. citizen and has a valid Social Security number issued by the due date of the return, including extensions. - Misha's brother, Dimitri, moved in with them in 2021. Dimitri is a citizen of Latvia and has no income. - Jane is employed by a Fortune 500 company and earned $28,333. - Misha works as a gardener and earned the equivalent of $18,000 in U.S. dollars. - Misha and Jane provide all the financial support for Mila and Dimitri. International Scenario 2: Retest Questions 3. How should Misha's income be treated on a Married Filing Jointly return? a. Misha's income does not need to be included on the return because Dimitri says he doesn't have to report it. b. They do not have to file a return because their combined income is less than the foreign earned income exclusion limit c. Misha's income does not need to be included on the return because it is paid by a company in Latvia d. Misha's worldwide income must be reported on the return 4. Misha cannot revoke the election to be treated as a resident alien at anytime. a. True b. False 5. Misha and Jane cannot claim the Other Dependents Credit for Dimitri. a. True b. False 6. Mila is a qualifying child for the Child Tax Credit on the Romanoff's return. a. True b. False Directions Refer to the scenario information for Alan and Maria Newport, beginning on page 136. 7. The amount of Alan's foreign earned income exclusion is S 8. Maria is required to report the $35,000 in wages from the Royal Suites Hotel. a. True b. False 9. Which sources of Alan and Maria's income are classified as general category income for the Foreign Tax Credit? a. Wages from the London Tourist Company b. Wages from Royal Suites Hotel c. Wages from the U.S. Embassy d. All of the above 10. Alan is able to exclude his wages from the U.S. Embassy because he is a civilian employee of the U.S. government. a. True b. False 11. What eligibility requirements must Alan meet in order to be able to exclude his foreign earned income? a. He must meet the bona fide residence test or physical presence test. b. He must have income that qualifies as foreign earned income. c. His tax home must be in a foreign country. d. All of the above 12. Maria is required to file Form 1116, Foreign Tax Credit, to claim the credit for the foreign taxes paid on her wages. a. True b. False 13. What is the amount of federal income tax withheld on Alan's Form 1040 ? a. $746.17 b. $3,190.52 c. $3,722.00 d. $5,146.00 14. If Alan qualifies to exclude his foreign earned income, he must file a Form 2555 , Foreign Earned Income, with his tax return. a. True b. False 15. To convert a sum of money into U.S. dollars, divide the amount of foreign currency by the exchange rate for the foreign currency to one U.S. dollar. a. True b. False Directions Using the tax software, complete the tax return, including Form 1040 and all appropriate forms, schedules, or worksheets. Answer the questions following the scenario. When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINs), replace the Xs as directed, or with any four digits of your choice. Interview Notes - Alan is a U.S. citizen married to Maria who is a British citizen. Maria has elected to be treated as a resident alien. They have both lived in England since February 15, 2015. They do not maintain an address in the U.S. and have no intentions of returning. - Alan considers himself a resident of England. They rent an apartment at 700 Bond Street, London, UK W2SC5. - Income: - Maria has an ITIN of 911-00- XXXX, and she does not want to claim the Foreign Income Exclusion for herself. - Alan's visa type: Unlimited - Alan works at the U.S. Embassy and has a Form W-2 for his salary. - In 2022, Alan got a job working part-time as a tourist guide. He works for the London Tourist Company located at 256 Oxford Street, London, UK, 2WSC4. Alan earned an equivalent of $6,000 in wages and paid taxes totaling $375. His taxes were paid to England as he earned his wages. - Maria works at her job as a manager for the Royal Suites Hotel. The hotel is located at 10 New Drum Street, London, UK, 1ECR3. She earned $35,000 that she already converted to U.S. currency. She states that she paid English income taxes of 2,000 Pounds. The 2022 average annual exchange rate was 1 U.S. Dollar (USD) =0.794 Pounds. - Alan was not required to file FinCen Form 114 or Form 8938. - Alan and Maria did not itemize in 2021, and they do not have enough deductions to itemize in 2022. Directions The first two scenarios do not require you to prepare a tax return. Read the interview notes for each scenario carefully and use your training and resource materials to answer the questions after the scenarios. nternational Scenario 1: Ben and Anna Rogers Interview Notes - Ben and Anna currently live in Australia. - They moved there on September 1, 2020 and rent a 2-bedroom apartment. Ben was transferred there for an indefinite period of time. Ben and Anna intend to eventually return to the United States. - Ben is employed by a U.S.