Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Director ancy on Aging www.realse toll free: 800 Michigan Street, owe LLP pendent Membe ally M 574-284-72 US NTS Use the following information to

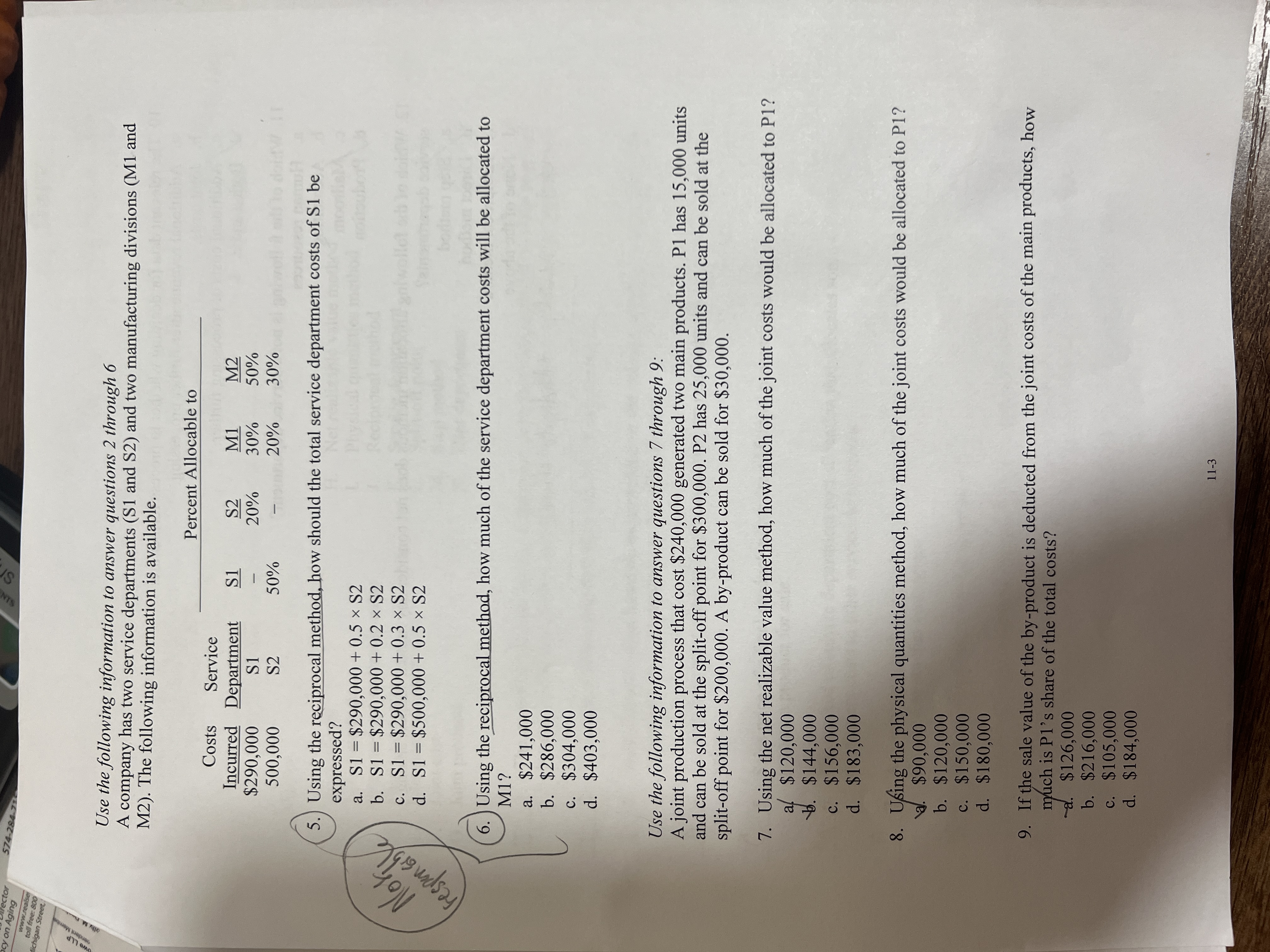

Director ancy on Aging www.realse toll free: 800 Michigan Street, owe LLP pendent Membe ally M 574-284-72 US NTS Use the following information to answer questions 2 through 6 A company has two service departments (S1 and S2) and two manufacturing divisions (M1 and M2). The following information is available. Percent Allocable to Costs Service Incurred Department S1 $290,000 S1 500,000 S2 M1 M2 20% 30% 50% S2 50% 20% 30% 5.) Using the reciprocal method, how should the total service department costs of S1 be expressed? a. S1 = $290,000+ 0.5 x S2 b. S1 = $290,000 + 0.2 S2 c. S1 = $290,000 + 0.3 S2 d. S1 = $500,000 + 0.5 S2 Noki responsible 6. Using the reciprocal method, how much of the service department costs will be allocated to M1? a. $241,000 b. $286,000 c. $304,000 d. $403,000 Use the following information to answer questions 7 through 9: A joint production process that cost $240,000 generated two main products. P1 has 15,000 units and can be sold at the split-off point for $300,000. P2 has 25,000 units and can be sold at the split-off point for $200,000. A by-product can be sold for $30,000. 7. Using the net realizable value method, how much of the joint costs would be allocated to P1? a $120,000 b. $144,000 c. $156,000 d. $183,000 8. Using the physical quantities method, how much of the joint costs would be allocated to P1? \a. $90,000 b. $120,000 c. $150,000 d. $180,000 9. If the sale value of the by-product is deducted from the joint costs of the main products, how much is P1's share of the total costs? a. $126,000 b. $216,000 c. $105,000 d. $184,000 11-3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started