Question

Directions: Your paper must: Be 4-6 pages in length. Include a proper introduction (5 sentences at least) and conclusion (5 sentences at least). Include 3

Directions:

Your paper must:

Be 4-6 pages in length.

Include a proper introduction (5 sentences at least) and conclusion (5 sentences at least).

Include 3 references.

Provide your reader with an overall understanding of the financial health of your chosen firm including the following:

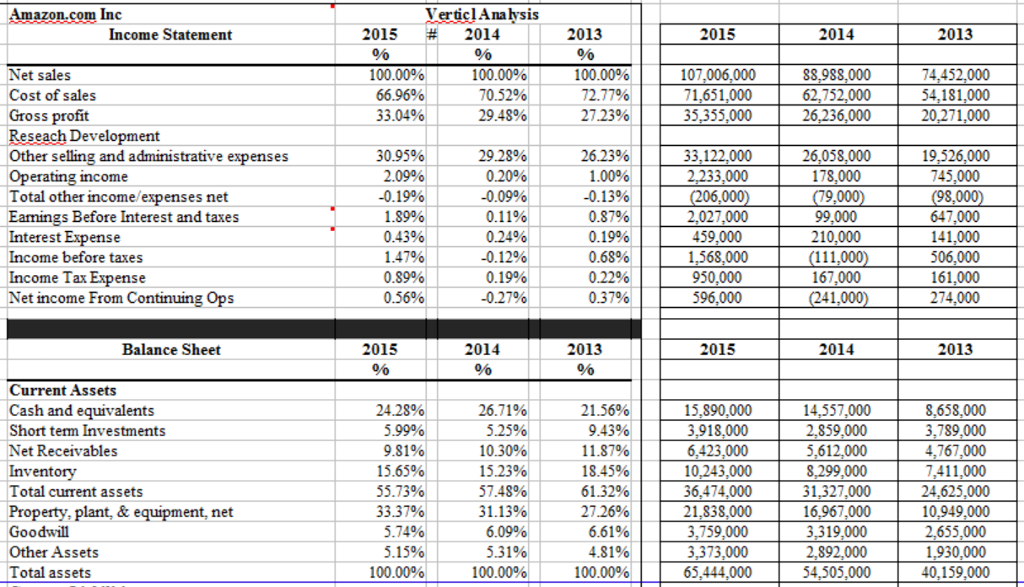

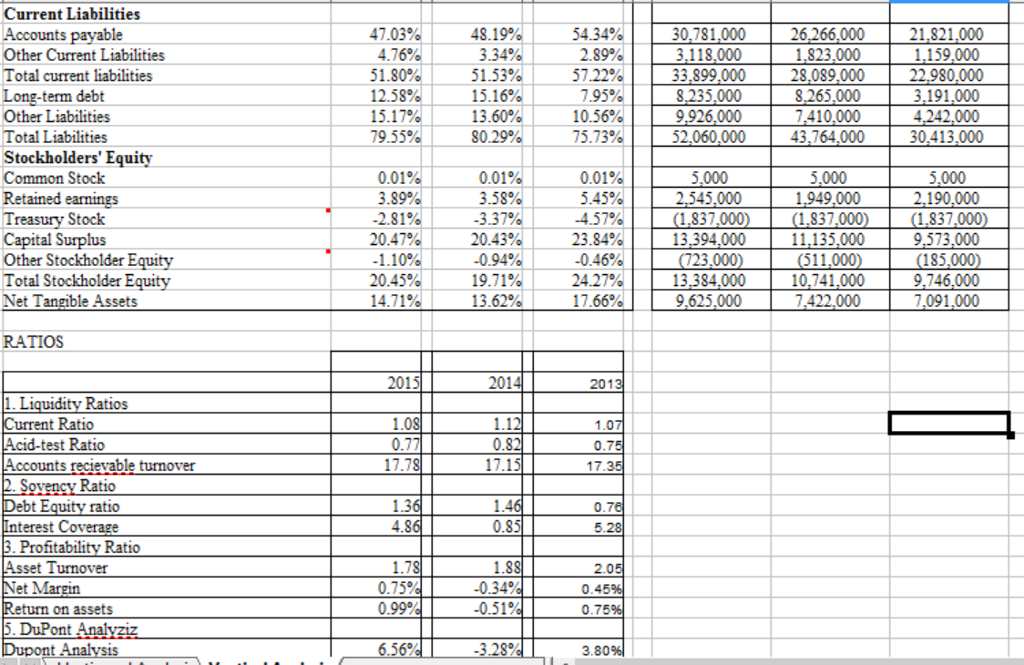

Discussion of the ratio analysis results, including rationale for the ratios chosen.

