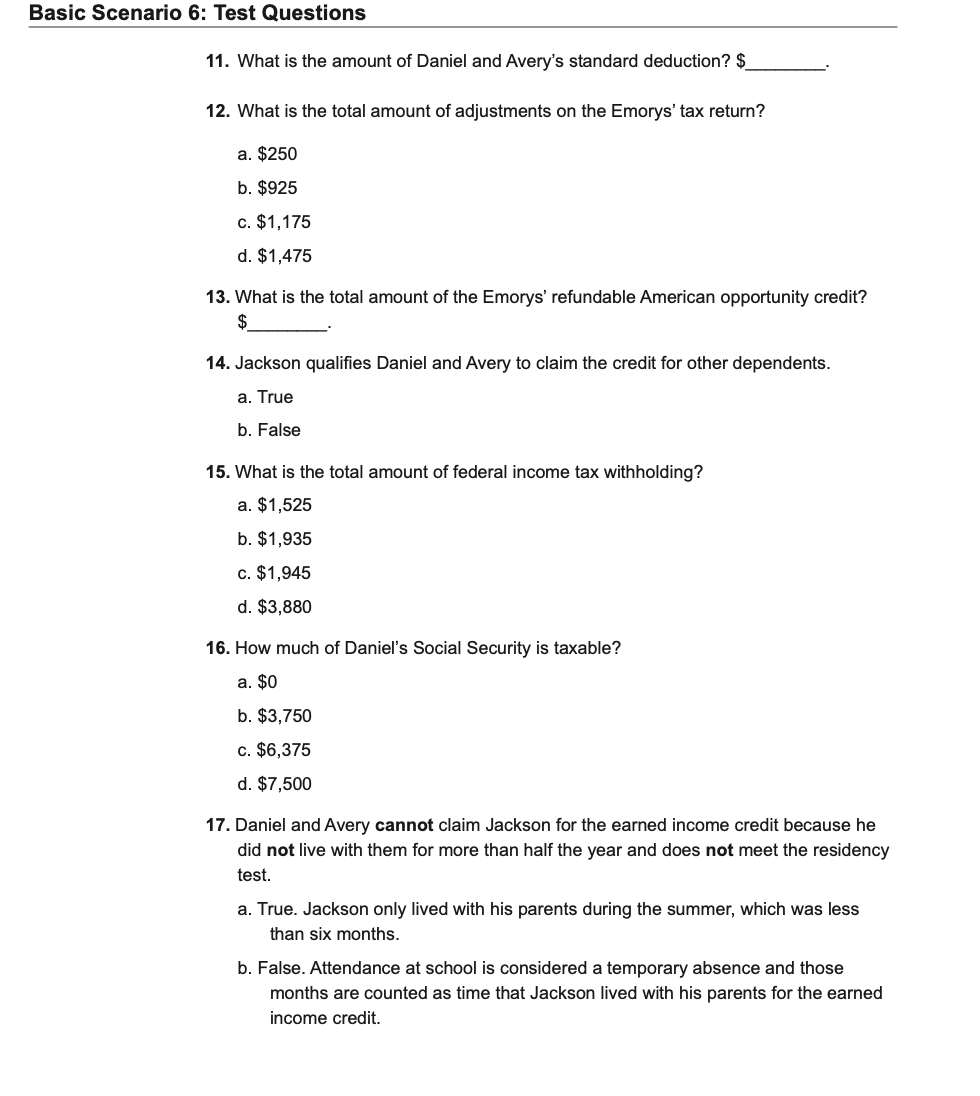

Directions Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSN) or Employer Identification Numbers (EINs), replace the Xs as directed, or with any four digits of your choice. Interview Notes Daniel, age 64 and Avery, age 53, are married. They elect to file Married Filing Jointly. Daniel is retired. He received Social Security benefits, a pension, and wages from a part-time job. Avery was a full-time elementary school teacher and paid $700 out of pocket for classroom supplies. Avery is paying off a student loan that she took out when she attended college for her bachelor's degree. Daniel and Avery have two sons, Jackson, age 19 and Matthew, age 16. Matthew lived at home the entire year. Jackson is a full-time college student in his second year of study. He is pursuing a degree in Accounting and does not have a felony drug conviction. He received a Form 1098-T for 2019. Box 2 was not filled in and Box 7 was not checked. Jackson lived in an apartment near campus during the school year and spent the summer at home with his parents. Jackson received a scholarship and the terms require that it be used to pay tuition. Daniel and Avery paid the cost of Jackson's tuition and course-related books in 2020 not covered by scholarship. They paid $90 for a parking sticker, $4,500 for a meal plan, $500 for textbooks purchased at the college bookstore, and $100 for access to an online textbook. Daniel and Avery paid more than half the cost of maintaining a home and support for Jackson and Matthew. Daniel and Avery do not have enough deductions to itemize on their federal tax return. They made a charitable contribution in the amount of $350 cash and they have a receipt for it. The Emorys made four timely estimated tax payments of $125 each for tax year 2020. . The Emorys received a $2,900 Economic Impact Payment (EIP) in 2020. If Daniel and Avery receive a refund, they would like to deposit it into their checking account. Documents from County Bank show that the routing number is 111000025. Their checking account number is 11337890. Basic Scenario 6: Test Questions 11. What is the amount of Daniel and Avery's standard deduction? $ 12. What is the total amount of adjustments on the Emorys' tax return? a. $250 b. $925 c. $1,175 d. $1,475 13. What is the total amount of the Emorys' refundable American opportunity credit? $ 14. Jackson qualifies Daniel and Avery to claim the credit for other dependents. a. True b. False 15. What is the total amount of federal income tax withholding? a. $1,525 b. $1,935 c. $1,945 d. $3,880 16. How much of Daniel's Social Security is taxable? a. $0 b. $3,750 c. $6,375 d. $7,500 17. Daniel and Avery cannot claim Jackson for the earned income credit because he did not live with them for more than half the year and does not meet the residency a. True. Jackson only lived with his parents during the summer, which was less than six months. b. False. Attendance at school is considered a temporary absence and those months are counted as time that Jackson lived with his parents for the