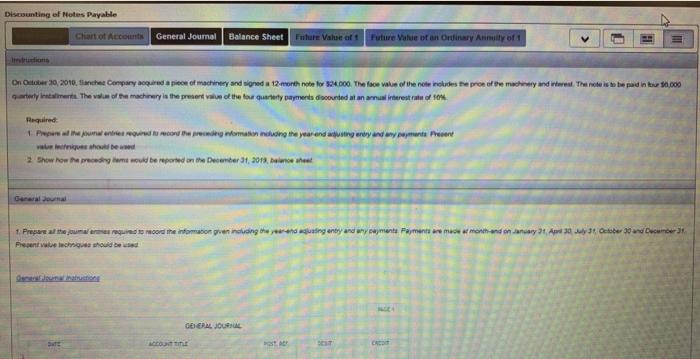

Discounting of Notes Payable Chart of Accounts General Journal Balance Sheet Future Value of 1 Future Value of an Ordinary Annuity of 1 Instructions

Discounting of Notes Payable Chart of Accounts General Journal Balance Sheet Future Value of 1 Future Value of an Ordinary Annuity of 1 Instructions On October 30, 2010, Sanchez Company acquired a piece of machinery and signed a 12-month note for 324.000. The face value of the notte includes the proe of the machinery and interest. The note is to be paid in four 30.000 quarterly instalments. The value of the machinery is the present value of the four quarterly payments discounted at an annual interest rate of 10% Required 1. Prepare ad the journal entries required to record the preceding information including the year and adjusting entry and any payments Present value fiques should be used 2. Show how the preceding ems would be reported on the December 31, 2013, belance shee General Journal 1. Prepare al the journalemes required to record the information given including the year-end adjusting entry and any payments Payments are made e onth-and on January 21, April 30 July 31 October 30 and December 31 Present value techniques should be used General Jounal intructions GENERAL JOURNAL ACCOUNT TITLE POSTA DEST CACT Clemical Journal 1. Prepare of the joumal entries required to record the information given including the year-end adjusting entry and any payments Payments are made of month-end on January 31, April 30, July 21, October 30 and December 31. Present value techniques should be used Gement Jo GENERAL JOURNAL DATE ACCOUNT TITLE POST CREDIT 1 Balance Sheet 2. Show how the preceding fems would be reported on the December 31, 2018, balance sheet Property Plant and Equip Current Liabilities SANCHEZ COMPANY Partial Balance Statement December 31, 2019 Chart of Accounts CHART OF ACCOUNTS Sanchez Company General Ledger ASSETS 111 Cash 121 Accounts Receivable 141 Inventory 152 Prepaid Insurance 181 Machine 189 Accumulated Depreciation LIABILITIES 211 Accounts Payable 231 Salaries Payable 250 Unearned Revenue 260 Notes Payable 261 Discount on Notes Payable 265 Income Taxes Payable REVENUE 411 Sales Revenue EXPENSES 500 Cost of Goods Sold 511 Insurance Expense 512 Utilities Expense 521 Salaries Expense 532 Bad Debt Expense 540 Interest Expense 541 Depreciation Expense 559 Miscellaneous Expenses 910 Income Tax Expense EQUITY 311 Common Stock 331 Retained Earnings Instructions On October 30, 2019, Sanchez Company acquired a piece of machinery and signed a 12-month note for $24,000. The face value of the note includes the price of the machinery and interest. The note is to be paid in four $6,000 quarterly installments. The value of the machinery is the present value of the four quarterly payments discounted at an annual interest rate of 16% Required: 1. Prepare all the journal entries required to record the preceding information including the year-end adjusting entry and any payments. Present value techniques should be used. 2. Show how the preceding items would be reported on the December 31, 2019, balance sheet. 1 ACCOUNT TITLE DATE Oct. 30, 2019 Machine Discount on Notes Payable GENERAL JOURNAL POST. REF. DEBIT 21,779.00 CREDIT 2 2,221.00 3 Notes Payable 24,000.00 4 Dec. 31, 2019 Interest Expense 581.00 5 Discount on Notes Payable 581.00 6 Jan. 31, 2020 Interest Expense 290.00 7 Notes Payable 6,000.00 8 Cash 6,000.00 9 Discount on Notes Payable 290.00 10 10 Apr. 30, 2020 Interest Expense 666.00 11 Notes Payable 6,000.00 12 Cash 6,000.00 13 Discount on Notes Payable 666.00 14 Jul. 31, 2020 Interest Expense 453.00 15 15 Notes Payable 6,000.00 16 Cash 6,000.00 17 Discount on Notes Payable 453.00 18 Oct. 30, 2020 Interest Expense 231.00 19 19 Notes Payable 6,000.00 20 Cash 6,000.00 23 21 Discount on Notes Payable 231.00 1. Prepare all the journal entries required to record the information given including the year-end adjusting entry and any payments. Payments are made at month-end on January 31, April 30, July 31, December 31. Present value techniques should be used. General Journal Instructions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to prepare the journal entries for the acquisition of the machinery and subsequent interest and payment entries The mach...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started