Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discharge for qualified principal residehce indishadissas ( QPR is: Not likely to trigger oanceliation of debtr inceme When the bank takes the home from the

Discharge for qualified principal residehce indishadissas QPR is:

Not likely to trigger oanceliation of debtr inceme

When the bank takes the home from the borower to satisfy the mortgage debt.

Available for a second home.

A restructuring of a loan that aliows the bonower lo retain ownership of their home.

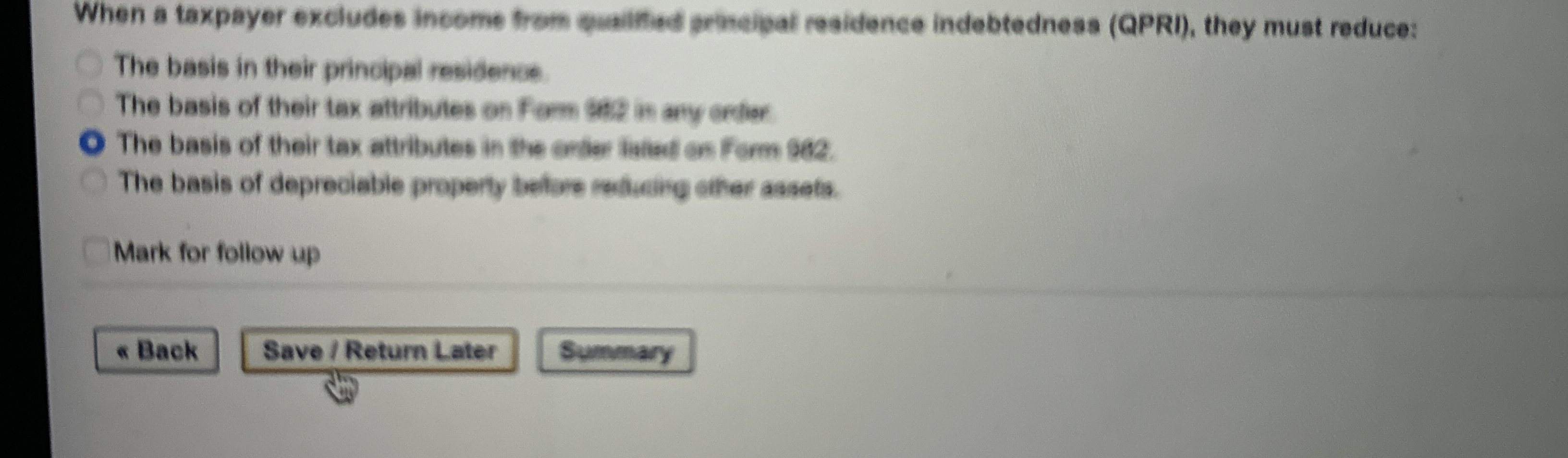

When a taxpayer excludes income from quailfed pronelpal reaidence indebtedness QPRI they must reduce:

The basis in their principal residence

The basis of their tax attibutes on F om tast m any orclise

The basis of their tax atributes in the ordar latael on form

The basis of depreciable property teeture medieing other assets.

Mark for follow up

Save Return Later

When a taxpayer excludes income from quailfed pronelpal reaidence indebtedness QPRI they must reduce:

The basis in their principal residence

The basis of their tax attibutes on F om tast m any orclise

The basis of their tax atributes in the ordar latael on form

The basis of depreciable property teeture medieing other assets.

Mark for follow up

Save Return Later

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started