earned income credit. Directions Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSN) or Employer Identification Numbers (EINs), replace the Xs as directed, or with any four digits of your choice. Interview Notes Daniel, age 64 and Avery, age 53, are married. They elect to file Married Filing Jointly. Daniel is retired. He received Social Security benefits, a pension, and wages from a part-time job. Avery was a full-time elementary school teacher and paid $700 out of pocket for classroom supplies. Avery is paying off a student loan that she took out when she attended college for her bachelor's degree. Daniel and Avery have two sons, Jackson, age 19 and Matthew, age 16. Matthew lived at home the entire year. Jackson is a full-time college student in his second year of study. He is pursuing a degree in Accounting and does not have a felony drug conviction. He received a Form 1098-T for 2019. Box 2 was not filled in and Box 7 was not checked. Jackson lived in an apartment near campus during the school year and spent the summer at home with his parents. Jackson received a scholarship and the terms require that it be used to pay tuition. Daniel and Avery paid the cost of Jackson's tuition and course-related books in 2020 not covered by scholarship. They paid $90 for a parking sticker, $4,500 for a meal plan, $500 for textbooks purchased at the college bookstore, and $100 for access to an online textbook. Daniel and Avery paid more than half the cost of maintaining a home and support for Jackson and Matthew. Daniel and Avery do not have enough deductions to itemize on their federal tax return. They made a charitable contribution in the amount of $350 cash and they have a receipt for it. The Emorys made four timely estimated tax payments of $125 each for tax year 2020. . The Emorys received a $2,900 Economic Impact Payment (EIP) in 2020. If Daniel and Avery receive a refund, they would like to deposit it into their checking account. Documents from County Bank show that the routing number is 111000025. Their checking account number is 11337890. Basic Scenario 6: Test Questions 11. What is the amount of Daniel and Avery's standard deduction? $ 12. What is the total amount of adjustments on the Emorys' tax return? a. $250 b. $925 c. $1,175 d. $1,475 13. What is the total amount of the Emorys' refundable American opportunity credit? $ 14. Jackson qualifies Daniel and Avery to claim the credit for other dependents. a. True b. False 15. What is the total amount of federal income tax withholding? a. $1,525 b. $1,935 c. $1,945 d. $3,880 16. How much of Daniel's Social Security is taxable? a. $0 b. $3,750 c. $6,375 d. $7,500 17. Daniel and Avery cannot claim Jackson for the earned income credit because he did not live with them for more than half the year and does not meet the residency a. True. Jackson only lived with his parents during the summer, which was less than six months. b. False. Attendance at school is considered a temporary absence and those months are counted as time that Jackson lived with his parents for the earned income credit