DIRECTIONS!Summarize your analysis. Review your comments in the financial analysis section and provide your assessment of the overall status of the firm. Include any recommendations you think are appropriate.

List any other recommendations you have for the firm in view of your analysis.

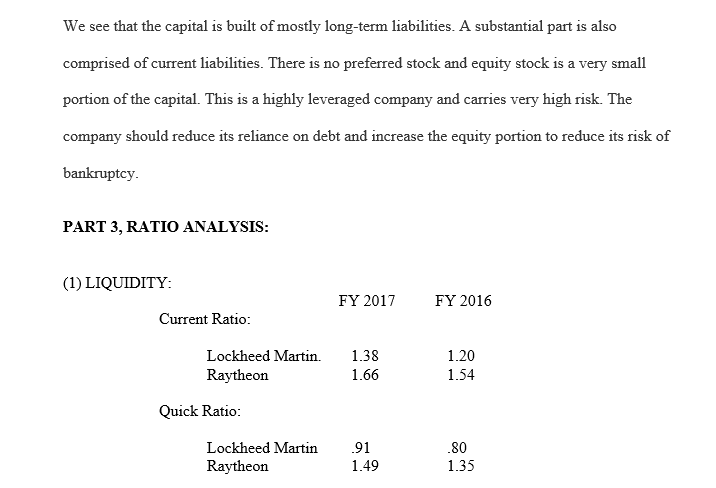

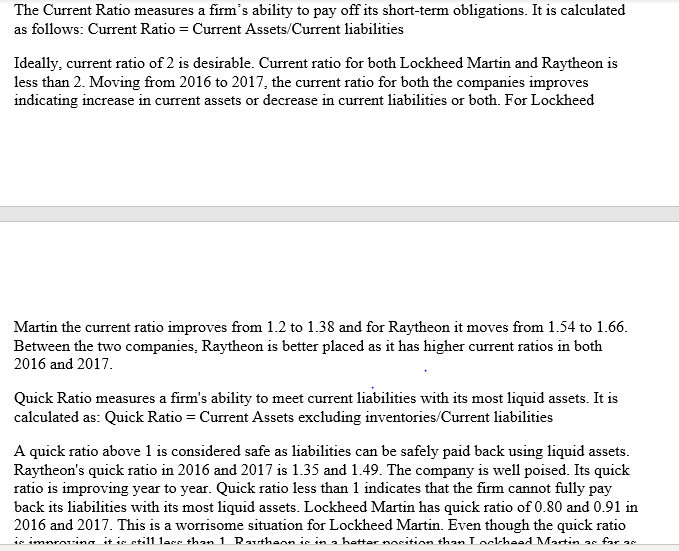

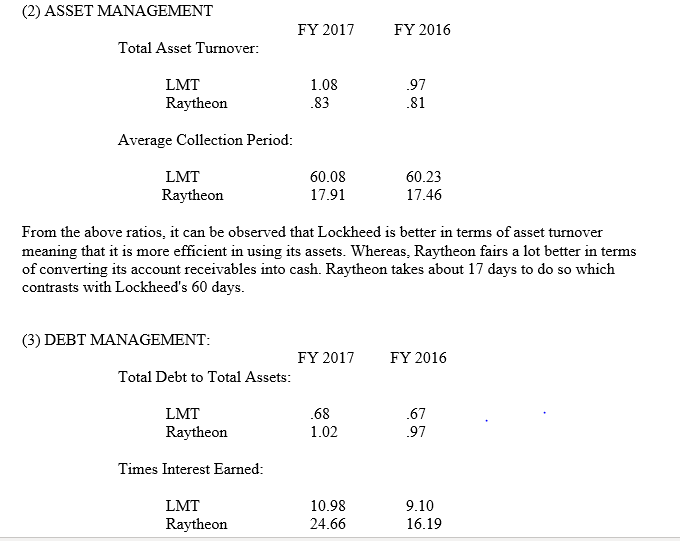

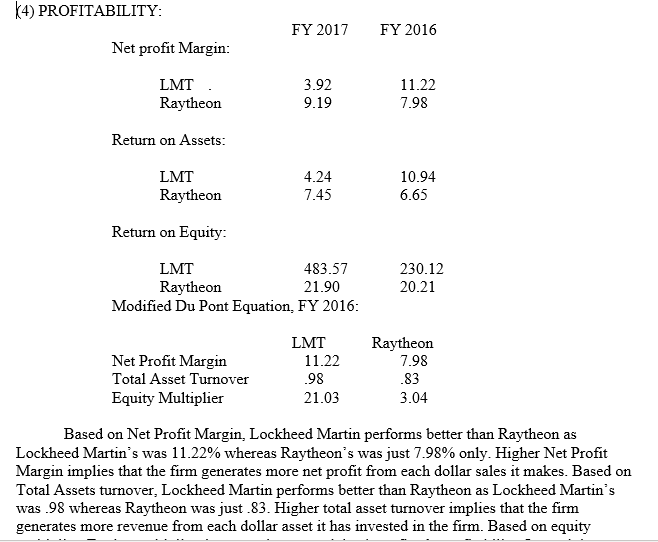

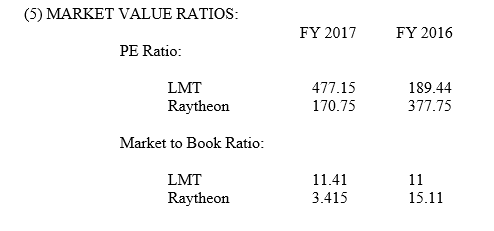

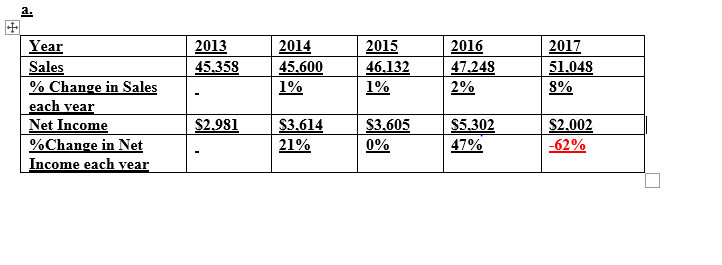

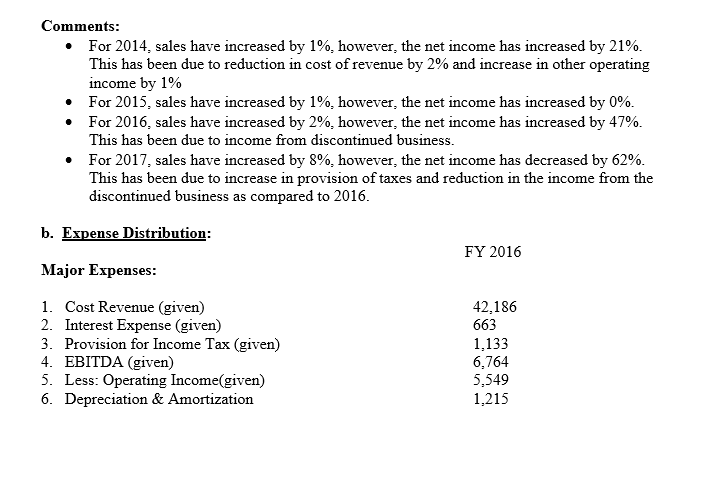

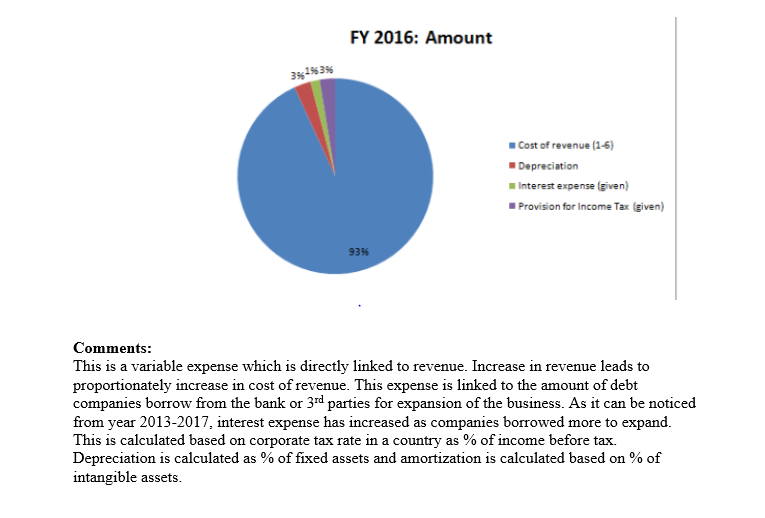

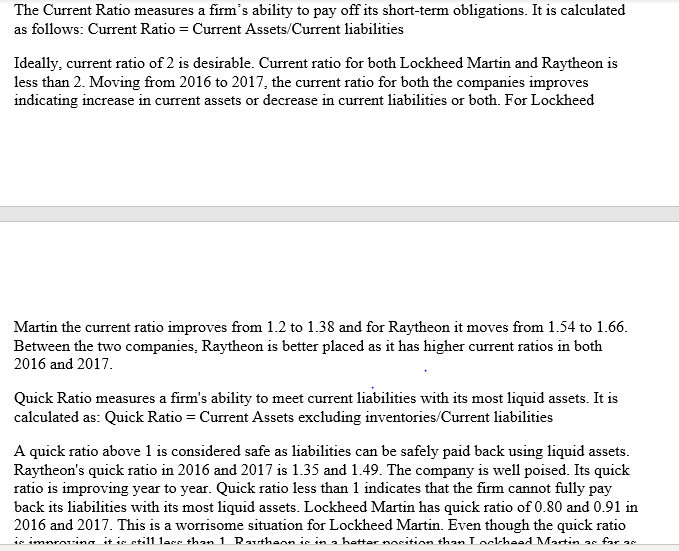

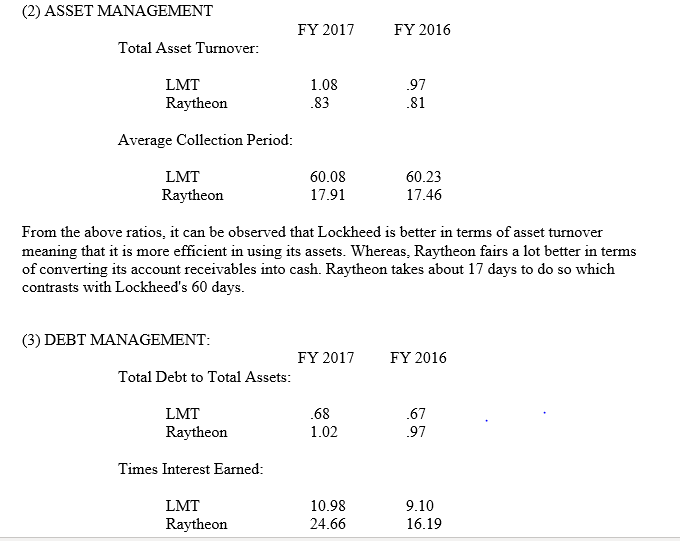

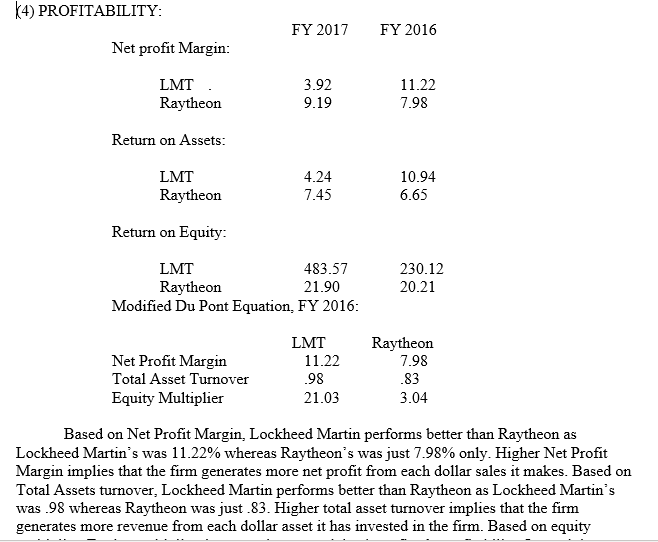

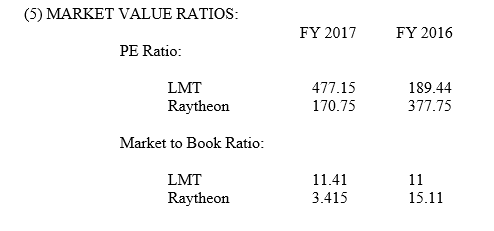

We see that the capital is built of mostly long-term liabilities. A substantial part is also comprised of current liabilities. There is no preferred stock and equity stock is a very small portion of the capital. This is a highly leveraged company and carries very high risk. The company should reduce its reliance on debt and increase the equity portion to reduce its risk of bankruptcy PART 3, RATIO ANALYSIS: (1) LIQUIDITY: FY 2017 FY 2016 Current Ratio: Lockheed Marti. 1.38 Raytheon 1.20 1.54 1.66 Quick Ratio: Lockheed Martin 91 Raytheon 80 1.35 1.49 The Current Ratio measures a firm's ability to pay off its short-term obligations. It is calculated as follows: Current Ratio Current Assets/Current liabilities