Question

Directions: Use the attached document to fill in the graphs. Kalogridis Corporation Kalagoridis Corporation Sales Budget for the Quarter ended March 31, 2014 Data November

Directions: Use the attached document to fill in the graphs.

Kalogridis Corporation

Kalagoridis Corporation

Sales Budget

for the Quarter ended March 31, 2014

| Data | |||||||||

| November | December | January | February | March | April | May | |||

| Sales Budget | |||||||||

| Budgeted Sales in Gallons | 8,000 | 10,000 | 15,000 | 12,000 | 11,000 | ||||

| Selling and Admin Expense Budget | |||||||||

| Salaries | 25,000 | ||||||||

| Rent | 7,000 | ||||||||

| Utilities | 800 | ||||||||

| Cash Budget | |||||||||

| Minumum Cash Balance | 5,000 | ||||||||

| Equipment Purchases | 9,000 | ||||||||

| Salvage Value | |||||||||

| Useful Life in Months | |||||||||

| Dividens | |||||||||

| APR on Debt | |||||||||

| APR on Investments | |||||||||

| Tax Rate |

| Equipment Purchase Payment Month of Purchase | 80% | ||||||||

| Equipment Purchase Payment Month After Purchase | 20% |

Kalogridis Corporation

Sales Budget

for the Quarter ended March 31, 2014

| January | February | March | April | May | Quarter Total | |

| Budgeted Unit Sales (in Gallons) | 8,000 | 10,000 | 15,000 | |||

| Selling Price per Gallon | 12.00 | 12.00 | 12.00 | |||

| Total Sales | 96,000 | 120,000 | 180,000 | |||

| Beginning Accounts Receivable | ||||||

| January Sales | ||||||

| February Sales | ||||||

| March Sales | ||||||

| Total Cash Collections | ||||||

Kalogridis Corporation

Production Budget

for the Quarter ended March 31, 2014

(In Cases)