-based Fortune 500 company and Anna teaches English as a second language. - Ben and Anna returned to the U.S. for 8 days for a wedding in June of 2022. They also took a 10-day vacation to cruise the Greek Isles. - Neither Ben nor Anna work for the U.S. government. - Ben and Anna have a house in the U.S. It is vacant while they are overseas. Their brother and sister-in-law house sit while they are living abroad. - Ben and Anna are U.S. citizens and have valid Social Security numbers. nternational Scenario 1: Retest Questions 1. The 10-day vacation cruise to the Greek Isles can be included when counting the 330 days for the physical presence test. a. True b. False 2. Which test qualifies Ben and Anna for claiming the foreign earned income exclusion? a. Bona fide resident test b. Physical presence test c. Neither a nor b d. Both a and b Interview Notes - Misha and Jane Romanoff are married and live in Riga, Latvia. - Jane is a U.S. citizen and has a valid Social Security number. Misha is citizen of Latvia and has an ITIN for U.S. tax filing purposes. - In 2017, Misha and Jane chose to treat Misha as a resident alien for tax purposes. This choice has never been suspended or revoked. - Misha and Jane have a daughter, Mila, who was born on August 5, 2020. Mila is a U.S. citizen and has a valid Social Security number issued by the due date of the return, including extensions. - Misha's brother, Dimitri, moved in with them in 2021. Dimitri is a citizen of Latvia and has no income. - Jane is employed by a Fortune 500 company and earned $28,333. - Misha works as a gardener and earned the equivalent of $18,000 in U.S. dollars. - Misha and Jane provide all the financial support for Mila and Dimitri. International Scenario 2: Retest Questions 3. How should Misha's income be treated on a Married Filing Jointly return? a. Misha's income does not need to be included on the return because Dimitri says he doesn't have to report it. b. They do not have to file a return because their combined income is less than the foreign earned income exclusion limit c. Misha's income does not need to be included on the return because it is paid by a company in Latvia d. Misha's worldwide income must be reported on the return 4. Misha cannot revoke the election to be treated as a resident alien at anytime. a. True b. False 5. Misha and Jane cannot claim the Other Dependents Credit for Dimitri. a. True b. False 6. Mila is a qualifying child for the Child Tax Credit on the Romanoff's return. a. True b. False Directions Refer to the scenario information for Alan and Maria Newport, beginning on page 136. 7. The amount of Alan's foreign earned income exclusion is S 8. Maria is required to report the $35,000 in wages from the Royal Suites Hotel. a. True b. False 9. Which sources of Alan and Maria's income are classified as general category income for the Foreign Tax Credit? a. Wages from the London Tourist Company b. Wages from Royal Suites Hotel c. Wages from the U.S. Embassy d. All of the above 10. Alan is able to exclude his wages from the U.S. Embassy because he is a civilian employee of the U.S. government. a. True b. False 11. What eligibility requirements must Alan meet in order to be able to exclude his foreign earned income? a. He must meet the bona fide residence test or physical presence test. b. He must have income that qualifies as foreign earned income. c. His tax home must be in a foreign country. d. All of the above 12. Maria is required to file Form 1116, Foreign Tax Credit, to claim the credit for the foreign taxes paid on her wages. a. True b. False 13. What is the amount of federal income tax withheld on Alan's Form 1040 ? a. $746.17 b. $3,190.52 c. $3,722.00 d. $5,146.00 14. If Alan qualifies to exclude his foreign earned income, he must file a Form 2555 , Foreign Earned Income, with his tax return. a. True b. False 15. To convert a sum of money into U.S. dollars, divide the amount of foreign currency by the exchange rate for the foreign currency to one U.S. dollar. a. True b. False Directions Using the tax software, complete the tax return, including Form 1040 and all appropriate forms, schedules, or worksheets. Answer the questions following the scenario. When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINs), replace the Xs as directed, or with any four digits of your choice. Interview Notes - Alan is a U.S. citizen married to Maria who is a British citizen. Maria has elected to be treated as a resident alien. They have both lived in England since February 15, 2015. They do not maintain an address in the U.S. and have no intentions of returning. - Alan considers himself a resident of England. They rent an apartment at 700 Bond Street, London, UK W2SC5. - Income: - Maria has an ITIN of 911-00- XXXX, and she does not want to claim the Foreign Income Exclusion for herself. - Alan's visa type: Unlimited - Alan works at the U.S. Embassy and has a Form W-2 for his salary. - In 2022, Alan got a job working part-time as a tourist guide. He works for the London Tourist Company located at 256 Oxford Street, London, UK, 2WSC4. Alan earned an equivalent of $6,000 in wages and paid taxes totaling $375. His taxes were paid to England as he earned his wages. - Maria works at her job as a manager for the Royal Suites Hotel. The hotel is located at 10 New Drum Street, London, UK, 1ECR3. She earned $35,000 that she already converted to U.S. currency. She states that she paid English income taxes of 2,000 Pounds. The 2022 average annual exchange rate was 1 U.S. Dollar (USD) =0.794 Pounds. - Alan was not required to file FinCen Form 114 or Form 8938. - Alan and Maria did not itemize in 2021, and they do not have enough deductions to itemize in 2022