Ideally, current ratio of 2 is desirable. Current ratio for both Lockheed Martin and Raytheon is less than 2. Moving from 2016 to 2017, the current ratio for both the companies improves indicating increase in current assets or decrease in current liabilities or both. For Lockheed Martin the current ratio improves from 1.2 to 1.38 and for Raytheon it moves from 1.54 to 1.66. Between the two companies, Raytheon is better placed as it has higher current ratios in both 2016 and 2017 Quick Ratio measures a firm's ability to meet current liabilities with its most liquid assets. It is calculated as: Quick Ratio Current Assets excluding inventories/Current liabilities A quick ratio above 1 is considered safe as liabilities can be safely paid back using liquid assets. Raytheon's quick ratio in 2016 and 2017 is 1.35 and 1.49. The company is well poised. Its quiclk ratio is improving year to year. Quick ratio less than 1 indicates that the firm cannot fully pay back its liabilities with its most liquid assets. Lockheed Martin has quick ratio of 0.80 and 0.91 in 2016 and 2017. This is a worrisome situation for Lockheed Martin. Even though the quick ratio (2) ASSET MANAGEMENT FY 2017 FY 2016 Total Asset Turnover LMT Raytheon 1.08 83 97 81 Average Collection Period LMT Raytheon 60.08 17.91 60.23 17.46 From the above ratios, it can be observed that Lockheed is better in terms of asset turnover meaning that it is more efficient in using its assets. Whereas, Raytheon fairs a lot better in terms of converting its