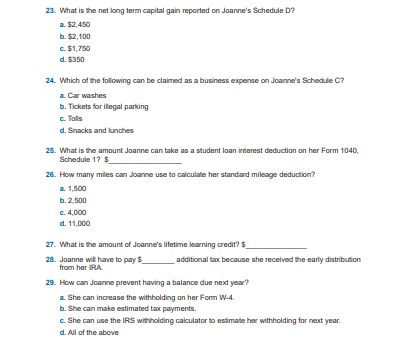

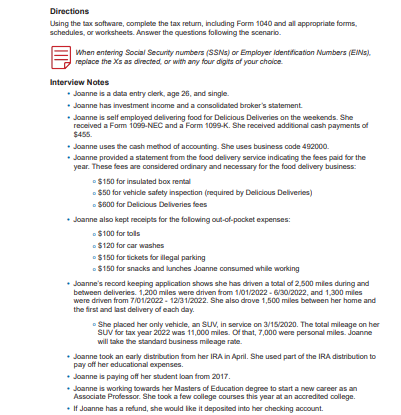

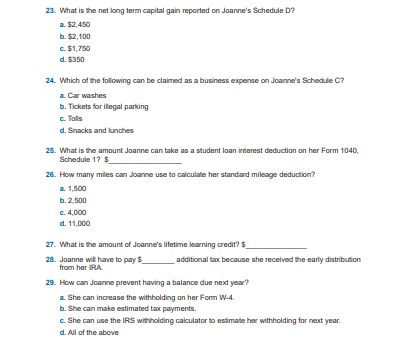

Directions Using the tax saftarare, complete the tax return, including Form 1040 and all appropriate forms, schedules, or worksheets. Answer the questions following the scenario. When entering Social Secunity numbers (SSNs) or Employer identification Numbers (EM.). replace the X s as directed, or with any four digits of your choice. Interview Notes - Joanne is a data entry clerk, age 2be, and single. - Joanne has imestment income and a consolidated broker's statement. - Joanne is self employed delivering food for Delicious Deliveries an the weekends. She received a Form 1099-NEC and a Form 1099-K. She received additional cash payments of $455. - Joanne uses the cash method af acoounting. She uses business code 492000. - Joanne prowided a statement from the food delivery service indicating the fees paid for the year. These fees are considered ordinary and necessary for the food delivery business: o $150 for insulated box rental o $50 for vehicle safety inspection (required by Delidious Deliveries) - Sb00 for Delicious Delveries tees + Joanne also kept receipts for the following out-of-pocket expenses: - \$100 for tolls - \$120 for car washes - $150 for tickets for llegal parking o \$150 for snacks and lunches Joanne consumed while working + Joanne's record beeping application shows she has drheen a total of 2,500 miles during and between deliveries. 1,200 miles were driven from 1/01/2022 - 6/30/2022, and 1,300 miles were drhven from 7/101/2022 - 12/31/2022. She also drove 1,500 miles between her hame and the first and hast delivery of each day. - She placed her only vehicle, an SUV, in service on 3/15/2020. The botal mileage on her SUN for tax year 2022 was 11,000 miles. Od that, 7,000 were personal miles. Joanne will take the standard business mileage rabe. + Joanne took an early distribution from her IRA in April. She used part of the IRA distribution to pay off her educational expenses. + Joanne is paying off her student loan from 2017. + Joanne is working towards her Masters of Education degree to start a new career as an Associate Protessor. She took a few college courses this year at an accredibed college. + If Joanne has a refund, she would lke it deposibed into her checking acoount. 23. What is the net long term capital gain reported on Joanne's Schedule D? a. $2,450 b. $2,100 c. $1,750 d. $350 24. Which of the following can be claimed as a business expense on Joanne's Schedule C? a. Car washes b. Tickets for illegal parking c. Tols d. Snacks and lunches 25. What is the amount Joanne can take as a student loan interest deduction on her Form 1040, Schedule 1?$ 26. How many miles can Joanne use to calculate her standard mileage deduction? a. 1,500 b. 2,500 c. 4,000 d. 11,000 27. What is the amount of Joanne's lifetime learning credit? $ 28. Joanne will have to pay $ additional tax because she received the early distribution from her IRA. 29. How can Joanne prevent having a balance due next year? a. She can increase the withholding on her Form W-4. b. She can make estimated tax payments. c. She can use the IRS witholding calculator to estimate her withholding for next year. d. All of the above