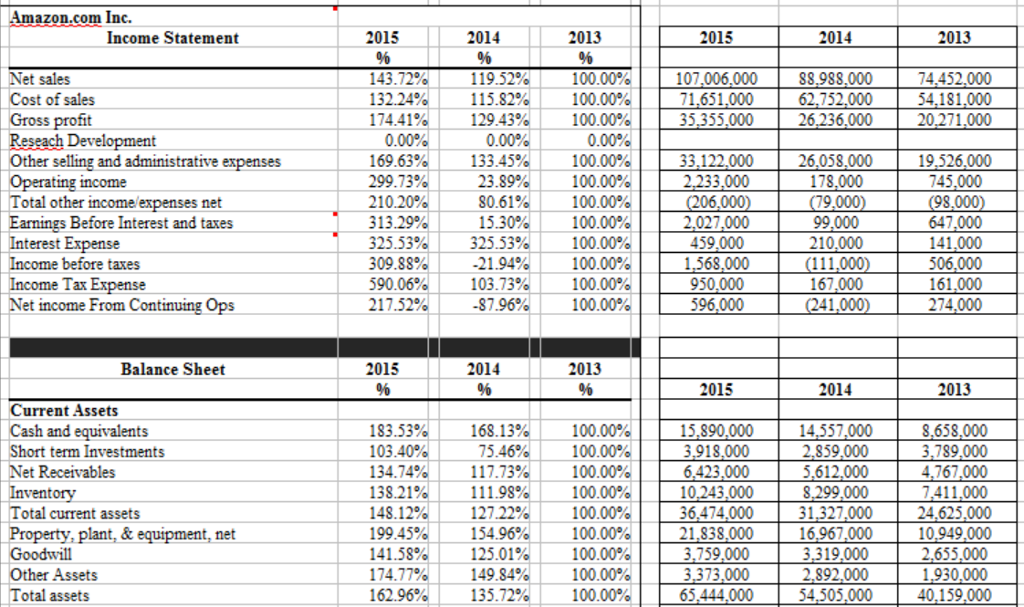

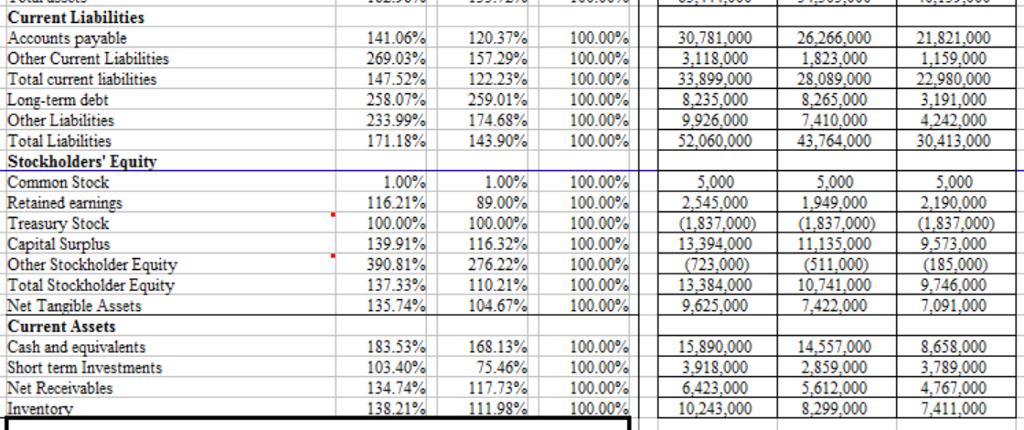

Discussion of all horizontal and vertical analysis from above.

Discussion of four items from the management discussion of the firm that support the conclusion formed in your discussion of the financial results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started