account receivables into cash. Raytheon takes about 17 days to do so which contrasts with Lockheed's 60 days (3) DEBT MANAGEMENT FY 2017 FY 2016 Total Debt to Total Assets LMT Raytheon 68 1.02 67 97 Times Interest Earned LMT Raytheon 10.98 24.66 9.10 16.19 (5) MARKET VALUE RATIOS: FY 2017FY 2016 PE Ratio: LMT Raytheon 477.15 170.75 189.44 377.75 Market to Book Ratio: LMT Raytheon 11.41 3.415 15.11 We see that the capital is built of mostly long-term liabilities. A substantial part is also comprised of current liabilities. There is no preferred stock and equity stock is a very small portion of the capital. This is a highly leveraged company and carries very high risk. The company should reduce its reliance on debt and increase the equity portion to reduce its risk of bankruptcy PART 3, RATIO ANALYSIS: (1) LIQUIDITY: FY 2017 FY 2016 Current Ratio: Lockheed Marti. 1.38 Raytheon 1.20 1.54 1.66 Quick Ratio: Lockheed Martin 91 Raytheon 80 1.35 1.49 The Current Ratio measures a firm's ability to pay off its short-term obligations. It is calculated as follows: Current Ratio Current Assets/Current liabilities Ideally, current ratio of 2 is desirable. Current ratio for both Lockheed Martin and Raytheon is less than 2. Moving from 2016 to 2017, the current ratio for both the companies improves indicating increase in current assets or decrease in current liabilities or both. For Lockheed Martin the current ratio improves from 1.2 to 1.38 and for Raytheon it moves from 1.54 to 1.66. Between the two companies, Raytheon