| January | February | March | April | Quarter | |

| Budgeted Unit Sales | |||||

| Add Desired Units of Ending Finished Goods Inventory | |||||

| Total Needs | |||||

| Less Units of Beginning Finished Goods Inventory | |||||

| Required Production in Units |

Direct Labor Budget

for the Quarter ended March 31, 2014

| January | February | March | Quarter | |

| Required Production in Gallons | ||||

| Direct Labor-Hours Per Gallon | ||||

| Total Direct Labor-Hours Needed | ||||

| Direct Labor Cost Per Hour | ||||

| Total Direct Labor Cost |

Manufacturing Overhead Budget

for the Quarter ended March 31, 2014

| January | February | March | Quarter | |

| Budgeted Direct Machine-Hours | ||||

| Variable Manufacturing Overhead Rate | ||||

| Variable Manufacturing Overhead | ||||

| Fixed Manufacturing Overhead | ||||

| Total Manufacturing Overhead | ||||

| Less Prepaid Insurance | ||||

| Less Depriciation | ||||

| Cash Disburrsements for Manufacturing Overhead | ||||

| Total Manufacturing Overhead | ||||

| Budgeted Directed Machine-Hours | ||||

| Predetermined Overhead Rate for the Year | ||||

Ending Finished Goods Inventory Budget

for the Quarter ended March 31, 2014

| Item | Quantity | Quantity | Cost | Cost | Total | ||

| Production Cost Per Gallon | |||||||

| Direct Materials | Gallons | Per Gallon | |||||

| Direct Labor | Hours | Per Hour | |||||

| Fixed Manufacturing Overhead | Gallon | Per Gallon | |||||

| Variable Manufacturing Overhead | Hours | Per Machine Hour | |||||

| Unit Product Cost | |||||||

| Budgeted Finished Goods Inventory | |||||||

| Ending Finished Goods Inventory | |||||||

| Unit Product Cost | |||||||

| Ending Finished Goods Inventory in Dollars |

Selling and Administrative Expense Budget

for the Quarter ended March 31, 2014

| January | February | March | Quarter | |

| Fixed Selling and Admin Expenses | ||||

| Salaries | ||||

| Rent | ||||

| Utilities | ||||

| Cash Dispersements for Selling and Administrative Expenses |

|

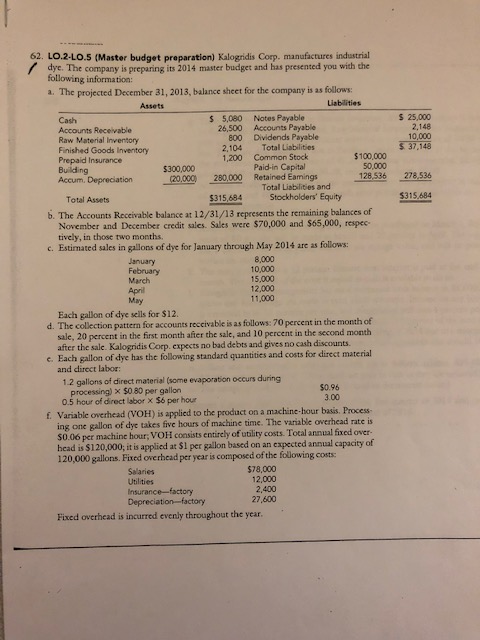

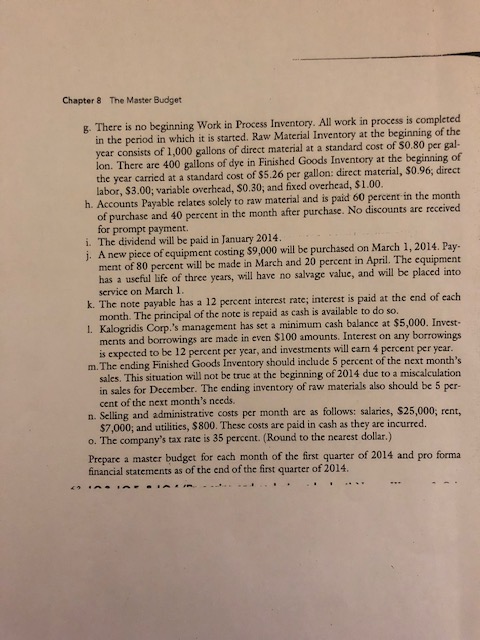

Cash Budget

62. LO.2-LO.5 (Master budget preparation) Kalogridis Corp. manufactures industrial rdye. The company is preparing its 2014 master budget and has presented you with the following information: a. The projected December 31, 2018, balance sheet for the company is as follows Assets Liablitier s 25,000 2,148 s 5,080 Notes Payable Cash Accounts Receivable Raw Material Inventory Finished Goods Inventory Prepaid Insurance Building 26,500 Accounts Payable 800 Dividends Payable 2,104 Total Liabilities S 37,148 $100,000 50,000 1,200 Common Stock $300,000 Paid-in Capital Acoum. Depreciation20009 00Rn'and Accum. Deprecaion 20,00020000 Retairanod Eang1.536 278.538 Total Liabilities and Total Assets $315,684 Stockholders Equity 5315.684 b. The Accounts Receivable balance at 12/31/13 represents the remaining balances of November and December credit sales. Sales were $70,000 and $65,000, respec- tively, in those two months. c. Estimated sales in gallons of dye for January through May 2014 are as follows: January February March 8,000 10,000 15,000 12,000 11,000 Each gallon of dye sells for $12. d. The collection pattern for accounts reccivable is as follows:70 percent in the month of sale, 20 percent in the first month after the sale, and 10 percent in the second month after the sale. Kalogridis Corp. e e. Each gallon of dye has the following standard quantities and costs for direct material and direct labor: 1.2 gallons of direct material (some evaporation occurs during $0.96 3.00 processing) x $0.80 per gallon 0.5 hour of direct labor x $6 per hour Variable overhead (VOH) is applied to the product on a machine hour basis. Process ing one gallon of dye takes five hours of machine time. The variable overhead rate is $0.06 per machine hour, VOH consists entirely of utility costs. Total annual fixed over- head is $120,000, it is applied at $1 per gallon based on an expected annual capacity of 120,000 gallons. Fixed overhead per year is composed of the following costs f. Salaries Utilities Insurance-factory Depreciation-factory $78,000 12,000 2.400 27,600 Fixed overhead is incurred evenly throughout the year. 62. LO.2-LO.5 (Master budget preparation) Kalogridis Corp. manufactures industrial rdye. The company is preparing its 2014 master budget and has presented you with the following information: a. The projected December 31, 2018, balance sheet for the company is as follows Assets Liablitier s 25,000 2,148 s 5,080 Notes Payable Cash Accounts Receivable Raw Material Inventory Finished Goods Inventory Prepaid Insurance Building 26,500 Accounts Payable 800 Dividends Payable 2,104 Total Liabilities S 37,148 $100,000 50,000 1,200 Common Stock $300,000 Paid-in Capital Acoum. Depreciation20009 00Rn'and Accum. Deprecaion 20,00020000 Retairanod Eang1.536 278.538 Total Liabilities and Total Assets $315,684 Stockholders Equity 5315.684 b. The Accounts Receivable balance at 12/31/13 represents the remaining balances of November and December credit sales. Sales were $70,000 and $65,000, respec- tively, in those two months. c. Estimated sales in gallons of dye for January through May 2014 are as follows: January February March 8,000 10,000 15,000 12,000 11,000 Each gallon of dye sells for $12. d. The collection pattern for accounts reccivable is as follows:70 percent in the month of sale, 20 percent in the first month after the sale, and 10 percent in the second month after the sale. Kalogridis Corp. e e. Each gallon of dye has the following standard quantities and costs for direct material and direct labor: 1.2 gallons of direct material (some evaporation occurs during $0.96 3.00 processing) x $0.80 per gallon 0.5 hour of direct labor x $6 per hour Variable overhead (VOH) is applied to the product on a machine hour basis. Process ing one gallon of dye takes five hours of machine time. The variable overhead rate is $0.06 per machine hour, VOH consists entirely of utility costs. Total annual fixed over- head is $120,000, it is applied at $1 per gallon based on an expected annual capacity of 120,000 gallons. Fixed overhead per year is composed of the following costs f. Salaries Utilities Insurance-factory Depreciation-factory $78,000 12,000 2.400 27,600 Fixed overhead is incurred evenly throughout the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started