Answered step by step

Verified Expert Solution

Question

1 Approved Answer

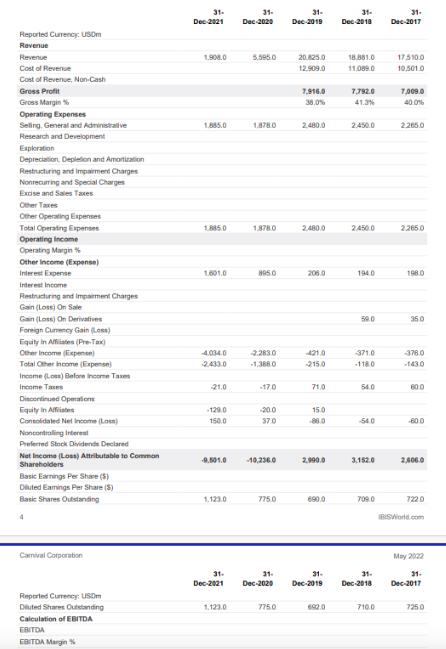

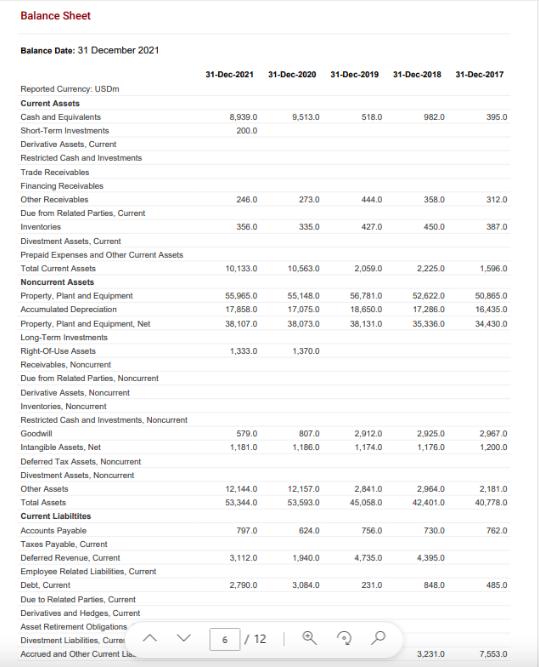

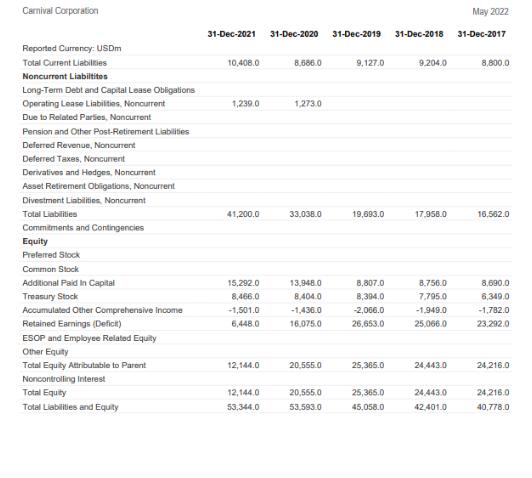

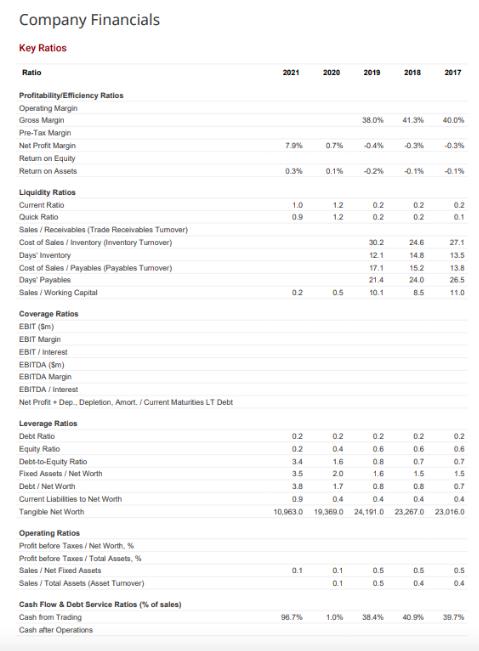

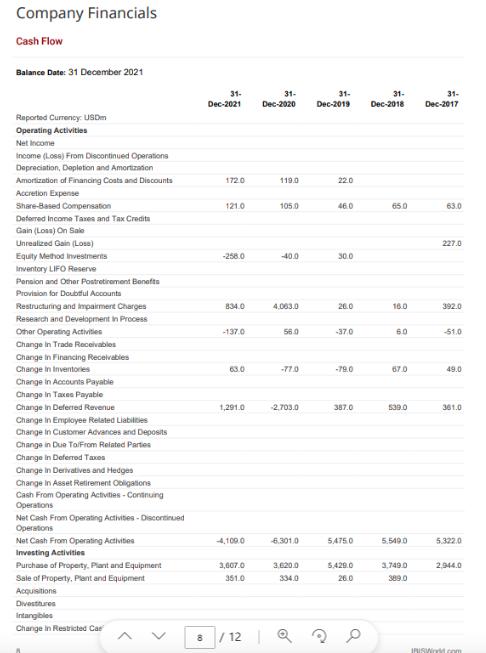

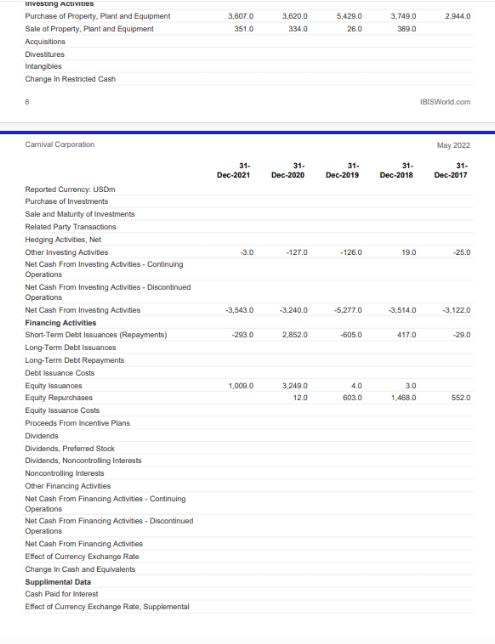

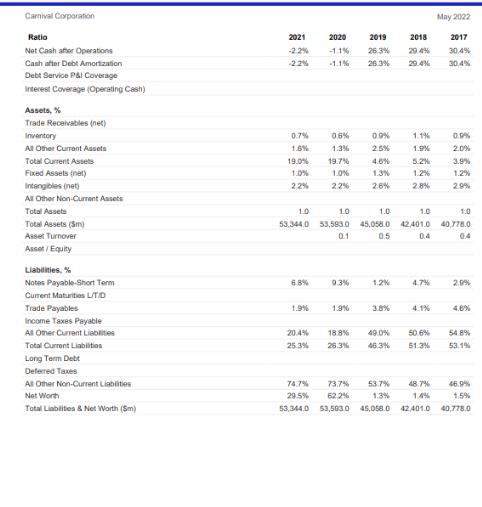

Directions: Using the documents below as your basis for additional research, discuss the feasibility and likelihood of success of Carnival Corporation pursuing each of Porter's

Directions: Using the documents below as your basis for additional research, discuss the feasibility and likelihood of success of Carnival Corporation pursuing each of Porter's Five Generic BLS (Broad Cost leadership, Broad Differentiation, Focused Cost Leadership, Focused Differentiation, Best Cost Provider).

Reported Currency: USO Revenue Revenue Cost of Revenue Cost of Revenue, Non-Cash Gross Profit Gross Margin% Operating Expenses Seling, General and Administrative Research and Development Exploration Depreciation Depletion and Amortization Restructuring and impairment Charges Nonrecurring and Special Charges Excise and Sales Taxes Other Taxes Other Operating Expenses Total Operating Expenses Operating income Operating Margin% Other Income (Expense) Interest Expense interest Income Restructuring and Impairment Charges Gain (Loss) On Sale Gain (Loss) On Derivatives Foreign Cuency Gain (Loss) Equity in Affiliates (Pre-Tax) Other Income (Expen) Total Other Income (Expense) Income (Loss) Before Income Taxes Income Taxes Discontinued Operations Equity In Affiliates Consolidated Net Income (Loss) Noncontrolling Interest Preferred Stock Dividends Declared Not Income (Loss) Attributable to Common Shareholders Basic Earnings Per Share ($) Diluted Earnings Per Share (5) Basic Shares Outstanding Carnival Corporation Reported Currency: USDm Diluted Shares Outstanding Calculation of EBITDA EBITDA EBITDA Margin 31. Dec-2021 1.908.0 1.885.0 1.885.0 1.001.0 -4.034.0 21.0 -129.0 150.0 -9.501.0 1.123.0 31. Dec-2021 1.123.0 31- 31- Dec-2020 Dec-2019 5,595.0 18780 1.878.0 895.0 2.283.0 -1,388.0 -17.0 -20.0 37.0 10,236.0 775.0 31. Dec-2020 775.0 20.825.0 12.909.0 7,916.0 36.0% 2.480.0 2.480.0 206.0 421.0 -215.0 71.0 15.0 2.990.0 690.0 31- Dec-2018 602.0 18.881.0 11,089.0 7,792.0 41.3% 2.450.0 2,450.0 1940 59.0 371.0 -1180 54.0 54.0 3,152.0 709.0 31- 31. Dec-2019 Dec-2018 710.0 31. Dec-2017 17.510.0 10,501.0 7,009.0 400% 2.265.0 2.265.0 1980 35.0 -376.0 -1430 600 -60.0 2,406.0 722.0 BSWorld.com May 2022 31. Dec-2017 725:0

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Feasibility and Likelihood of Success for Carnival Corporation Pursuing Porters Five Generic Strategies Based on the provided information lets analyze the feasibility and likelihood of success for Car...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started