is better placed as it has higher current ratios in both 2016 and 2017 Quick Ratio measures a firm's ability to meet current liabilities with its most liquid assets. It is calculated as: Quick Ratio Current Assets excluding inventories/Current liabilities A quick ratio above 1 is considered safe as liabilities can be safely paid back using liquid assets. Raytheon's quick ratio in 2016 and 2017 is 1.35 and 1.49. The company is well poised. Its quiclk ratio is improving year to year. Quick ratio less than 1 indicates that the firm cannot fully pay back its liabilities with its most liquid assets. Lockheed Martin has quick ratio of 0.80 and 0.91 in 2016 and 2017. This is a worrisome situation for Lockheed Martin. Even though the quick ratio (2) ASSET MANAGEMENT FY 2017 FY 2016 Total Asset Turnover LMT Raytheon 1.08 83 97 81 Average Collection Period LMT Raytheon 60.08 17.91 60.23 17.46 From the above ratios, it can be observed that Lockheed is better in terms of asset turnover meaning that it is more efficient in using its assets. Whereas, Raytheon fairs a lot better in terms of converting its account receivables into cash. Raytheon takes about 17 days to do so which contrasts with Lockheed's 60 days (3) DEBT MANAGEMENT FY 2017 FY 2016 Total Debt to Total Assets LMT Raytheon 68 1.02 67 97 Times Interest Earned LMT Raytheon 10.98 24.66 9.10 16.19 (5) MARKET VALUE RATIOS: FY 2017FY 2016 PE Ratio: LMT Raytheon 477.15 170.75 189.44 377.75 Market to Book Ratio: LMT Raytheon 11.41 3.415 15.11